Ah you meant buttons. They have them at wdw DVC booths as well. I was hoping you meant the tinkerbell pin that they were stingy about giving since I would have loved to have a backup. I never visited the Aulani show rooms before at Disneyland. Maybe I’ll find a guide that’s bored enough to take me one day.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

VDH Unit and Sales Tracker

- Thread starter ehh

- Start date

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

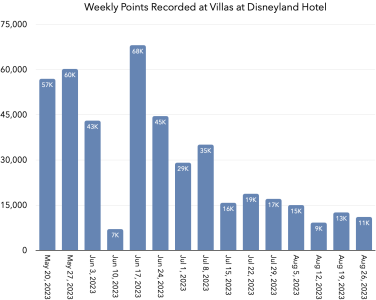

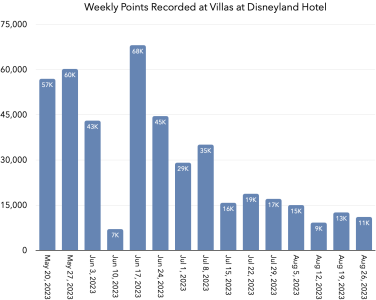

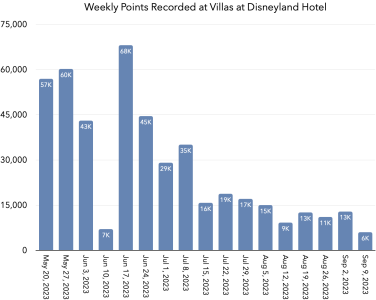

Weekly Update!

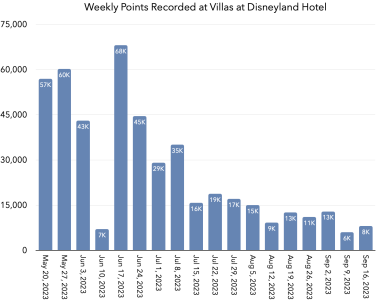

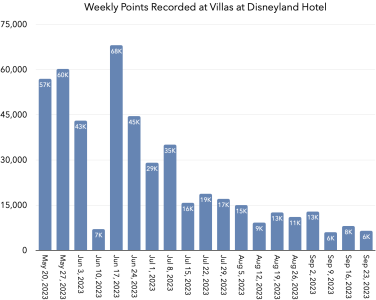

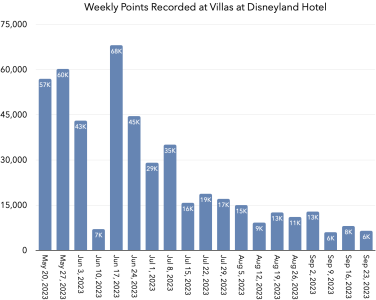

Total points recorded to date: ~443k points

Points recorded last week (August 12 - August 18): ~11.1k points

Sell out date based on last week's rate of recorded points: July 2028

Last 4 weeks: ~47.8k points

Rolling 4 week average: ~12.0k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Feb/Mar 2028

Previously, it looked like things had settled into a 'steady state' of a little over 16k/wk, but sales have slowly been decreasing.

However, at this point, there isn't much reason to buy points now unless it's to get ahead of a specific stay in the future. New incentives will be announced soon.

12.0k/wk works out to ~53.8k/month with 4.5wk months, dropping into 'tired WDW' status. At the 4wk average rate of 12.0k/wk, VDH will sell out in almost exactly 4.5 years, Feb/Mar 2028.

At 12.0k/wk, the current levels of declarations will last until mid February 2024. I've previously detailed why DVD may have only declared ~727k points (72 rooms), and I'm going to continue to watch for any sort of trajectory that may force them to declare more prior to Jan 1, 2024. Because of this factor, I don't think it's a guarantee that the upcoming incentives will be much better, if at all.

Said another way: while 54k/month rate may not be what they want longterm, it may be beneficial short term if there were some errors/mistakes in forecasting demand and competing cash bookings. They might need to sell slower than ~65k/month for the rest of year.

Other interesting facts about the contracts recorded last week:

