DanCali

DIS Veteran

- Joined

- Mar 9, 2023

- Messages

- 1,120

As to whether RIV sales are lower than Poly currently because of the resale restrictions, I just don't think that's a good test case - RIV is 6 years old, PIT is brand new. If they were both brand new and PIT was still outselling RIV, then it's a much more clear test case. Personally, looking at the full historical data on RIV since it opened, I have a hard time concluding that resale restrictions have had any meaningful impact on RIV sales. I think this bookmarked post and some other parts of the thread is a very good one for anyone who is interested in more of the RIV sales history: https://www.disboards.com/threads/first-riviera-rofr.3971706/page-12#post-66328828

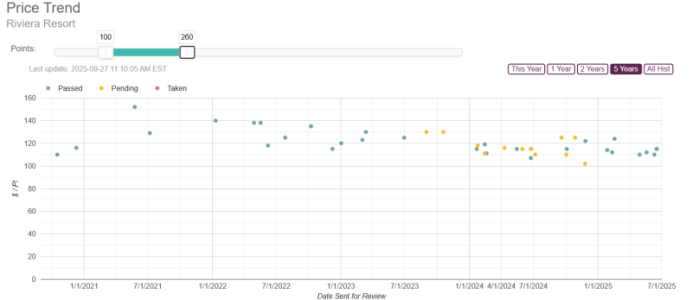

I think the thing missing from that older argument that Riviera sales have not lagged VGF/BPK sales is that the resale price of Riviera at the time as in the $130s-$140s and was at least in the same ballpark as VGF ($150s). That may have given people the premature impression that restrictions do not affect resale prices that much. That's no longer the case with Riviera resale in the low $100s and PVB resale in the $150-$160s. With the impact on resale prices becoming more and more evident, the hesitance of buyers who consider prevailing resale prices as a material factor in a direct purchase has also increased.

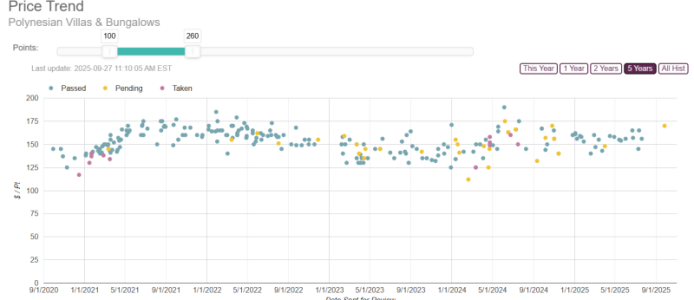

Here's the 5-year trend for PVB rofrs of 100-260 points from dvcrofr.com - it's basically flat:

Here's the Riviera data - as you get more resale supply, prices have gone down:

Last edited: