Boba(not-so)Fit

Earning My Ears

- Joined

- Apr 3, 2023

- Messages

- 61

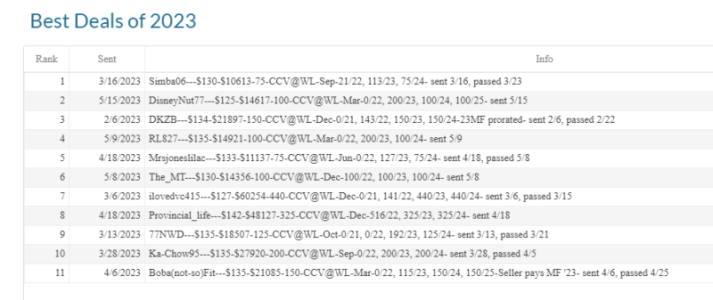

Thanks for the effort in creating that site. It is looking pretty good.Thanks, wow you're on top of things! I've been experimenting with different ways of normalizing prices to take into account banked/stripped points, seller-paid closing costs, and seller-paid dues. Currently the normalized price is one which equates the initial cost with the PV of "cash flows" generated by the points (Points * solved-for $/Pt) and annual dues. I assume 45 days to close, discount rate of 5%, closing costs of $750, banked points with less than 7 months to expiry are only worth 50% of their value, and less than 4 months are given no value. The value of banked points close to expiration is probably the most important assumptions in terms of rearranging the results and something I'm still working on. I have figures that get adjusted even further for use year and contract size which I may move to, but it needs more analysis. I think the next step is to provide more clarity on the website around how they are ranked. That will lend itself to a tool for people to evaluate their own offers against the historical sales. Also to caveat, I do suspect some of the data was not entered correctly as well (e.g., not including all costs in final price), but I haven't dug in too much yet.

For me when comparing my contracts to others, I keep it pretty simple. I typically use the $/pts per year method found on the search engine site but expand it to take into account the closing costs and MF paid (since they are included in everyone's string). This helps normalize across contracts with a different # of points.

total cost (as per the generator tool) / total # points over life of the contract

So for example, my most recent contract

Boba(not-so)Fit---$135-$21085-150-CCV@WL-Mar-0/22, 115/23, 150/24, 150/25-Seller pays MF '23- sent 4/6, passed 4/25

My total cost was $135*150+ $835 closing = $21085

$21085 / (115 current points + 44 years remaining * 150 points) = $21085/6715 = $3.14 per point

As a comparison, if someone got the same contract for $5 cheaper but paid '23 MF their value would be (assuming same closing costs and CCV '23 MF of $7.92*115 = $910.80)

$21245.80 / 6715 = $3.16 per point

There are probably some holes in this method that some will point out but it works pretty good for me. But then again, maybe I am just bitter because I didn't make the Best Deals list.

...because I can't...lol! I mean, I can but I don't want to. If the basic analysis checks out for me, we actually will save money in the future, and it's what we love, that's as far as I will go.

...because I can't...lol! I mean, I can but I don't want to. If the basic analysis checks out for me, we actually will save money in the future, and it's what we love, that's as far as I will go.