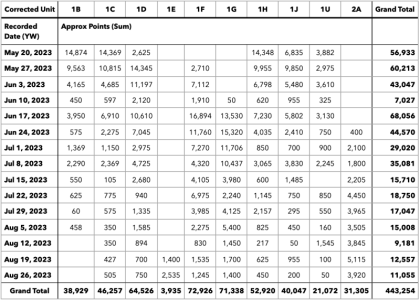

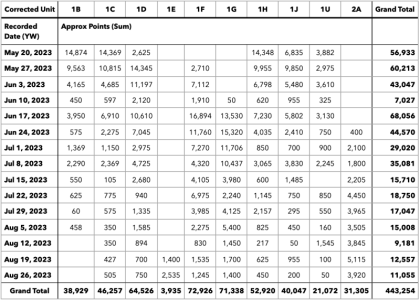

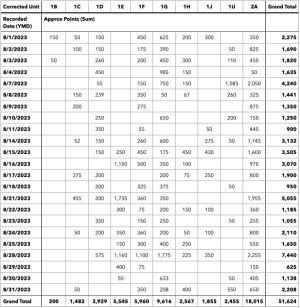

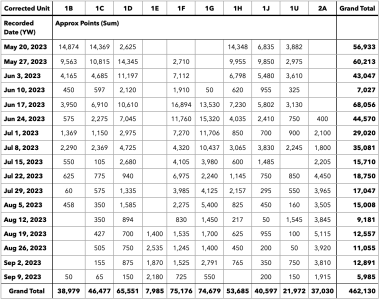

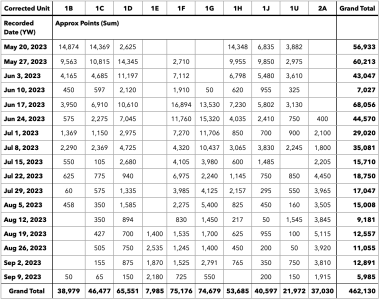

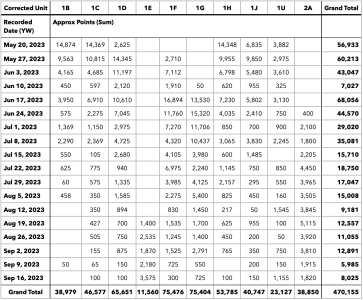

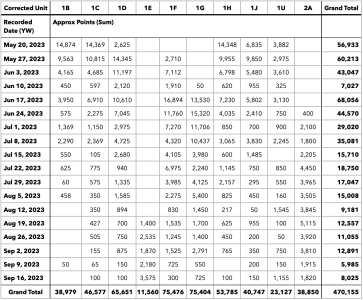

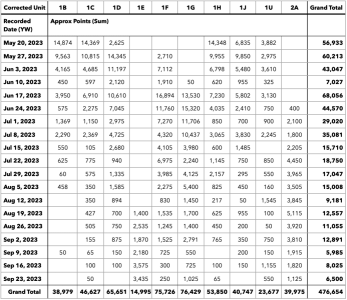

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Total points recorded to date: ~443k points

Points recorded last week (August 12 - August 18): ~11.1k points

Sell out date based on last week's rate of recorded points: July 2028

Last 4 weeks: ~47.8k points

Rolling 4 week average: ~12.0k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Feb/Mar 2028

Previously, it looked like things had settled into a 'steady state' of a little over 16k/wk, but sales have slowly been decreasing.

However, at this point, there isn't much reason to buy points now unless it's to get ahead of a specific stay in the future. New incentives will be announced soon.

12.0k/wk works out to ~53.8k/month with 4.5wk months, dropping into 'tired WDW' status. At the 4wk average rate of 12.0k/wk, VDH will sell out in almost exactly 4.5 years, Feb/Mar 2028.

At 12.0k/wk, the current levels of declarations will last until mid February 2024. I've previously detailed why DVD may have only declared ~727k points (72 rooms), and I'm going to continue to watch for any sort of trajectory that may force them to declare more prior to Jan 1, 2024. Because of this factor, I don't think it's a guarantee that the upcoming incentives will be much better, if at all.

Said another way: while 54k/month rate may not be what they want longterm, it may be beneficial short term if there were some errors/mistakes in forecasting demand and competing cash bookings. They might need to sell slower than ~65k/month for the rest of year.

Other interesting facts about the contracts recorded last week:

- 79 contracts recorded, the 4th lowest week yet

- 31x 150pt contracts

- 17x 50pt contracts

- 8x 200pt contracts

- 5x 100pt contracts

- 5x 250pt contracts

- 13x other contracts

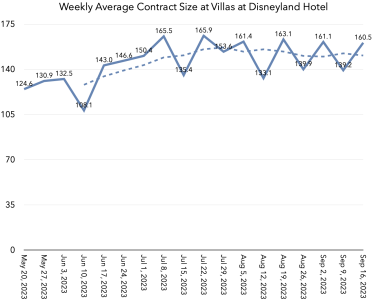

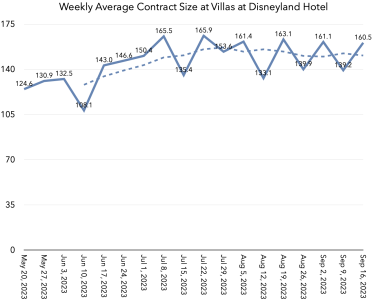

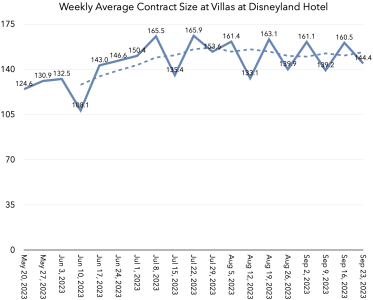

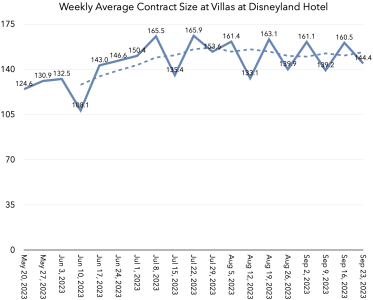

- 139.9pt average contract size last week

- Week one was 124.6pt average

- Week two was 130.9pt average

- Week three was 132.5pt average

- Week four was 108.1pt average

- Week five was 143.0pt average

- Week six was 146.6pt average

- Week seven was 150.4pt average

- Week eight was 165.5pt average

- Week nine was 158.9pt average

- Week ten was 169.2pt average

- Week eleven was 153.6pt average

- Week twelve was 161.4pt average

- Week thirteen was 133.1pt average

- Week fourteen was 163.1pt average

- 700pt is largest contract

- 50pt is smallest contract

- 250pt is the largest contract size purchased multiple times (5x)

- Unit 2A was assigned the most (3.9k, 2nd most was 1E at 2.5k)

