- Joined

- Nov 15, 2008

- Messages

- 48,008

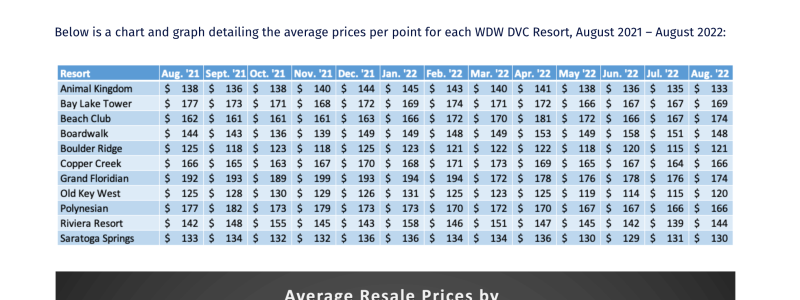

Lot of post-purchase rationalization in this thread. Here is my source for CCV: https://www.dvcresalemarket.com/blog/dvc-resale-average-sales-prices-for-june-2020/. The $130 number y'all are citing is an aberration. And if we're doing outliers, I could quickly cite the $118/point resale price on the ROFR thread for Riviera.

If you bought Riviera and are happy, I'm happy for you. You say it wasn't an investment, so you shouldn't really care about the resale value anyways (since you are never going to sell). Please don't come for me!

One question I would have for anyone is how much do you think Riviera would be selling for without the restrictions? Like I said, I think it'd be $160/point (probably higher). If you truly feel that $144/point is where it would be, I think you're crazy.

I will tell you why I think it would not be much higher right now…other than maybe $150…

The direct price. 200 points today for RIV direct is $188..with incentives,

Using your $160/pt…That would result in a $5600 savings over direct,

Since we are assuming no restrictions, what would one be eligible for for that extra? Access to discounted APs and membership extras…which is what was in place when CCV went on sale…

Take a family of 4 wHo might save $1600 a year on that AP…it’s 4 years and you have made up the difference. And you now are eligible for whatever benefits that DVD might offer.

So, is it worth spending an extra $5600 now to have the chance at discounts and less expensive APs? Very well may be.

Now, APs are currently suspended so it may be viewed different but since we are turning back the clock, I’m putting it back to what was available when CCV and others were on sale.

We all know membership extras don’t matter to everyone and are not guaranteed. But, resale locks you out of them today and direct gives you a chance.

So, that new buyer today who wants to own at RIV and finds value in what direct has to offer…and I am pretending no restrictions of any kind on any resort…spending that extra $5600 is not such a huge amount over the course of ownership that they go direct.

Now, let’s use average price of $144…you are looking at $8800 more to go direct….much different situation…now, that potential AP savings takes almost 6 years to make back up. Maybe that’s enough of a savings to forgo direct..

As long as direct gives you benefits that resale doesn’t, the difference between the two has to be enough to forgo those benefits.

IMO, if the resale restrictions were a factor to any big degree, RIV would be averaging a lot lower than it is.

Actually, .when you think about it, those RIV resale buyers could have spent about $5K more and ended up with BLT, PVB, or CCV and had access to all the resorts except RIV….but they didn’t…and that is why I think the resale price is more about the difference between direct and resale and not the restrictions….right now

Lets see what happens in two more years when we know about Poly tower.

Last edited: