Case in point for the points above:

If I'm not mistaken Marriott currently sells points for a rack rate of $19.91/pt (often with some 20% discount, so say $16/pt). They may also throw in some nice amount of one time use Bonvoy hotel points and do some fuzzy math around their value.

Based on reports, resale prices of $3+ per point are usually passing rofr (and buyer pays an extra $3/pt per resale point to "activate" them). Once activated,

the resale points are completely unrestricted and identical to retail points.

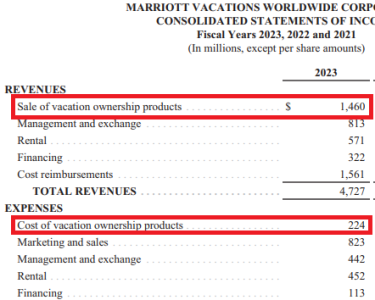

MVC will often buy the points via rofr at $2-$3 and sell them for $16-$19. Here's how profitable that can be (albeit also note the huge sales marketing costs compared to the cost of the inventory itself):

View attachment 942659

(Disclaimer: this is by no means an endorsement to buy any stocks/securities!)

So an informed buyer might say - why pay $16-$19 when you can pay $6 all-in? Why pay $16-$19 for something that's barely worth $3 if you try to sell it?

And yet, in the company's earnings release this week, they are projecting to sell ~$1.9 billion in contract sales in 2025 (this is just a part of total revenues, which also include management fees, exchange fees, rental income, and the financing business). All that with an identical resale product that can be bought at a 60%-70% discount even after the "activation fee" that doubles the resale cost...

Given this, there's probably no reason to DVC to prop up resale prices of restricted resorts in order to convince a minority of informed buyers to buy direct. They can probably make a bigger profit on the typically uninformed buyers when buying cheaper inventory via ROFR. For the informed buyers - maybe a points washing program is in order!

Now if I stumble upon a pot of gold, I'd consider buying direct so I could also use those points at VDH.

Now if I stumble upon a pot of gold, I'd consider buying direct so I could also use those points at VDH.