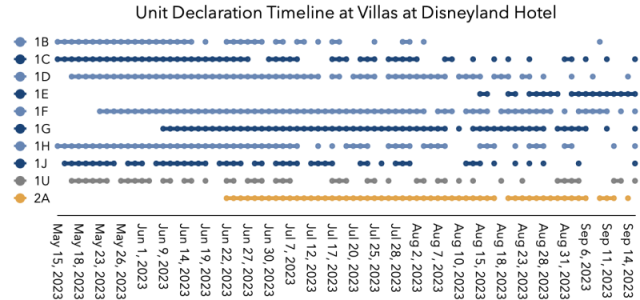

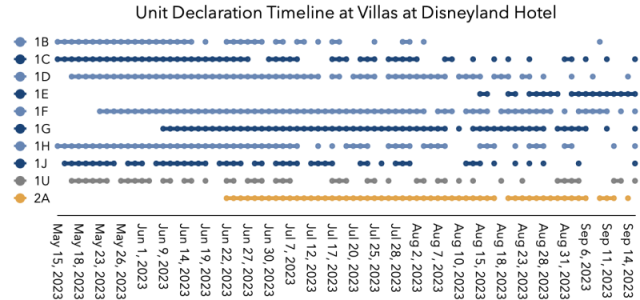

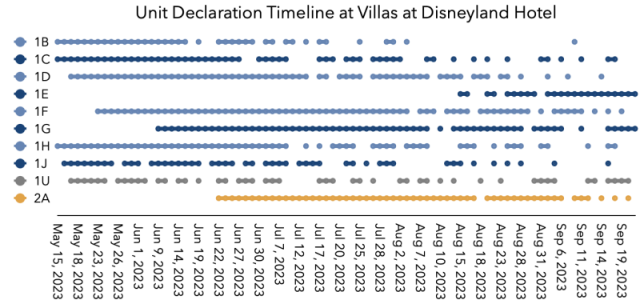

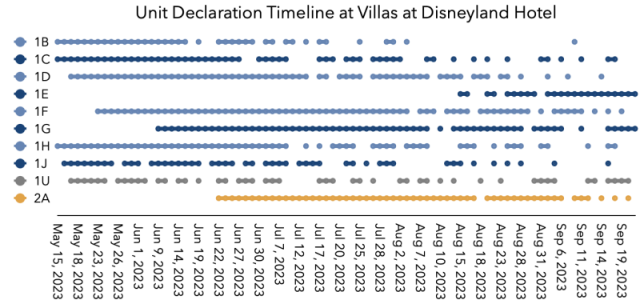

- We are on sell-out watch for a few of the earliest Units: 1B, 1C, 1D, 1F, 1H

- 1B had no contracts recorded last 3 weeks, I think it is effectively sold out

- All of these Units are at fewer than 10k available points

- We are on sell-out watch for a few of the earliest Units: 1B, 1C, 1D, 1F, 1H

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Weekly Update!

Total points recorded to date: ~443k points

Points recorded last week (August 12 - August 18): ~11.1k points

Sell out date based on last week's rate of recorded points: July 2028

Last 4 weeks: ~47.8k points

Rolling 4 week average: ~12.0k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Feb/Mar 2028

Previously, it looked like things had settled into a 'steady state' of a little over 16k/wk, but sales have slowly been decreasing.

However, at this point, there isn't much reason to buy points now unless it's to get ahead of a specific stay in the future. New incentives will be announced soon.

12.0k/wk works out to ~53.8k/month with 4.5wk months, dropping into 'tired WDW' status. At the 4wk average rate of 12.0k/wk, VDH will sell out in almost exactly 4.5 years, Feb/Mar 2028.

At 12.0k/wk, the current levels of declarations will last until mid February 2024. I've previously detailed why DVD may have only declared ~727k points (72 rooms), and I'm going to continue to watch for any sort of trajectory that may force them to declare more prior to Jan 1, 2024. Because of this factor, I don't think it's a guarantee that the upcoming incentives will be much better, if at all.

Said another way: while 54k/month rate may not be what they want longterm, it may be beneficial short term if there were some errors/mistakes in forecasting demand and competing cash bookings. They might need to sell slower than ~65k/month for the rest of year.

Other interesting facts about the contracts recorded last week:

- 79 contracts recorded, the 4th lowest week yet

- 31x 150pt contracts

- 17x 50pt contracts

- 8x 200pt contracts

- 5x 100pt contracts

- 5x 250pt contracts

- 13x other contracts

- 139.9pt average contract size last week

- Week one was 124.6pt average

- Week two was 130.9pt average

- Week three was 132.5pt average

- Week four was 108.1pt average

- Week five was 143.0pt average

- Week six was 146.6pt average

- Week seven was 150.4pt average

- Week eight was 165.5pt average

- Week nine was 158.9pt average

- Week ten was 169.2pt average

- Week eleven was 153.6pt average

- Week twelve was 161.4pt average

- Week thirteen was 133.1pt average

- Week fourteen was 163.1pt average

- 700pt is largest contract

- 50pt is smallest contract

- 250pt is the largest contract size purchased multiple times (5x)

- Unit 2A was assigned the most (3.9k, 2nd most was 1E at 2.5k)

- We are on sell-out watch for a few of the earliest Units: 1B, 1C, 1D, 1F, 1H

- 1B had no contracts recorded last 3 weeks, I think it is effectively sold out

- All of these Units are at fewer than 10k available points

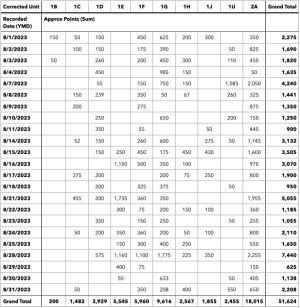

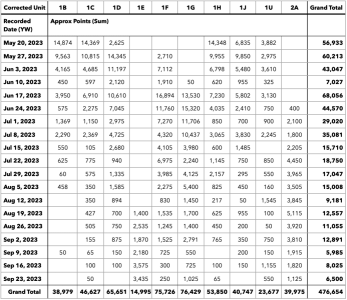

Unit/date breakdown:

View attachment 788946

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

View attachment 788947

Can we get an update please ?

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Will post an August monthly update today! And maybe also a 2-week update tonight.Can we get an update please ?

Timing got a little weird with a holiday last Monday (withholding the 9/1 recordings) and me visiting Disneyland after that

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

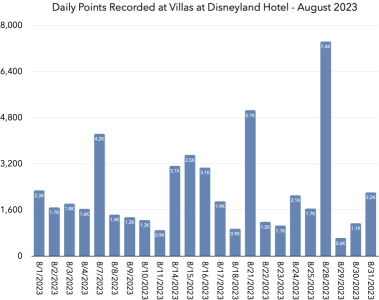

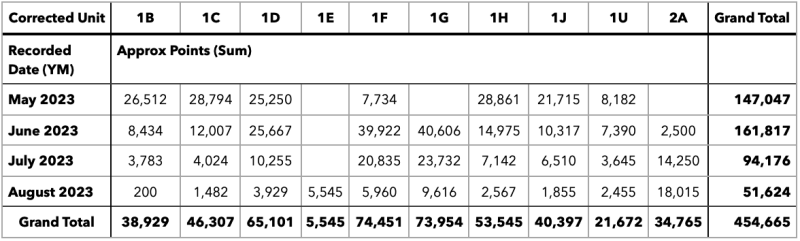

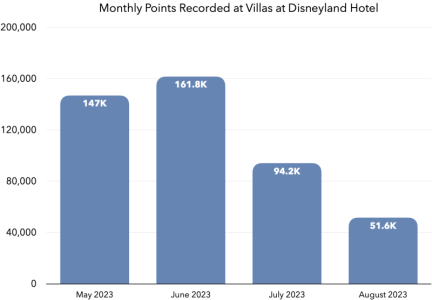

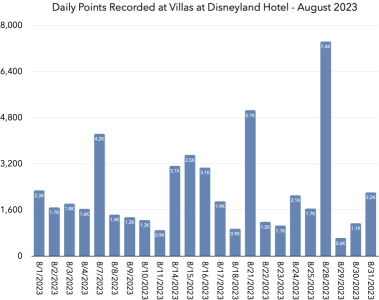

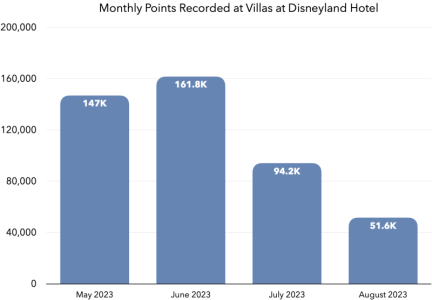

Monthly Update!

Total points recorded as of August 31st: ~455k points (13.96% of all points).

Points recorded in August: ~51.6k points.

August sales continued the trend downward from July. I wouldn't describe this as strong sales, at all. At the current rate of sales (51.6k/month), VDH will sell out in 54-55 months, or 4yrs and 6-7 months, roughly Mar/Apr 2028.

The incentives that are released tomorrow will be a strong indicator of whether Disney is interested in pushing sales up or if they're content with this sales pace. As I detailed last month, there is a potential rationale for keeping this sales pace: they already booked the rooms on cash and can't add inventory via declarations before 2024.

Currently ~22.3% of points are declared and at least ~14% of the resort has been sold. That leaves just ~8.3% of headroom, roughly 270k points, before more Units must be declared. At the current sales rate of ~12k/wk, that's just 22 weeks from the end of August, which we'll hit roughly late Jan/early Feb 2024. This is a potentially unsafe buffer for any sort of holiday sales spike.

My thinking here could be completely unfounded, but considering they started renting rooms on cash prior to any sales starting, they may have heavily relied on their sales forecasts to determine how much inventory they could rent. That forecast is in the POS and it's the current level of declarations.

What does this mean for potential buyers? We may not see improved incentives tomorrow or even later this year.

My guess? The inventory they allotted to cash rentals was conservative and they left plenty of buffer for solid sales, making being correct in their prediction insignificant and we will see more declarations before Jan 1, 2024. Magical Beginnings might also be used to help stabilize the situation (maybe?).

Fun facts about August's sales:

Nothing remarkable about mega-contracts, just one 1000pt contract at the top of the pile.

Unit 1E showed up for the first time!

There were a few 'odd' points contracts that could have been Favorite Weeks:

It is likely that Unit 1B has sold out as it was last recorded August 3rd. We're also getting close to selling out some other Units: 1C, 1D, 1F, 1G, and 1H. We still haven't seen 1A or 1I (one eye) show up in any recorded deeds yet. I'm also not sure how many Units are in Phase 2, but we've only seen Unit 2A from Phase 2 so far. I've been procrastinating on getting the 2nd declaration documents, but I'll work on that.

