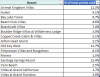

Here is chart of the approximate % of total

DVC points sold to date by the resort they are tied to. I

stress approximate because I have guessed at Riviera and Aulani. In theory, each resort would have points on the resale market in approximate proportion to their % of points. In reality, the older resorts had higher buy in minimums, so there are usually a lower % of OKW, BWV, HHI, etc contracts listed than points listed. You can check this against the various resale sites, a few tell you how many contracts are available, others you have to count (or drop the info into excel and make excel count)

View attachment 512432