Monthly Update!

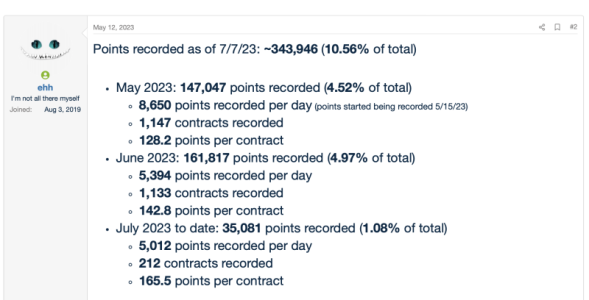

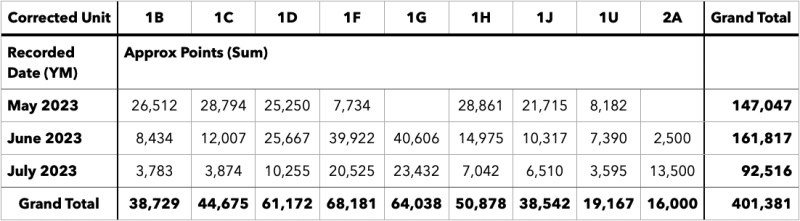

Total points recorded to date:

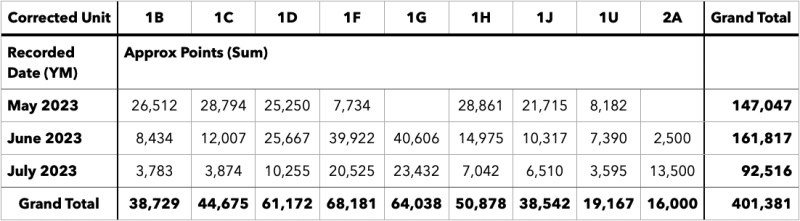

~401k points (12.33% of all points).

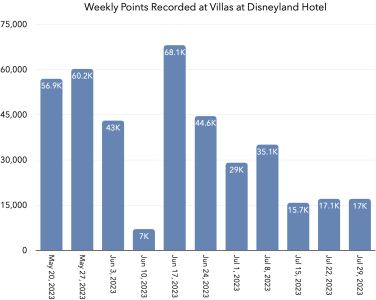

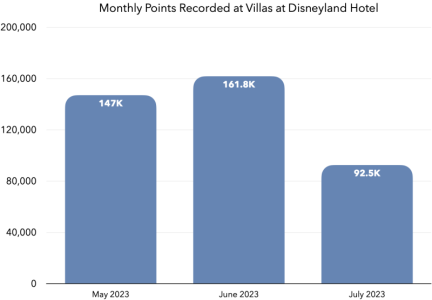

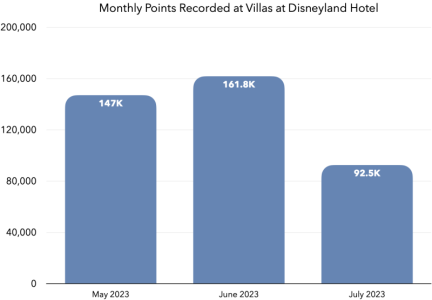

Points recorded in July:

~92.5k points.

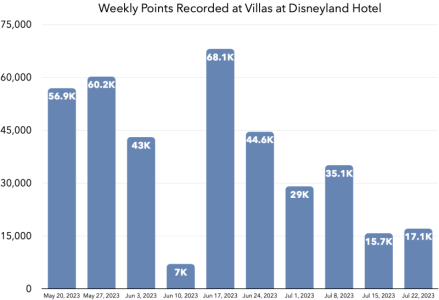

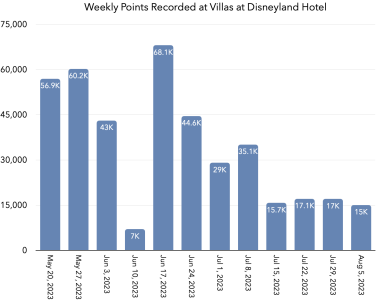

July is the lowest sales month so far, but is still a strong sales month considering we're past the initial sales surge and there's 3 other resorts currently for sale. Sales appear to have stabilized at around 17k per week (~77k/month) in recent weeks.

