I need to whine for a minute... (newbie blues)...

After careful consideration, I have decided to go ahead and move our emergency fund to WF temporarily to get that $525 bonus... They weren't able to "verify identity" online, so yesterday I decided to go into the branch. (Fortunately VERY local to me and close to other stops on my errands-run...)

So get this... the cashier says they "only do that by appointment" (practically rolling her eyes as she says it.) Then, when asked about making an appointment, "you have to go online."

I was *TRULY* unsure at that point if it is worth $500 to me to put up with that kind of attitude!!! It gets better. Then next available appointment was not until the 5th and at a different branch! (So I have to wait 2 days to make an appointment to give them MY money...????)

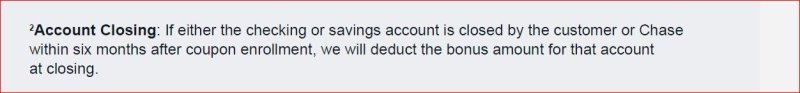

At this point, the only reason I am going through with it is because when I went to make the appointment, the $325 checking deal was back... I missed out on that last week because they "could not verify identity" online... so yes, for $850, I will go through the hoops... but these little adventures have already taught me that I **LOVE** my credit union (lousy rates and all) and that WF and Cap1 are both LOUSY institutions that I will never do business with unless they are paying me! (Chase has been fine so far... still not keeping the account past when the 90-day bonus hits, though...)

I just want something that's easier than constantly purchasing a new policy for every overseas trip.

I just want something that's easier than constantly purchasing a new policy for every overseas trip.

But we did the snorkeling in Silfra a number of years ago as a port adventure on our

But we did the snorkeling in Silfra a number of years ago as a port adventure on our