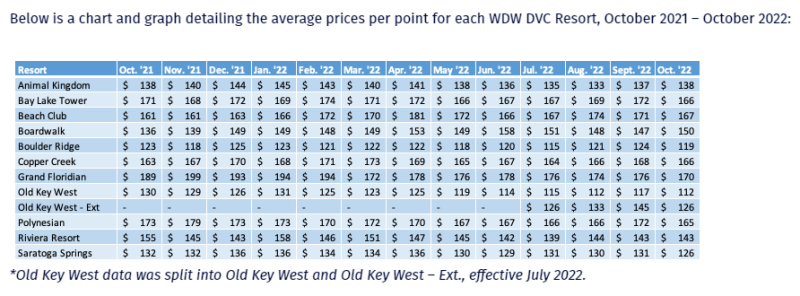

Again, not sure I would really read into it too much because I could make this argument...The market at the time VGF (Big Pine Key expansion) went on sale in 2022 was red hot across the board for all

DVC resorts. Everything peaked leading up to VGF price announcement thinking it was going to go for well over $200per point, and then everything settled back down upon the pricing announcement and the cooling of the economy. Poly's bell-curve was really no different from VGF's in 2020-2022 (peaking at $179), despite having no expansion to piggyback off of. Did that really make any impact on Disney's ability to sell VGF new at $207 before any discounts? Probably not since the price of resale vs direct was so close and the previous price for a "sold out" VGF direct was $250 before BPK. If anything, it may have made selling VGF easier early on! I would assume Poly's resale price would rise rapidly as well should it be part of the same association - thus making it fairly easy for Disney to make the argument of buying direct.

At the end of the day, people are more reluctant to buy Riviera due to the restrictions compared to VGF. They built this beautiful, brand new Riviera tower near Epcot, and yet they are still having trouble selling it out. Is that something Disney really wants to deal with long-term with all their future Florida resorts or would they prefer to sell them out in 2-3 years? I genuinely don't know the answer to that question, and I'm not sure Disney does either.

View attachment 780840

View attachment 780841

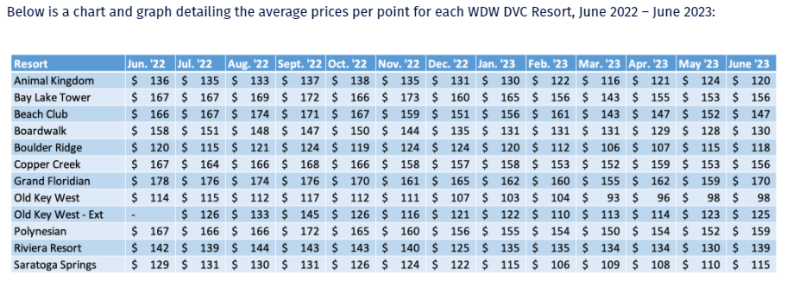

There is no evidence to support that people are more reluctant to buy RIV direct than VGF simply because it has restrictions. For 4 or 5 months, in 2022, RIV outsold VGF almost 2:1 when it was priced lower. Restrictions did not cause buyers to shy away.

Sales only rebounded for VGF direct in December when DVD flipped the script and had to start selling VGF for less. That simply tells you that price is the number one factor when people are buying direct right now and DVD had to lower VGF in order to compete with RIV last year. My guess is that they want VGF to be close enough for them to call it "sold out" when the tower goes for sale.

VDH is selling fine with restrictions. While yes, it is located elsewhere and restrictions at VDH may not mean the same thing as at a WDW resort, people are still able to overlook them in favor of a resort they like.

In terms of RIV sales, 6.7 million points is a lot of points to sell...and even if they had had higher than average monthly sales, and no pandemic, it would take about 4 to 5 years to sell...add in COVID and current situation and you can see why it may be off its original target.

Last year, when VGF went up, there was a big factor in play that saw prices go the way they did and that was ROFR. When DVD was even taking SSR in the high $120's, it impacted how high buyers had to go to get one through, especially at those more popular resorts.

Now, the price of PVB has gone down but I do believe it is for the same reason that every other resort is currently down...no ROFR and more buyers than sellers, and other economic reasons. So, when Poly tower details are announced, I don't think it is going to take the same hit that VGF did because it already has due to market conditions.

But, for VGF, those prices dropped at least $20/point within weeks of VGF sales starting back up....because not only did VGF start at the same base price of $207, the incentives were strong.

In the end, they are not going to have trouble selling resorts with restrictions if they stay on that path. And, if Poly tower follows suit in terms of popularity with cash guests (like RIV and AUL do, which is why I don't believe they care how long it takes to sell), they won't care if it takes longer to have the points in stock.

[green fella is Riviera]

[green fella is Riviera]