emchen

I’m addicted (to DVC)!

- Joined

- Jul 4, 2019

- Messages

- 1,174

Did you pay over 90 days too ?My contracts finally have been recorded! I bought back in May (before it went on sale to non owners) Quality assurance took a long time to contact me about a missing document. I guess they’ve been busy

$30k water bottleGot our gold dvc water bottle, “stay cool year after year” cooling towel, dvc certificate with accurate month and year we first joined (July 2, 2019), two magnets, and a welcome note. All presented in a beautiful box with gold paper wrap. Very nice!…we love our $30k water bottle!

Aha! I have you and DVD beat! I bought two tranches of 150 points each! One in May and one in June, so I expect to get the second water bottle in a month! (I did it to rent out one tranche to "stay for free" at VDH.)$30k water bottlewhether you’ve purchased $30k or $100k you still only get 1 water bottle

I sure miss those $30k backpacks. Does the water taste extra tasty from that bottle?Got our gold dvc water bottle, “stay cool year after year” cooling towel, dvc certificate with accurate month and year we first joined (July 2, 2019), two magnets, and a welcome note. All presented in a beautiful box with gold paper wrap. Very nice!…we love our $30k water bottle!

DittoFor what it’s worth I am also willing to send someone a water bottle in exchange for $30,000.

Amazing insight! I wonder if incentives could get better than what was first introduced back in May. Probably not. But you never know! Didn't VGC's incentives get better as it initially "struggled" selling?Weekly Update!

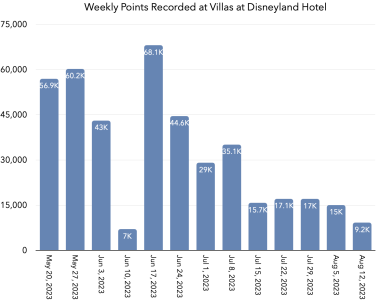

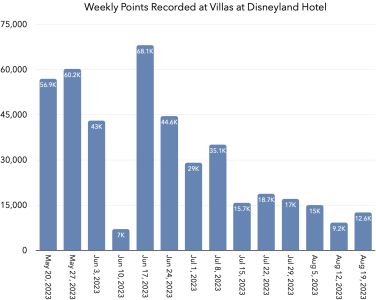

Total points recorded to date: ~418k points

Points recorded last week (August 5 - August 11): ~9.2k points

Sell out date based on last week's rate of recorded points: July 2029

Last 4 weeks: ~58.3k points

Rolling 4 week average: ~14.6k points/wk

Sell out date based on last 4 weeks' rate of recorded points: May 2027

While it looked like things had settled into a 'steady state' of a little over 16k/wk, last week was a notable slowdown from even that. At last week's rate, only 41k points would be sold in a 4.5wk month, which is surely below expectations.

At the 4wk average rate of 14.6k/wk, VDH will sell out in ~195 weeks, or 3 years and 9 months, roughly May 2027. At 14.6k/wk, the current levels of declarations will last until early January 2024. I've previously detailed why DVD may have only declared ~727k points (72 rooms), and I'm going to continue to watch for any sort of trajectory that may force them to declare more prior to Jan 1, 2024.

This is to say that while the 41k/month rate may not be what they want longterm, it may be beneficial short term if there were some errors/mistakes in forecasting demand. Will be very interesting to see how incentives are adjusted in September.

Other interesting facts about the contracts recorded last week:

- 69 contracts recorded, the 2nd lowest week yet

- 23x 150pt contracts

- 11x 50pt contracts

- 9x 75pt contracts

- 6x 200pt contracts

- 5x 100pt contracts

- 15x other contracts

- 133.1pt average contract size last week

- Week one was 124.6pt average

- Week two was 130.9pt average

- Week three was 132.5pt average

- Week four was 108.1pt average

- Week five was 143.0pt average

- Week six was 146.6pt average

- Week seven was 150.4pt average

- Week eight was 165.5pt average

- Week nine was 158.9pt average

- Week ten was 169.2pt average

- Week eleven was 153.6pt average

- Week twelve was 161.4pt average

- 300pt is largest contract

- 50pt is smallest contract

- 300pt is the largest contract size purchased multiple times (4x)

- Unit 2A was assigned the most (3.8k, 2nd most was 1G at 1.5k)