Other interesting facts about the contracts recorded in August:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

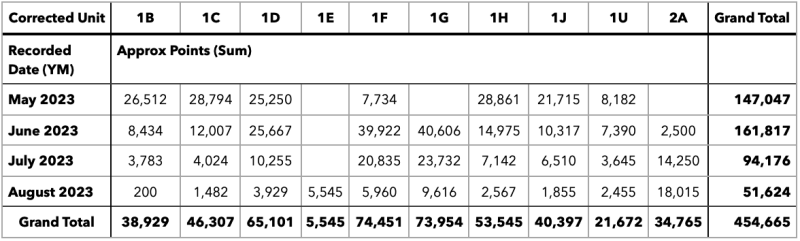

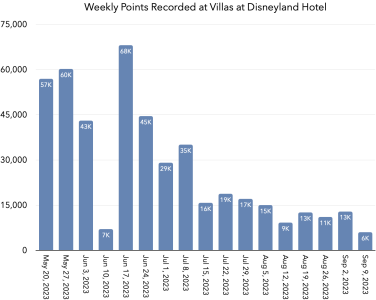

Points recorded by month:

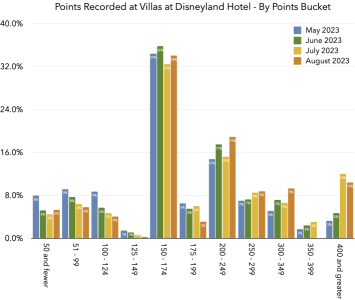

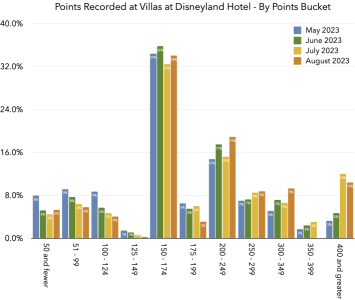

And a histogram showing that the contracts are continuing to skew larger as time passes (though August lacked mega contracts compared to July):

Total points recorded as of August 31st: ~455k points (13.96% of all points).

Points recorded in August: ~51.6k points.

August sales continued the trend downward from July. I wouldn't describe this as strong sales, at all. At the current rate of sales (51.6k/month), VDH will sell out in 54-55 months, or 4yrs and 6-7 months, roughly Mar/Apr 2028.

The incentives that are released tomorrow will be a strong indicator of whether Disney is interested in pushing sales up or if they're content with this sales pace. As I detailed last month, there is a potential rationale for keeping this sales pace: they already booked the rooms on cash and can't add inventory via declarations before 2024.

Currently ~22.3% of points are declared and at least ~14% of the resort has been sold. That leaves just ~8.3% of headroom, roughly 270k points, before more Units must be declared. At the current sales rate of ~12k/wk, that's just 22 weeks from the end of August, which we'll hit roughly late Jan/early Feb 2024. This is a potentially unsafe buffer for any sort of holiday sales spike.

My thinking here could be completely unfounded, but considering they started renting rooms on cash prior to any sales starting, they may have heavily relied on their sales forecasts to determine how much inventory they could rent. That forecast is in the POS and it's the current level of declarations.

What does this mean for potential buyers? We may not see improved incentives tomorrow or even later this year.

My guess? The inventory they allotted to cash rentals was conservative and they left plenty of buffer for solid sales, making being correct in their prediction insignificant and we will see more declarations before Jan 1, 2024. Magical Beginnings might also be used to help stabilize the situation (maybe?).

Fun facts about August's sales:

Nothing remarkable about mega-contracts, just one 1000pt contract at the top of the pile.

Unit 1E showed up for the first time!

There were a few 'odd' points contracts that could have been Favorite Weeks:

- 2x 207-208pt contracts that could be FW Deluxe Studio Preferred Views W23-32

- 1x 480pt contract that could be FW 2-Bedroom W11

It is likely that Unit 1B has sold out as it was last recorded August 3rd. We're also getting close to selling out some other Units: 1C, 1D, 1F, 1G, and 1H. We still haven't seen 1A or 1I (one eye) show up in any recorded deeds yet. I'm also not sure how many Units are in Phase 2, but we've only seen Unit 2A from Phase 2 so far. I've been procrastinating on getting the 2nd declaration documents, but I'll work on that.

Other interesting facts about the contracts recorded in August:

- 338 contracts recorded

- 114x 150pt contracts (193 the prior month)

- 55x 50pt contracts (84 the prior month)

- 40x 200pt contracts (66 the prior month)

- 24x 75pt contracts (57 the prior month)

- 21x 100pt contracts (39 the prior month)

- 17x 250pt contracts (30 the prior month)

- 15x 300pt contracts (13 the prior month)

- 8x 60pt contracts (10 the prior month)

- 44x other contracts (107 the prior month)

- 152.7pt average contract size in August

- May had an average of 128.2pt

- June had an average of 142.8pt

- July had an average of 157.2pt

- 1,000pt is largest contract in August

- 50pt is smallest contract

- 500pt is the largest contract size purchased multiple times (2x)

- Unit 2A was assigned the most (18k, 2nd most was 1G at 9.6k)

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Points recorded by month:

And a histogram showing that the contracts are continuing to skew larger as time passes (though August lacked mega contracts compared to July):

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Update from the last 2 weeks!

