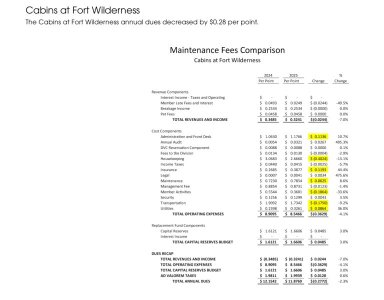

Hmmm. It's not just Housekeeping that is a good percentage higher either. Transportation dues (I guess the interior buses?) jump out, but so does Administration and Front Desk ($1.1766 vs. .6957) and Insurance (.38 vs .21), though the insurance cost makes some sense.

The problem here is that they were going to have an issue either way. Either keep the

point chart respectable and have high dues, or keep the dues respectable and have high

point charts. The former is the way they went, I would suspect that if they went with the latter, not only would you still not have people buying in (as the costs would be the same as since dues x points = total cost, you'd still be paying the same total cost, for instance, 100 points at $12 pp for $1,200 in MF or make them cost 150 points at $8.00 pp for the same $1,200 in MF)

So, there's the dilemma, make people buy 100 points and have outrageous dues, or keep the dues down and have outrageous point costs. This doesn't even take into account the aspect that restrictions here are probably hurting this property (as a niche property) more than others as well as the ambiguity of the trust aspects of the POS may keep people from pulling the trigger as well.

I think that they were going to have sales issues either way they went on this one, however, with the path they took, at least while the Cabins are a sales nightmare, from a 7-month booking standpoint, they are extremely popular with existing members (and, looking at the fact that breakage income credit is higher at CFW, they are also doing well renting these for cash). Also, remember that in the POS, they specifically outline the right to rebalance points among the trust, so if they added Lakeshore Lodge to the trust, not only could they add in the existing CFW cabins, they can rebalance the points among the cabins and the Lodge units as they see fit according to the Trust POS. Too much uncertainty, I think for many people.

In the end, I think that what you're seeing mostly with CFW is Fixed Week sales in uber-popular weeks around Halloween, 4th of July, and perhaps Christmas/New Year's. These are typically times where they close the Fort down to external traffic. Also, the Fixed Week, I suppose, would insulate you from any shenanigans they could pull by rebalancing the point chart.

It's too bad, because we would actually love to have points at the Fort, but we already have 700 direct points, and we are flexible enough in when we go that it just makes way more sense to take our chances at the 7 month window than to purchase direct.