goofytinkerbell

DIS Veteran

- Joined

- Jul 5, 2009

- Messages

- 560

1

Last edited:

I have two young adult children with autism who will always live with me, too.Well, our 2 kids are autistic and we are pretty sure one will continue to live with us forever. The other wants to eventually have his own place, but he means his OWN place (no roommates). At this point, we don't even know if he can hold down a job. At 18, he still lacks the social skills to pass through the hiring phase of even a part time job. So, we will be supporting them financially for a long time, although we are hopeful that they will qualify for SSI and also work a bit to help offset those costs associated with continual support.

I think parents need to be willing to support their kids when they REALLY NEED IT, but a situation like an adult child with an established career, I don't know if that warrants continuous support. At that point, its more about the adult child learning how to budget and prioritize spending. At 22, I was married (to a fresh military officer) and before I had a job, our take home pay was just under $3000/month and our first apartment rent was $1250. This was in 2001. We wouldn't have dreamed of asking our parents for money. I hustled to find a job and then once I did and we were in better shape, THEN we got to do all the fun stuff like go out to eat and go to the movies. Before that, we simply did without extras. It was a long, boring 6 months.

For our daughter/new teacher, I think the only thing we did was keep her on our cell phone plan, and that was just an accident.

We also didn't realize it was a thing for parents to go to her job and help her set up her classroom.

This is a fantastic way to do it. We have a branch of my family doing this right now. The grandparents paid for their son's education (which he's not using) and are paying for tons of things while he doesn't even hold down a proper job. His kids are growing up believing they can go to university and then 'bum around' and they'll always have plenty of money. The oldest has already dropped out of university (which his grandparents were paying for) because he was bored, though I think he's planning to go back this year. If the grandparents continue as they are, they will be funding the grandkids lives, but they're getting older and I suspect they won't be around by the time the grandkids have their own kids. The house of cards is going to collapse. In the meantime, the whole lot of them are spoiled, entitled and completely ungrateful. I get the grandparents were trying to help everyone. There's nothing wrong with wanting to help. But I think they've done more damage than good, and they've raised a bunch of horrible, selfish people (I could tell stories to back that up, but this is a long enough rant).

My sister has 2 kids. She and BIL invested well over the years. They had their share of struggles when they first married and had kids. Lots of free babysitting was done, including by yours truly. Now they are in their 60s with 2 young grandkids. Their kids are in their early 40s. Only one of their kids is married. They help pay for private school, big vacations, all that stuff for the grandkids. I just keep thinking, because they married young and had kids young, their kids could be in their 70s before the parents pass. So what happens if they need nursing home or in home care and use up their money? Their kids aren’t going to have anything to continue that lifestyle with their own kids nor will they have inheritance to fall back on. I guess I just feel like they are enabling them. Their kid with the grandkids is the one who expects the most. The other is self sufficient and doesn’t get nearly as much from his parents.the even scarier thing is-the 2nd generation (kids of the parents who helped out) assumed THEIR parents could afford all this and never gave consideration to the fact that they were not in high paying careers so they just assumed when they passed since they had lived in their family home for decades it would be sold off at a huge profit resulting in nice inheritance. WRONG-they couldn't afford to help to the extent they did so there was re-fi after re-fi resulting in very little equity when it was sold off. sadly i suspect the anticipated inheritance had been earmarked by 2nd generation as their 'retirement savings' so absent that since they are approaching their late 60's i'm afraid 3rd generation may find themselves fully underwater trying to support themselves, their children AND their parents.

My sister has 2 kids. She and BIL invested well over the years. They had their share of struggles when they first married and had kids. Lots of free babysitting was done, including by yours truly. Now they are in their 60s with 2 young grandkids. Their kids are in their early 40s. Only one of their kids is married. They help pay for private school, big vacations, all that stuff for the grandkids. I just keep thinking, because they married young and had kids young, their kids could be in their 70s before the parents pass. So what happens if they need nursing home or in home care and use up their money? Their kids aren’t going to have anything to continue that lifestyle with their own kids nor will they have inheritance to fall back on. I guess I just feel like they are enabling them. Their kid with the grandkids is the one who expects the most. The other is self sufficient and doesn’t get nearly as much from his parents.

My sister does get mad at my BIL sometimes because he wants to give them what they want all the time. Want a hotel room by the airport the night before vacation? Oh here, I have hotel points. My sister thinks they need to struggle a bit more than they do. For example, they all share a cell phone plan and she makes them each take their turn paying. I just wonder if they are helping them in the long run.