Total points recorded to date: ~462k points (14.2%)

Total points declared to date: ~727k points (22.3%)

Points recorded last 2 weeks (August 19 - September 8): ~18.9k points (12.9k two weeks ago, 6k last week, 9.4k pts/wk)

Sell out date based on last week's rate of recorded points: Aug/Sept 2032 (lol)

Last 4 weeks: ~42.5k points

Rolling 4 week average: ~10.6k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Sept 2028

Gonna keep this one short. Deeds recorded last week were sold ~3 weeks ago and is very much a "no reason to buy today" zone on the calendar with new incentives coming soon (but not yet the 10day rescission window) and little reason to need to buy for stays exactly 11m from now as August isn't exactly a high-priority time for DVC (I know D23 is almost exactly 11 months from now, but inventory is already gone and that wasn't announced when these sales occurred, which was about 2 weeks ago).

Other interesting facts about the contracts recorded last week:

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Total points recorded to date: ~462k points (14.2%)

Total points declared to date: ~727k points (22.3%)

Points recorded last 2 weeks (August 19 - September 8): ~18.9k points (12.9k two weeks ago, 6k last week, 9.4k pts/wk)

Sell out date based on last week's rate of recorded points: Aug/Sept 2032 (lol)

Last 4 weeks: ~42.5k points

Rolling 4 week average: ~10.6k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Sept 2028

Gonna keep this one short. Deeds recorded last week were sold ~3 weeks ago and is very much a "no reason to buy today" zone on the calendar with new incentives coming soon (but not yet the 10day rescission window) and little reason to need to buy for stays exactly 11m from now as August isn't exactly a high-priority time for DVC (I know D23 is almost exactly 11 months from now, but inventory is already gone and that wasn't announced when these sales occurred, which was about 2 weeks ago).

Other interesting facts about the contracts recorded last week:

- 43 contracts recorded, the lowest week yet

- 14x 150pt contracts

- 8x 50pt contracts

- 5x 200pt contracts

- 5x 100pt contracts

- 4x 250pt contracts

- 7x other contracts

- 139.2pt average contract size last week

- Week one was 124.6pt average

- Week two was 130.9pt average

- Week three was 132.5pt average

- Week four was 108.1pt average

- Week five was 143.0pt average

- Week six was 146.6pt average

- Week seven was 150.4pt average

- Week eight was 165.5pt average

- Week nine was 158.9pt average

- Week ten was 169.2pt average

- Week eleven was 153.6pt average

- Week twelve was 161.4pt average

- Week thirteen was 133.1pt average

- Week fourteen was 163.1pt average

- Week fifteen was 139.9pt average

- Week sixteen was 161.1pt average

- 300pt is largest contract

- 50pt is smallest contract

- 300pt is the largest contract size purchased multiple times (2x)

- Unit 1E was assigned the most (2.2k, 2nd most was 2A at 1.9k)

- While 1B showed up for the first time in over a month, it's still effectively sold out

- We are on sell-out watch for additional Units: 1C, 1D, 1F, 1H

- All of these Units are at fewer than 10k available points, most even less than that

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 9,152

I’m glad the VDH rooms didn’t get styled like this… my wife would have impoverished us with the amount of points she would have made me purchase!

https://disneyparks.disney.go.com/b...-little-mermaid-and-more-at-disneyland-paris/

https://disneyparks.disney.go.com/b...-little-mermaid-and-more-at-disneyland-paris/

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Welp, the incentives got worseThe incentives that are released tomorrow will be a strong indicator of whether Disney is interested in pushing sales up or if they're content with this sales pace. As I detailed last month, there is a potential rationale for keeping this sales pace: they already booked the rooms on cash and can't add inventory via declarations before 2024.

Very curious how many rescission window sales there were, guess we'll know in about 2 weeks.

Looks like the standard rooms have some design elements in common with the Grand Flo Resort Studios/Hotel Room refurbs and the BoardWalk Inn refurbs, specifically the wall treatments behind the beds (headboard-ish). I bet we start seeing more full-height and wall-height headboards (and wall treatments) in other refurbs going forward. Could start at BWV refurbs but maybe we'll have to wait a few more years for something the VGF hard goods refurb.I’m glad the VDH rooms didn’t get styled like this… my wife would have impoverished us with the amount of points she would have made me purchase!

https://disneyparks.disney.go.com/b...-little-mermaid-and-more-at-disneyland-paris/

The suites lower down in that post are very ornate, beyond what we'd ever see in DVC except Grand Villa/Cabin/Bungalow-class rooms, I'd think.

UrsulaWantsYourSoul

DIS Veteran

- Joined

- Jun 23, 2020

- Messages

- 3,683

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Weekly update!

Total points recorded to date: ~470k points (14.4%)

Total points declared to date: ~727k points (22.3%)

Points recorded last week (September 9 - 15): 8k points

Sell out date based on last week's rate of recorded points: May 2030 (lol)

Last 4 weeks: ~38k points

Rolling 4 week average: ~9.5k points/wk

Sell out date based on last 4 weeks' rate of recorded points: May 2029

Slow sales continue. Ho hum.

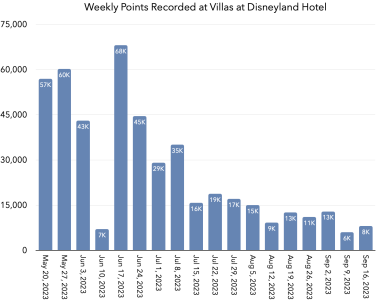

I added two new visualizations that I plan to maintain in my updates, one for average contract size and another for Unit Declaration Timeline, both below. Let me know what you think!