In the post above I detail how quickly the resort will sell out at the current sales pace (roughly October 2026), but for this post I want to consider when DVD will need to make another declaration: fairly soon!

Currently ~22.3% of points are declared and at least ~12.3% of the resort has been sold. That leaves just ~10% of headroom, roughly 325k points, before more Units must be declared. At the current sales rate of ~17k/wk, that's just 19 weeks from now, about mid-December 2023.

Why is this interesting? DVD predicted, in the POS, that they would need to declare just Phases 1 and 2 in 2023 when estimating the operating costs for the dues. But currently VDH is outselling this pace and if this pace maintains then DVD will be in a position where they

must declare more Units prior to the end of 2023, breaking their prediction.

What does this mean for current owners? Probably nothing, even in terms of dues. And even if they do a bunch of declarations on Jan 1, 2024 to reestablish a buffer,

those Units are already in the 2024 bookable inventory as

DVC tends to release inventory predictively.

What does this mean for potential buyers? Well that depends on how important it is for DVD to stick to their predictions. If it's important to nail the prediction, then they

must slow the current sales rate. That means pulling levers to slow down sales, such as reducing incentives at the next opportunity.

Why might they

need to stick to their prediction? Let's say they released 22.3% of inventory to be booked through December 2023, as per their estimates, and also rented out the entire remaining 77.7% of inventory. Barring any funny math maneuvering, in this situation they'd need to choose between 1) canceling cash reservations and 2) temporarily shutting down DVC sales when the current declarations sell out, which is on pace for mid-December. Merry Christmas and Happy Holidays!

My guess? The inventory they allotted to rentals was conservative and they left plenty of buffer for solid sales, making being correct in their prediction insignificant and we will see more declarations before Jan 1, 2024. I also think it's pretty cool that VDH is outselling expectations.

Fun facts about July's sales:

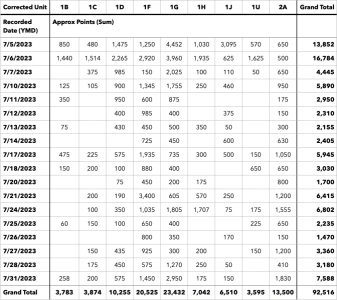

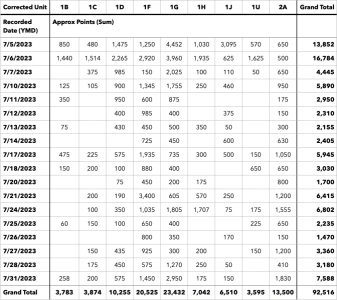

Gotta start with how one family bought two 1,500pt contracts. Very exciting for them!

Also we're getting close to selling out some Units: 1B, 1C, 1D, and 1H. But we still haven't seen 1A, 1E, or 1I (one eye) show up in any recorded deeds yet, which is odd. I'm also not sure how many Units are in Phase 2, but we've only seen Unit 2A from Phase 2 so far. I've been procrastinating on getting the 2nd declaration documents, but I'll work on that this week.

Other interesting facts about the contracts recorded in July:

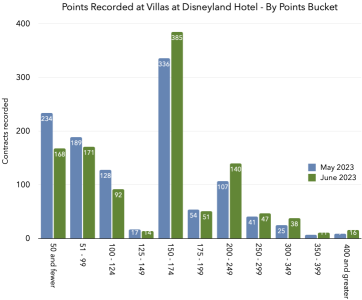

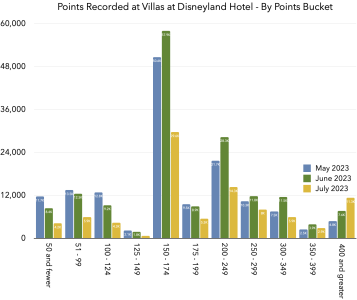

- 587 contracts recorded

- 187x 150pt contracts (386 the prior month)

- 83x 50pt contracts (168 the prior month)

- 66x 200pt contracts (125 the prior month)

- 56x 75pt contracts (109 the prior month)

- 38x 100pt contracts (90 the prior month)

- 30x 250pt contracts (47 the prior month)

- 26x 175pt contracts (48 the prior month)

- 12x 300pt contracts (31 the prior month)

- 89x other contracts (147 the prior month)