This is exactly what family is about!I’ll answer as the young adult: after graduating my parents made it clear I was more than welcome to move back home for as long as needed as long as I was working. Their goal for my brother and I was always to allow us to 1. Focus on paying off our student loans and 2. Also try to save a decent amount while doing that. They kept us on their health insurance until we were kicked off for our age, we just needed to pay for any extra bills that came along with it such as getting glasses or doctors appointments. They also kept us on their phone plan. We were never expected to really pay for anything around the house, but I’m sure if we weren’t actually working like we were or if we were messing around it would have been different. We bought our own cars and paid for insurance and gas for those on our own, but every once in a while my dad would surprise us and take them for a car wash and fill up for us.

When I got my first apartment with my fiancé obviously I was responsible for paying that rent and everything that goes along with living in an apartment, but insurance and phone bills stayed with them and they would offer to help here and there just to be nice with groceries or something. They even ended up letting me move back home for a year when we decided we wanted to buy a house but needed time without rent to really finish saving enough for it. Now that I’m married and have a house, the only constant thing they have offered is to keep me on their phone plan which I’ll never complain about! I just pay for the actual phone when I need a new one.

I’m so thankful they allowed me to stay after college and never forced me out, rent is absolutely insane out there and they are happy that I was able to get most of my student loans payed off while also being able to afford a nice starter home well within mine and my husband‘s means - it would have probably taken a heck of a lot longer to get here if I would have had to move out on my own right away!

The Book "The Millionaire Next Door" goes into this--I assume that you, Barkley, have read it, just because you seem the type (I mean that as a good thing). There's a chapter on "Economic Outpatient Care"--well-meaning parents who give a lot of financial support to their adult children. We're not talking covering insurance straight out of college or cell phones--it's money to buy a nicer house, pay for private school, get a nicer car. It ends up crippling the adult children, and their expectations for additional funds in the form of an inheritance. The parents are well-intentioned, but the adult children (a) never learn to fly on their own, and (b) never learn that they CAN fly on their own.while administering a family member's estate there were pointed comments by their beneficiaries (adult children) as to how 'small' their inheritances were. we held our tongues knowing after going through all the bills and bank records that had the deceased not passed in the manner they had and gone into nursing care it would have been a manner a month or two/not fallen ill and continued in their existing lifestyle-less than a year before they would have been totally absent any savings/living on a small pension (not social security eligible) insufficient to meet any basic needs (as in less than their relatively low rent at the time).

I think with my sister’s mindset, they keep things kind of in check. The funny thing is, while they help with tuition for the grandkids, they don’t really give money for everyday expenses. So in this sense they do have to be responsible and they should be able to survive day to day without the parents. One thing that’s funny, the niece with kids always drives second hand cars till they die. That’s fine except when they have car trouble she actually borrows my car. Or she has in the past. The most recent time she used her dad’s vehicle. My sister doesn’t loan her car to anyone. Ever. The biggest thing they do is take them in expensive vacations. And if they go out to eat the parents pay. My parents never bought my meals when I was 40. After vacations my niece talks about how they got on each others nerves. I want to ask why she doesn’t want to take her own family vacations. But whatever. The unmarried nephew saves his money, buys all his own things, is totally self sufficient although he does take advantage of the vacations. He works at a non profit so doesn’t make a lot but is very thrifty.while administering a family member's estate there were pointed comments by their beneficiaries (adult children) as to how 'small' their inheritances were. we held our tongues knowing after going through all the bills and bank records that had the deceased not passed in the manner they had and gone into nursing care it would have been a manner a month or two/not fallen ill and continued in their existing lifestyle-less than a year before they would have been totally absent any savings/living on a small pension (not social security eligible) insufficient to meet any basic needs (as in less than their relatively low rent at the time).

I remember my mom jokingly telling my sister and I all the time when we were teenagers that she was ready to get us off her payroll.I think it’s the sign of the times also. That we can’t let our kids experience hardships. There were times I worked an extra job or had a side hustle. My husband and I have worked hard for what we have. We will pay for dinner sometimes but I want to enjoy the fruits of our labor! I want my kids off the payroll!

Ha my parents never did that!

I guess my mom would have, I just never thought to ask. My mom and I weren’t like todays moms/daughters. I wanted my independence. I used to take my niece and nephew and they loved going. When I first started I did it all in my own. Then a few years in they were maybe 10-12 and they were helpful with setting up the desks, covering the bulletin boards, putting things on the shelves, etc. it was always so hot. I liked to go in July to get it all finished so I didn’t have your go back in until the mandatory days. There wasn’t ac in the building and it was HOT!I remember my mom jokingly telling my sister and I all the time when we were teenagers that she was ready to get us off her payroll.

My mom never came and helped me in my classroom, but she would have if I asked. The school where I work has lots of young teachers, and we have lots of moms coming to help out. They come help get things set up and sometimes come even when the kids are there to help with special projects.