Similar to last week, deeds recorded last week were sold ~3 weeks ago, which is very much a "no reason to buy today" zone on the calendar with new incentives coming soon (but not yet the 10day rescission window) and little reason to need to buy for stays exactly 11m from now as August isn't exactly a high-priority time for DVC (I know D23 is almost exactly 11 months from now, but inventory is already gone and that wasn't announced when these sales occurred, which was about 3 weeks ago).

Other interesting facts about the contracts recorded last week:

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Total points recorded to date: ~470k points (14.4%)

Total points declared to date: ~727k points (22.3%)

Points recorded last week (September 9 - 15): 8k points

Sell out date based on last week's rate of recorded points: May 2030 (lol)

Last 4 weeks: ~38k points

Rolling 4 week average: ~9.5k points/wk

Sell out date based on last 4 weeks' rate of recorded points: May 2029

Slow sales continue. Ho hum.

I added two new visualizations that I plan to maintain in my updates, one for average contract size and another for Unit Declaration Timeline, both below. Let me know what you think!

Similar to last week, deeds recorded last week were sold ~3 weeks ago, which is very much a "no reason to buy today" zone on the calendar with new incentives coming soon (but not yet the 10day rescission window) and little reason to need to buy for stays exactly 11m from now as August isn't exactly a high-priority time for DVC (I know D23 is almost exactly 11 months from now, but inventory is already gone and that wasn't announced when these sales occurred, which was about 3 weeks ago).

Other interesting facts about the contracts recorded last week:

- 50 contracts recorded, the 2nd lowest week yet

- 9x 150pt contracts

- 9x 50pt contracts

- 8x 200pt contracts

- 5x 75pt contracts

- 5x 250pt contracts

- 14x other contracts

- 160.5pt average contract size last week

- Week one was 124.6pt average

- Week two was 130.9pt average

- Week three was 132.5pt average

- Week four was 108.1pt average

- Week five was 143.0pt average

- Week six was 146.6pt average

- Week seven was 150.4pt average

- Week eight was 165.5pt average

- Week nine was 158.9pt average

- Week ten was 169.2pt average

- Week eleven was 153.6pt average

- Week twelve was 161.4pt average

- Week thirteen was 133.1pt average

- Week fourteen was 163.1pt average

- Week fifteen was 139.9pt average

- Week sixteen was 161.1pt average

- Week seventeen was 139.2pt average

- 500pt is largest contract

- 50pt is smallest contract

- 500pt is the largest contract size purchased multiple times (2x)

- Unit 1E was assigned the most (3.6k, 2nd most was 2A at 1.8k)

- 1B returned to dormancy, I've declared it effectively sold out

- We are on sell-out watch for additional Units: 1C, 1D, 1F, 1H

- All of these Units are at fewer than 10k available points, most even less than that

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

UrsulaWantsYourSoul

DIS Veteran

- Joined

- Jun 23, 2020

- Messages

- 3,683

Will be so interesting to see what happens once it's open and people can see rooms on tours. Hopefully that gives a nice uptick.

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

That's a great point! Every single sale is sight-unseen so far.Will be so interesting to see what happens once it's open and people can see rooms on tours. Hopefully that gives a nice uptick.

Riviera sold better during its sight-unseen period, roughly ~900k points sold by the time it opened (vs. 470k so far for VDH). But it was selling for nearly 2x as long and was the only non-sold out resort selling for about half that time.

raionheart

Earning My Ears

- Joined

- Oct 31, 2012

- Messages

- 33

50 pts -- Unit 1E -- 0.0551% OCT UY

FlyingDonut

Mouseketeer

- Joined

- Aug 17, 2023

- Messages

- 245

I haven't been on property in a few years, is VDH in the preview center at WDW?Every single sale is sight-unseen so far.

I know it's not the same but I think I remember touring a mockup CCV and RIV room at the preview center years ago. (and I definitely remember the free ice cream!)

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Ahhhh! Thank you for posting 1E details! Based on this, 1E is around 90,750pts.50 pts -- Unit 1E -- 0.0551% OCT UY

There is no VDH preview in WDW or DL, unfortunately.I haven't been on property in a few years, is VDH in the preview center at WDW?

I know it's not the same but I think I remember touring a mockup CCV and RIV room at the preview center years ago. (and I definitely remember the free ice cream!)

Interesting that there was a RIV mockup room, I had forgotten about that.

NVDISFamily

I work to pay DVC dues.

- Joined

- Apr 16, 2022

- Messages

- 1,604

We are a bit late in providing this info but here goes....

Contract 1 -

185 pts -- Unit 2A -- 0.3723% DEC UY

Contract 2 -

185 pts -- Unit 2A -- 0.3723% DEC UY

Contract 1 -

185 pts -- Unit 2A -- 0.3723% DEC UY

Contract 2 -

185 pts -- Unit 2A -- 0.3723% DEC UY

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Thanks @raionheart, @superlarz, and @NVDISFamily for posting some unit sizes and % owned!

Want to show why it's useful and/or interesting for folks to post additional data when it's available:

The math works out to 49,691 ± 7pts based on @NVDISFamily's contracts, but specific range narrows it further: 49,684 - 49,698. Combining both shared 2A examples we get a range that's even narrower than just the one from @NVDISFamily's contracts: 49,685 - 49,698. Yes, it's just 1pt narrower, but other examples in the past have been more extreme (a 50pt and 55pt contract pair at 1H is a good example).

Anyway, thanks for sharing y'all!

