lsutigers03

DIS Veteran

- Joined

- Aug 14, 2019

- Messages

- 1,119

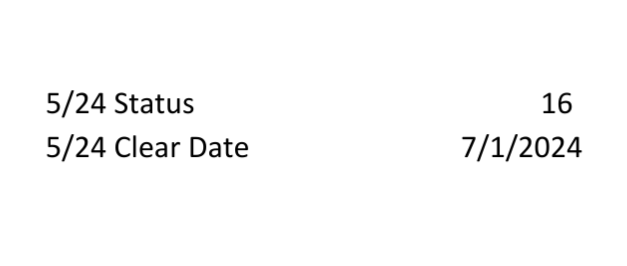

Have you ever run into issues doing this? I've signed up for three chase Biz cards and never had an issue but I only did it once a year.I'm a SUB chaser but not lots. I focus on URs so I and DH were signing up for Biz cards every 3ish months.