Yes! And honestly one thing I was so grateful for was even if my parents couldn’t help financially, they always made sure we understood the ins and outs of our own finances: what were our student loans going to look like based on going to so and so school and their tuition, what kind of car payment would be realistic with our income at the time, how much house could we really afford without getting in over our heads. Learning all of that growing up can be much more valuable in the long run and has definitely helped set me up for success!This is exactly what family is about!Helping each other out! It is not making it “easy” for your kids or making them entitled. It is literally doing the best you can as a parent to help your kids out.

Again I think it depends on the situation. I know of several different variations on the living with the parents. I also know of people who finally got to live on their own and now they have to move back in due to financial strain. One friends rent skyrocketed. They put the apartment on the market. To outright buy said apartment was a five figure number. Rent was still in the four figure number but double what my friend had initially signed the lease for. I was shocked and saddened for them. They have a great steady job, no crazy financial strain issues, student loans almost fully paid off. Just sad.Only if the sign is those just out of college expecting to live the same lifestyle they were accustomed to while living with their parents.

Is it really better for both parent & child to have the child living "on their own" but only with financial help vs the child living at home with their parents?

i have two examples: one that is just I don’t even know how to describe it bjt I wouldn’t say controlling and one that looks controlling but it is just what we see on social media.I’ve always been a bit put off by adults who continue to take an allowance (monthly payments) from their parents. I’m also put off by parents who try to control their adult children. I figure I had 18 years to give them advice and ever increasing experience and now it’s time for them to take over control of their life, both choices and consequences.

DD is 20 and while we do pay the majority of her college costs she is responsible for everything else. She works and pays for her car payment, insurance, phone (she’s on our plan but pays is her portion each month), groceries (no dining plan, but her dorm room has a full kitchen), gas, personal expenses, clothes, fun money, etc. she also pays us 300 a month towards her schooling. That comes out to only 3,600 per year for school which I felt was fair. We pay all the rest of the tuition/fees/dorm. She’ll graduate debt free. She also pays for her extra activities like sorority and cheer team. She budgets very well. She has a checking and savings account and her own credit card that she pays off in full every month. She is blown away by other friends at school who are given everything and have no idea how to budget or plan. She’s also shocked by how many of the parents still try to tell their kids what they can and can’t do! Some that even force their kids into a particular major or career since it’s their money. Now while she’s home from school over the summer if I’m picking up take out for dinner I buy her some too and whenever we go out to eat together I pay. When we go on family trips I pay for the trip itself and she just pays for extras that she wants. I’m saving right now because when she graduates in 2 years we’re planning to do 4-5 weeeks in Europe just the 2 of us. I’ll be paying for that as her grad gift. She’s saving for her wardrobe for the tripI don’t mind at all helping out with something from time to time or just doing something unexpected. When I help her move back into the dorm in a couple of weeks I’ll surprise her with a 150 giftcard to the grocery store to help her get set up for the beginning of the year. But giving monthly allowances or paying for her expenses is a hard no for me.

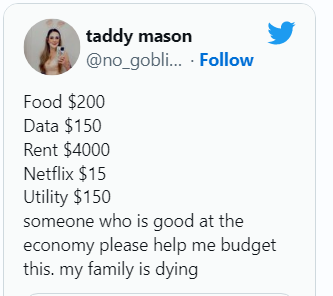

To me living with parents, paying all own bills, including food, toiletries, etc plus paying rent should be the first step of gradual release. Helping children budget and showing them actual costs for “living on their own” is important too. I think some, not all, of children out on their own for the first time have NO CLUE how much it truly costs. Some may need cut out certain “luxury” expenses (gym membership, cable/streaming services, music subscriptions, etc) to make it work within their income. Or comprise on where they live, with a roommate or two vs on their own. I don’t think jumping into “on their own” vs with parent(s) is necessarily the ideal at 21 yo.Again I think it depends on the situation. I know of several different variations on the living with the parents.

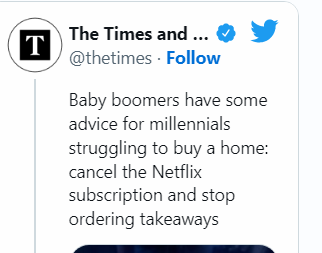

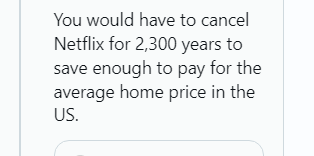

This is often used as an example of why youths struggle. Sure "every little bit helps" but in truth these things aren't why youths have issues reconciling their income.Some may need cut out certain “luxury” expenses (gym membership, cable/streaming services, music subscriptions, etc) to make it work within their income.