Want to show why it's useful and/or interesting for folks to post additional data when it's available:

Based on this, we now know Unit 1E is 90,744 ± 82 pts.50 pts -- Unit 1E -- 0.0551% OCT UY

Because this is a larger contract, we can narrow the error range proportionally, even if the ratio is exactly the same. We now know 1E is 90,744 ± 21 pts.200 pts -- Unit 1E -- 0.2204% OCT UY

And because these are 'weird' points amounts, we can also potentially get a lot of precision here when combined with other % posted! A prior post shared their 2A contract to be 75pts, 0.1509%, which works out to 49,702 ± 16pts (technically the range is 49,685 - 49,718). But because this new contract is a non-multiple of 75 as well as being larger, we have the chance to 'double' refine it (that is, improve our Unit knowledge both by the contract being larger, but also being potentially out of phase with other contracts posted).We are a bit late in providing this info but here goes....

Contract 1 -

185 pts -- Unit 2A -- 0.3723% DEC UY

Contract 2 -

185 pts -- Unit 2A -- 0.3723% DEC UY

The math works out to 49,691 ± 7pts based on @NVDISFamily's contracts, but specific range narrows it further: 49,684 - 49,698. Combining both shared 2A examples we get a range that's even narrower than just the one from @NVDISFamily's contracts: 49,685 - 49,698. Yes, it's just 1pt narrower, but other examples in the past have been more extreme (a 50pt and 55pt contract pair at 1H is a good example).

Anyway, thanks for sharing y'all!

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Weekly update!

OCRW did update yesterday and it turns out no DVC contracts were recorded on Friday, so I could have just posted this Monday evening

Total points recorded to date: ~477k points (14.6%)

Total points declared to date: ~727k points (22.3%)

Points recorded last week (September 16 - 22): 6.5k points

Sell out date based on last week's rate of recorded points: Dec 2031 (lol)

Last 4 weeks: ~33k points

Rolling 4 week average: ~8.4k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Aug/Sept 2031

Slow sales continue. Ho hum.

Contracts recorded last week were likely mostly purchased between Sept 2 and Sept 11, right at the very end of the prior incentives. And all before anyone has seen these rooms, as @UrsulaWantsYourSoul pointed out. Maybe we start to see things pick up with buzzer-beaters on the summer incentives and then post-review purchases in the coming weeks.

Other interesting facts about the contracts recorded last week:

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

OCRW did update yesterday and it turns out no DVC contracts were recorded on Friday, so I could have just posted this Monday evening

Total points recorded to date: ~477k points (14.6%)

Total points declared to date: ~727k points (22.3%)

Points recorded last week (September 16 - 22): 6.5k points

Sell out date based on last week's rate of recorded points: Dec 2031 (lol)

Last 4 weeks: ~33k points

Rolling 4 week average: ~8.4k points/wk

Sell out date based on last 4 weeks' rate of recorded points: Aug/Sept 2031

Slow sales continue. Ho hum.

Contracts recorded last week were likely mostly purchased between Sept 2 and Sept 11, right at the very end of the prior incentives. And all before anyone has seen these rooms, as @UrsulaWantsYourSoul pointed out. Maybe we start to see things pick up with buzzer-beaters on the summer incentives and then post-review purchases in the coming weeks.

Other interesting facts about the contracts recorded last week:

- 45 contracts recorded, the 2nd lowest week yet

- 15x 150pt contracts

- 9x 200pt contracts

- 5x 50pt contracts

- 16x other contracts

- 144.4pt average contract size last week

- Week one was 124.6pt average

- Week two was 130.9pt average

- Week three was 132.5pt average

- Week four was 108.1pt average

- Week five was 143.0pt average

- Week six was 146.6pt average

- Week seven was 150.4pt average

- Week eight was 165.5pt average

- Week nine was 158.9pt average

- Week ten was 169.2pt average

- Week eleven was 153.6pt average

- Week twelve was 161.4pt average

- Week thirteen was 133.1pt average

- Week fourteen was 163.1pt average

- Week fifteen was 139.9pt average

- Week sixteen was 161.1pt average

- Week seventeen was 139.2pt average

- Week eighteen was 160.5pt average

- 250pt is largest contract

- 50pt is smallest contract

- 250pt is the largest contract size purchased multiple times (3x)

- Unit 1E was assigned the most (3.4k, 2nd most was 2A at 1.1k)

- 1B remains dormant, essentially sold out

- We are on sell-out watch for additional Units: 1C, 1D, 1F, 1H

- All of these Units are at fewer than 10k available points, most even less than that

Unit/date breakdown:

"1U" unit stands for "Phase 1 - Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

-

How Disney Pricing Changed in 2003 and Never Looked Back

-

Two Pieces of Disneyland History Now Rotate Daily on Main Street

-

New 'Tangled' Look at Disney Springs PhotoPass Studio

-

Disney Character Meals Are Not Automatically Worth the Price

-

Route Update for Disney Starlight Parade at Magic Kingdom

-

Disney Dream Adds Railing After Overboard Incident

-

Cool KIDS' SUMMER Resorts Change for Disney World in 2026

New Threads

- Replies

- 0

- Views

- 1

- Replies

- 0

- Views

- 82

- Replies

- 2

- Views

- 132

New Posts

- Replies

- 226

- Views

- 52K

- Replies

- 3

- Views

- 163

- Replies

- 0

- Views

- 1

- Replies

- 2

- Views

- 132

- Replies

- 127

- Views

- 19K

- Replies

- 33

- Views

- 5K

- Replies

- 595

- Views

- 60K