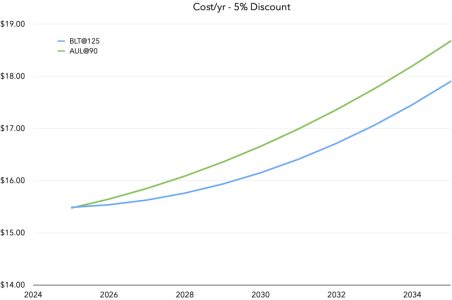

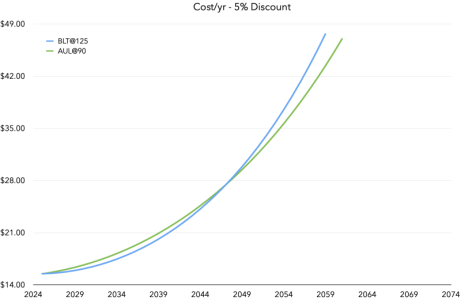

So I know I said I might have been convinced to avoid AUL entirely just yesterday, but I started doing a deeper look at 'most economical points' last night, and, um, I might be back on the AUL-train (but only subsidized).

It's not ready to post fully, but I borrowed from

@CastAStone's

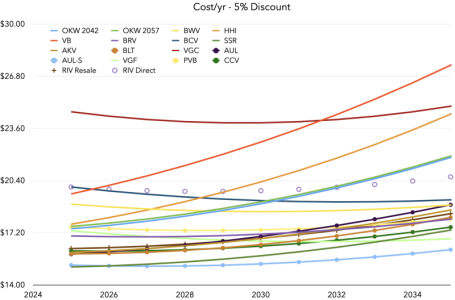

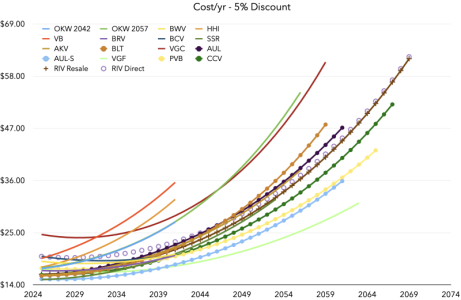

'Discount' methodology for upfront cost weighting over time (though I might have used slightly different math) and my own dues forecasting methodolgy, then plotted it out over the course of the contract length.

I mostly want to look at the first 5 or 10 years of a contract, rather than just the 1st year. I realized that with variable dues growth, some resorts might have a lower year 5 cost than year 10. And if dues growth was low enough compared to contract length (BCV, BWV, and VGF), maybe even out past year 10.

I will eventually make a fuller post about this with more effort, but here's just a '5% discount', zoomed in through 2035, and with random chart colors not conducive for readability:

View attachment 876705

The Aulani Subsidized numbers sure are something...I used $129/pt for AUL-S and $97 for AUL.

Also, with a 5% annual value decay (rather than 'discount') and $82 for OKW42 and $116 for OKW57, the last 15 years work out to $32.29 in additional value, which is almost exactly what the market organically priced them at ($34).