Colleen27

DIS Legend

- Joined

- Mar 31, 2007

- Messages

- 24,187

I know that every school system is different, but our HS has special offerings for first generation college-bound kids. I didn't look closely--my kids don't qualify--but it was either a class or social/after school group to help kids navigate the college scene, starting their freshman year. You know--how to apply, taking the SAT/ACTs, filling out the FAFSA, etc. I'm sure there was a heavy ESL component, to involve immigrant parents as much as possible.

Yeah, yeah, I know--I'm going to hear the wailing of "our school doesn't have that!", just like we hear for things like dual enrollment, early college, and AP classes. All I can say is, if you hear of ideas that you think could help students in your area, go to a school board meeting and advocate for change. Many ideas have been kicked around here, from community college to ROTC to using service hours to pay down student loans. There's always someone, somewhere who an idea won't work for. The perfect becomes the enemy of the good. Personally, I think the whole college industrial complex is broken, but I don't see any politician, anywhere, having the guts to take it on.

Around me, it isn't the perfect that is the enemy of the good. It is the appeal to tradition - this was good enough for me and good enough for my father, so is sure as heck is good enough for my kid - and a refusal to engage with the realities of how the working world has changed. Couple that with a worldview that is skeptical about "university brainwashing" and other such strawmen and there just isn't much public will to make it easier for kids to go on to a level of education a significant and vocal share of residents view as a scam or worse. Toss in a district in constant fiscal crisis because of state funding formulas - ours just restored pre-2008 recession levels of funding in 2019, without adjusting for inflation, but since that is per pupil and our district population is aging we're still faced with annual cuts just to keep the budget balanced - and implementing something like the early college program, which allows students to graduate with both a diploma and an associates, is seen as a luxury rather than a necessary way to help kids afford college.

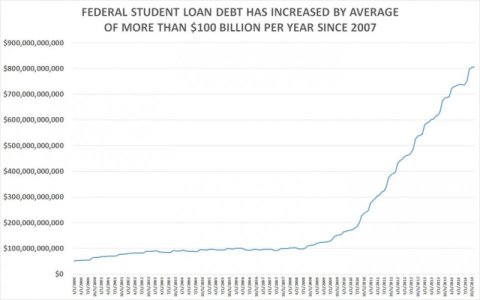

Well if folks think that private loans will every be forgiven they are clueless, I think most realize we are talking about the federal loans given in the students names. I don’t think an amount over $10,000 has been mentioned, and students are limited to $27,500. Most people I know with loans believe they system needs to be fixed with the interest, and public universities should cost much less than they do. The majority of borrowers don’t get in trouble by attending $80,000 a year private universities, but just by attending in state flagships that should be affordable to those that can’t afford the privates.

Exactly. "Expensive private universities" and "worthless degrees" are convenient scapegoats but in reality, almost 80% of American undergrads go to public universities and some of the people struggling the most with student loan payments are in socially essential fields like teaching and social work. And though I can't find stats on it, I'll bet a good share of the 20% who are at private universities are kids like my daughter, who found that the private uni works out to be cheaper after accounting for a much more generous merit and need aid package there compared to the public unis that offered a couple grand in scholarships and loans for the rest.