Chili327

DIS Veteran

- Joined

- Feb 18, 2023

- Messages

- 4,793

I need to learn how to play this, have no idea what it isStayed at the dolphin last night for our kid’s robotics tournament, hopped the skyliner over to RIV when we left EPCOT. Like the resort more each time I go there. But y’all, what is with the bocci ball court? It was 9:30 and this family went out there and were just slamming the balls into the walls, legit sounded like target practice it was so loud. Is this a one off, or have others experienced this and it’s no big deal to you? It would drive me nuts if my room was right there.

At Riv I once witnessed an old man absolutely lambast a pair of 10 year olds for playing too loudly. It was a sceneStayed at the dolphin last night for our kid’s robotics tournament, hopped the skyliner over to RIV when we left EPCOT. Like the resort more each time I go there. But y’all, what is with the bocci ball court? It was 9:30 and this family went out there and were just slamming the balls into the walls, legit sounded like target practice it was so loud. Is this a one off, or have others experienced this and it’s no big deal to you? It would drive me nuts if my room was right there.

Let me try that again.

By old do you mean mid 40’s, cause I would totally do this. Keep it down kids, shaking my fist.At Riv I once witnessed an old man absolutely lambast a pair of 10 year olds for playing too loudly. It was a scene

So you have no reliable data until at least 2022

While we can't predict the future, we can make some predictions based on known future events:

At some point RIV will sell out -- That typically boosts re-sale prices. So that should actually reduce the gap.

We also know that all the other current Epcot resorts will expire in just over 16 years -- Which should make RIV a more desirable resort as we get closer to 2042. So it should further boost RIV resale prices.

Gotcha, I wasn't sure if you meant "won" a poll.Let me try that again.

What do you mean most Riviera owners have a mortgage?

Have you done a poll?

I know I absolutely hate writing on my phone.Gotcha, I wasn't sure if you meant "won" a poll.

Me too!!!! It’s not just here either any typing I do gets screwed up. Sometimes it’s me and sometimes it’s that darn autocorrect!!I know I absolutely hate writing on my phone.

I agree Riviera resale data is not reliable pre-2022. I also think it's not reliable today at all but in the sense that the slide is just getting started... 25% of the resort was sold in the past 2 years and 25% is still unsold. So as of today the vast majority of existing RIV owners have owned for less then 5 years, and about 1/3 of them have owned for less than 2 years. and 25% of the resort has yet to be sold. The current supply doesn't begin to reflect what you will see in 5-7 years, and that's well before the sky will allegedly fall on the O14 resorts in 2042. What if RIV resale supply triples or quadruples by the end of the decade (not unrealistic), while the pool of potential buyers willing to pay $100+ is exhausted by then? Think about how a demand curve slopes down - you have fewer buyers available at higher prices, and more buyers at lower prices. Those willing to pay the high prices are buying now, the others are not.

View attachment 943304

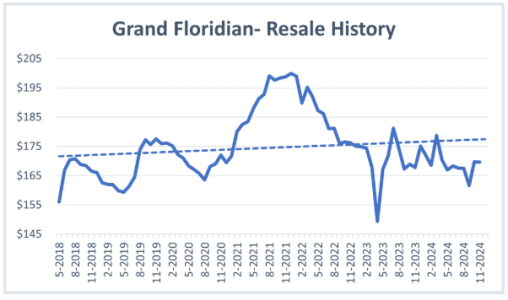

Will the "sold-out" status bump resale prices? We're not really seeing that with VGF, so I don't know why RIV will be any different.

View attachment 943312

Is it not reasonable to expect there will be a BCV2 and BWV2 at that point? There will be competition from direct and eventually resale contracts from those resorts. And the "new normal" for restricted resorts by then can just be that resale prices are 70%-90% less than direct prices, just like other timeshare systems that intentionally decimated the functionality (and value) of their resale products. It's 15-20 years down the road, so who knows...

Those worried about what happens in after 2042 should remember that you can raise a toddler to college-age by then. And I definitely don't think I need to personally worry about what happens in the 2060s... my time horizon is not like DVCs, so resale restrictions possibly becoming the only alternative available in 4 decades will be someone else's problem to figure out!

If I were in the market for more points, I would be tempted to add some Riviera resale. Another thing that some people might forget is that you don't necessarily need to stay there every year if you own other resorts. You can stay every other or even every 3 years.Another piece to ponder is that when other resorts sold out, buying resale at any resort still gave you at least 7 months access, even if you didn’t buy it.

Buyers who want access to RIV, will only have direct or resale RIV.

So, it’s an unknown variable at this point and why it’s possible the impact of sold out status on pricing might work a bit differently than in resorts of the past.

If the resale market for DVC wasn’t as strong as it is, would as many people still sell? Its easy now because its held value.

So, could it be a double edged sword in the future. Lower resale price tempers supply? Which stabilizes pricing?

We simply don’t know and won’t for maybe another few years at the earliest?

It will be an interesting watch! I do know that resale RIv prices now, if I wanted more, are pretty attractive for having to use there.

If I were in the market for more points, I would be tempted to add some Riviera resale. Another thing that some people might forget is that you don't necessarily need to stay there every year if you own other resorts. You can stay every other or even every 3 years.

Yes - agreed. And I’ve been watching the market - the few small Riv contracts are taken within hours of posting usually at asking, which is at the high end. So comparatively high, in fact, that it has pushed me to consider just buying another 50 direct.If I were in the market for more points, I would be tempted to add some Riviera resale. Another thing that some people might forget is that you don't necessarily need to stay there every year if you own other resorts. You can stay every other or even every 3 years.

Would it be wise to purchase two 75 point contracts in the same use year if you've never had direct points or is that a pain to deal with later?Yes - agreed. And I’ve been watching the market - the few small Riv contracts are taken within hours of posting usually at asking, which is at the high end. So comparatively high, in fact, that it has pushed me to consider just buying another 50 direct.

No, that’s a good idea as it adds up to 150 points to get you the benefits and you can always offload one of them if neededWould it be wise to purchase two 75 point contracts in the same use year if you've never had direct points or is that a pain to deal with later?

We plan to add another 150ish points before sellout and this is what we’ll do. Maybe do 3-50pt contracts but 75 is most likely (75pt resale is what I’ve been looking for in my UY)Would it be wise to purchase two 75 point contracts in the same use year if you've never had direct points or is that a pain to deal with later?

I was thinking 3 50 point contracts too, especially since they'll be sought after later. Masons closing costs for akv was $592, small price to pay if I can sell them for $23-$30 or even more pp down the lineWe plan to add another 150ish points before sellout and this is what we’ll do. Maybe do 3-50pt contracts but 75 is most likely (75pt resale is what I’ve been looking for in my UY)

Multiple direct contracts in the same UY is no issue at all. They function as one bucket at whichever resort they are from.Would it be wise to purchase two 75 point contracts in the same use year if you've never had direct points or is that a pain to deal with later?

Thank you this is helpful info!Multiple direct contracts in the same UY is no issue at all. They function as one bucket at whichever resort they are from.

In order of increasing complexity:

Direct same UY < Resale same UY < Direct + resale same UY < Direct multiple UY < Direct + resale multiple UY

Roughly.