- We are on sell-out watch for a few of the earliest Units: 1B, 1C, 1D, 1H

- 1B had no contracts recorded last week

- All of these Units are at fewer than 10k available points

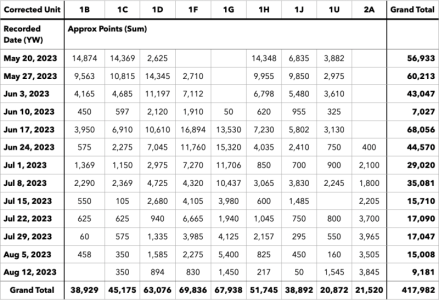

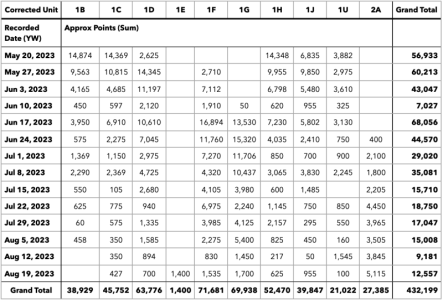

Unit/date breakdown:

View attachment 785412

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

View attachment 785413

They did get very aggressive with VGC incentives well after initial sales, though I think the consensus was that was more macroeconomic as the US was finally emerging from the Great Recession.Amazing insight! I wonder if incentives could get better than what was first introduced back in May. Probably not. But you never know! Didn't VGC's incentives get better as it initially "struggled" selling?

good point. come on recession! where is it when you need one!They did get very aggressive with VGC incentives well after initial sales, though I think the consensus was that was more macroeconomic as the US was finally emerging from the Great Recession.

Shh, i've almost talked my self into buying direct. lolJust an FYI that the Aulani DVC center was really promoting VDH last week at the member celebration, resort billboards/signs, model, etc. we even got VDH pins as part of a welcome gift. So, it would appear they are more focused on selling points at VDH than on trying to sell Aulani. Given how profitable those Aulani rooms are with the international travelers there… I am not surprised.

It’ll be fascinating to see where the resell pricing lands 12 months from now with the transient tax and dues.

Looking forward to checking out the VDH tower when we head out to VGC in October.

Where is 150 points landing on a ppp after all the incentives/magical beginnings/etc for VDH?Shh, i've almost talked my self into buying direct. lol

I paid $185pp with 3% travel on CSR card. I’m personally betting on resale prices not affected by resale restrictions but maybe I’m just a biased local owner.Where is 150 points landing on a ppp after all the incentives/magical beginnings/etc for VDH?

It looks like Rivera is going for around $121pp resale on contracts over 100 points. (https://www.fidelityrealestate.com/blog/june-2023-average-dvc-resale-price-per-point/). That is no transient tax and about .50pp lower dues.

On a 150 points that would be around $18k.

VDH has a significantly better location for walking, but appears to have a drop off in luxury and lacks a signature dining experience at the moment.

Maybe $115 on resale once everything settles down unless professional point renters step in?

Of course, I still don’t understand why VGF resale prices are so high given current direct incentives….

Was it the Tinkerbell pin?Just an FYI that the Aulani DVC center was really promoting VDH last week at the member celebration, resort billboards/signs, model, etc. we even got VDH pins as part of a welcome gift. So, it would appear they are more focused on selling points at VDH than on trying to sell Aulani. Given how profitable those Aulani rooms are with the international travelers there… I am not surprised.

It’ll be fascinating to see where the resell pricing lands 12 months from now with the transient tax and dues.

Looking forward to checking out the VDH tower when we head out to VGC in October.

I’m only looking at 50-80 points so im at $230pp.Where is 150 points landing on a ppp after all the incentives/magical beginnings/etc for VDH?

It looks like Rivera is going for around $121pp resale on contracts over 100 points. (https://www.fidelityrealestate.com/blog/june-2023-average-dvc-resale-price-per-point/). That is no transient tax and about .50pp lower dues.

On a 150 points that would be around $18k.

VDH has a significantly better location for walking, but appears to have a drop off in luxury and lacks a signature dining experience at the moment.

Maybe $115 on resale once everything settles down unless professional point renters step in?

Of course, I still don’t understand why VGF resale prices are so high given current direct incentives….

Was it the Tinkerbell pin?