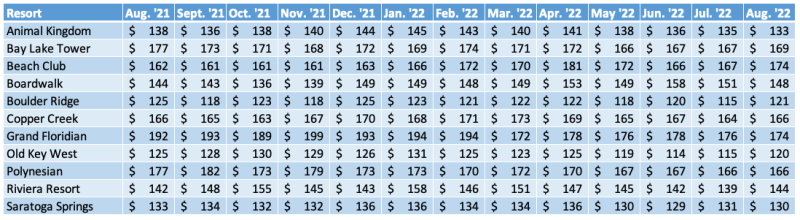

Because we’re talking about resale value. Could have bought Boardwalk resale instead of Riviera Direct in January 2020 and be selling at a 10% profit today instead of a 23% loss.

?? No… I bought Riviera direct in 2020. If I sold re-sale today, my loss would be about 10%.

If I bought Boardwalk direct in 2020, my loss today would be about 40%.

If I bought Riviera re-sale in Late 2019, I could re-sell it today at a 15% profit.

If I bought Boardwalk resale in late 2019, I’d only have a 8% increase.

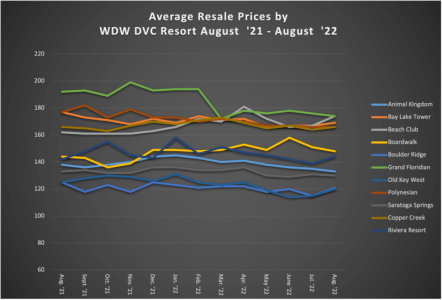

You need to compare apples to apples. Now, there is month right month variation. But overall, fluctuations in re-sale price at BWV are about the same as the fluctuations at Riviera. In fact, over the last year, Riviera has stayed pretty flat while most DVC have seen their resale prices drop.