- Joined

- Nov 15, 2008

- Messages

- 48,480

There is plenty empirical evidence at how these types of restrictions affected resale values at other timeshare developers, specifically the Vistana Westin/Sheraton timeshares (formerly Starwood Vacation ownership, now part of Marriott Vacation Club).

There are nuances with weeks vs points, season types, and the type of restrictions, but suffice it to say that, once the market stabilized, you literally had once category of timeshares that held its resale values (unrestricted, high season) and once that was near-zero (restricted, regardless of season).

If you have access to Redweek just take a look at the Westin Kierland Villas (in the AZ desert) 2BR high season resale prices ($12-$16K) versus Westin Desert Willow (in the CA desert) 2BR high season resale prices which are going for near zero. Both are Westin, both highly popular in the winter months, but the one in Scottsdale can trade internally into a 2BR Westin in Hawaii (where dues are almost double) using points, while the one in Palm Desert can only try to trade via Interval.

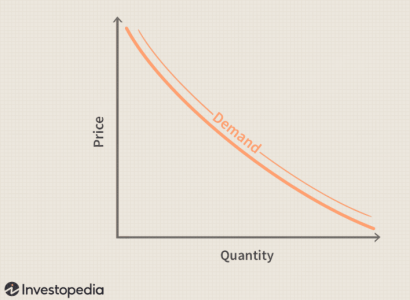

Even though the resort is only 5 years old, and still in active sales, there is plenty of evidence that resale prices at RIV have decreased at a rapid pace since 2022, while resorts like PVB, BLT, VGF have not decreased much at all. I'm not trying to bash Riviera as a resort (I love the resort itself) but when the supply of a lousy product (due to restrictions imposed by the developer) increases, prices do go down... And it's inevitable supply will continue to increase over the next 5 years as more original buyers sell due to various reasons.

If you perceive the value of a timeshare as $X due to usage at home resort and $Y due to flexibility to trade, with the total resale value being X+Y, that "Y" part for Riviera is zero. Whether Y is 20% of the total value or 60% of the total value may be resort dependent (e.g., lower for VGC and higher for SSR) and subjective, but overall some value is lost due to restrictions. For most resorts, I'd put it personally closer to 50%, so I wouldn't be surprised to see it settle at half the price of prime O14 resorts expiring in the 2060s. But that's just a personal opinion given to how much less I'd be willing to pay for my own resale contracts if they were restricted. In the end, supply and demand will determine the resale price....

My point was that there is a market of buyers out there who are willing to pay similar pricing for RIV and other popular resorts, like BLT and CCV.

And there are resorts that sell for less. It’s age doesn’t factor in IMO.

Even if it didn’t have restrictions, I don’t think we’d see much higher pricing on it right now because of the pricing we are seeing at VGF and PVB.

So we are left with how well is it doing market wise for a resort you can not trade and I’d say in the scheme of things it’s holding its own

When it’s sold out and you can’t get it direct for a decent price, I predict it will stabilize.

The resale pricing in general has gone down in the past few years and so some of what we are seeing for RIV is, in part, impacted by those same factors.