- 157.6pt average contract size in July

- May had an average of 128.2pt

- June had an average of 142.8pt

- 1,500pt is largest contract in July (2x)

- 50pt is smallest contract

- 1,500pt is the largest contract size purchased multiple times (2x)

- Unit 1G was assigned the most (23.4k, 2nd most was 1F at 20.5k)

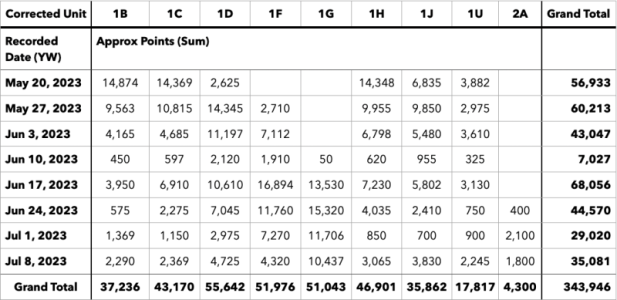

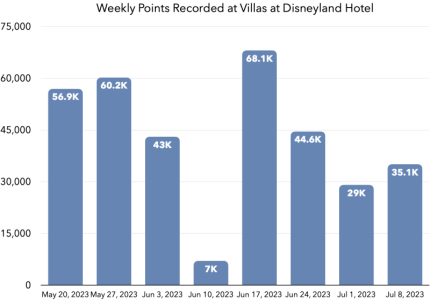

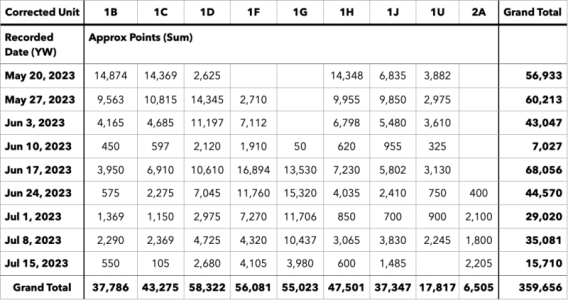

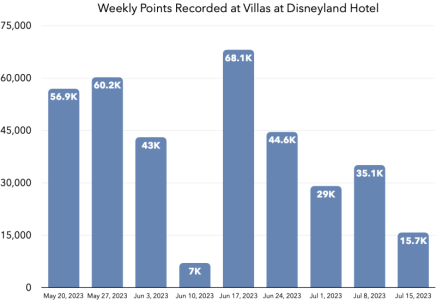

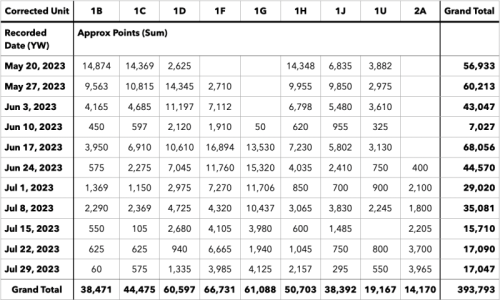

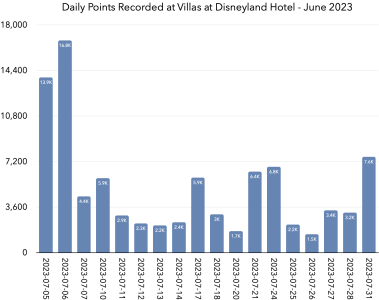

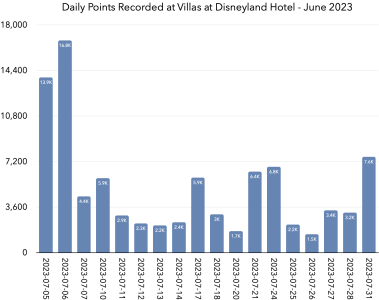

Points recorded by date:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Points recorded by month:

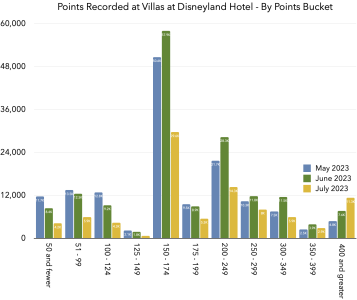

And a histogram showing that the contracts are skewing larger and larger as time passes:

July, despite recording significantly fewer points than May, had more points recorded from 250+ point contracts than May did.