Thanks for doing this and sharing. I am back and forth on DVC and today is a day where I want to buy. For Column G [

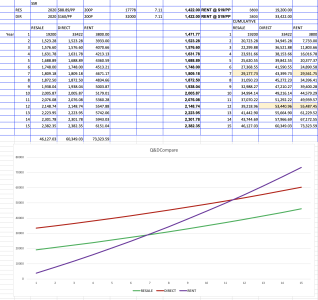

Cash Price or Point Rental Price for Equivalent Room(s)] do you think it's safe to just use a rental price of $19 per point? I referenced the board sponsor and it is $19 booking seven months out, $21 eleven months out. With a 7% ROI opportunity cost, it seems it may never be worth it (i.e. For my calculations of a 130 point contract @ BW for $125 a point, I would have saved ~$19k while investing would have netted me $86k over that same timeframe). Am I looking at this wrong?

I appreciate your insight.

Misunderstood how the model was working! apologies

Last edited: