You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where is bottom?

- Thread starter Cfabar1

- Start date

- Joined

- Feb 16, 2008

- Messages

- 974

Goldman Sachs should hire you to run the firm.Perplexing people aren’t aware we’re currently in recession while pretending as if we aren’t and that predicting one is impossible. We’re already here; there’s no prediction necessary. Manufacturing numbers are worse today than at the deepest part of COVID lockdowns in May 2020. Credit card usage is spiking dramatically. People are clinging to debt in the game of musical chairs.

Pretending like the recession isn’t here is akin to Wiley E Coyote having already walked off the side of the cliff and still being suspended in midair and he hasn’t looked down so he hasn’t fallen yet.

Disney_David

Mouseketeer

- Joined

- Jan 3, 2023

- Messages

- 297

We are definitely kindred spirits. I book Swolphin every year for NYE too.I've been Platinum Elite for a long time (though not lifetime), I agree with all of your points. I was a prior Starwood Elite and I feel like the points, even after conversion, don't go nearly as far as they used to. (Still, have ridonkulous amounbts of points, though) Swolphin is, to me, something in between "on property, deluxe resort" and "good neighbor" - I feel like it has a bit more personality and yes, great location, but it's still a hotel room. Our first DVC stay on our own points, we did 3 days at the Swan, which we all enjoyed, and then a 1br standard at BLT which my then 7-yo exclaimed, when we opened the door, "wow! This is the nicest hotel room I've ever seen!!" (She apparently forgot our previous point rentals at BWV (1br) and BLT(2br) )

There came a few times we made last minute trips to WDW and I elected to use points for Swolphin and its location rather than DVC points for SSR which was the only resort left on short notice. If we were only going to book studios, I would include Swolphin in the mix based on location alone. But having a 1br, especially a new(ly refurbished) one like VGF and RIV, is worth the points to me. And I am that cheapskate who would never pay cash rates for a 1br DVC.

We did rent points for quite some time, but I didn't like reestablishing trust with each owner even though some of them have become my "friends" here and were really helpful in talking to me about their experiences. I do also like the ability to modify and stalk and change reservations like when my sister decided last year to join us - I stalked my way to an extra studio at BCV 3-4 months in advance - no way I could have done that with point rentals. (We were already in a 2br at BCV and my backup was to book them a room at Swolphin which I held until I got that studio.) (Yes, very first world problems)

That said, I do like the flexibility with Marriott points. Before we bought RIV, I would book NYE there on points, and it wasn't that hard to do.

We live in NYC; pre-COVID we never felt any sticker shock with TS/Signature restaurants because that just felt liek the price of a good restaurant meal. I will add that since COVID/inflation, the WDW Signature dining feels like a decent deal again.

Once you have a contract and points, there is a lot less time pressure to jump on a good deal. You have vacations planned and you feel less like each contract you make an offer on is so unique that you need to have it.

(And I see you made an offer, so ... good luck!)

Thank you. The offer was accepted, the deposit has been taken - it’s the waiting game now I guess! I didn’t try and nickel and dime due to the banked and loaded points, so I, hoping Disney let’s me through!

I was just talking about it with my wife today. It’ll be exciting to book our first DVC stay, and like you said, I prefer having the power in my hands, over someone I’m renting from.

I also wouldn’t pay rack, those rates are absurd.

kboo

DIS Veteran

- Joined

- Mar 10, 2014

- Messages

- 4,799

When RIV came online I thought resales would be around 100 and I could quickly pick up some resale points for RIV only stays (since all my other points are pre-2019), but they didn't so I ended up buying direct .... But if they do settle around 100 I could be swayed to pick up some to get us in a GV ....The economy. If the economy. Disney is not the only company laying off. RIV will be under 100 because there will be more resale conracts on the market - supply and demand - Resale is limited to only RIV which will hurt resale. 2042 resorts will drop due to years left - BC and BW will still hold value due to their location. AKV, SSR, and OKW I think will be 70s to 80's. VGF and PVD hard to say.

- Joined

- Nov 15, 2008

- Messages

- 48,536

When RIV came online I thought resales would be around 100 and I could quickly pick up some resale points for RIV only stays (since all my other points are pre-2019), but they didn't so I ended up buying direct .... But if they do settle around 100 I could be swayed to pick up some to get us in a GV ....

That is when we will jump in...we are willing to go as high as $115/pt for 75 to 100 points but the contracts out there that have the Dec UY I want are not that low and sellers are not interested in selling that low.

As I shared, I understand why...if I was selling RIV now I would not take that little either...but it can never hurt to offer!!

kboo

DIS Veteran

- Joined

- Mar 10, 2014

- Messages

- 4,799

yep. Both of our VGF resale contracts (bought in 2018) were from sellers who had financed and found themselves in a place where they could no longer keep their contracts. I think both were no longer paying their maintenance fees. This may happen to some RIV direct buyers in the next few years. For their sake I hope they get through any more financial downturn intact, but that timing lines up to suggest that the next 3 years will be telling for RIV.That is when we will jump in...we are willing to go as high as $115/pt for 75 to 100 points but the contracts out there that have the Dec UY I want are not that low and sellers are not interested in selling that low.

As I shared, I understand why...if I was selling RIV now I would not take that little either...but it can never hurt to offer!!

Epcot Forever Forever

What I should have said was nothing.

- Joined

- Jul 2, 2021

- Messages

- 1,426

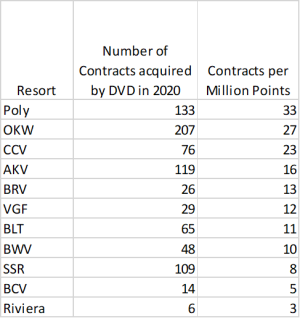

I agree. Even when things were good, Disney was mostly foreclosing on the most recently sold out resorts. Someone did this analysis a few years ago and I never forgot it because it shows just how many points Disney gets back early on even without ROFRing a thing:yep. Both of our VGF resale contracts (bought in 2018) were from sellers who had financed and found themselves in a place where they could no longer keep their contracts. I think both were no longer paying their maintenance fees. This may happen to some RIV direct buyers in the next few years. For their sake I hope they get through any more financial downturn intact, but that timing lines up to suggest that the next 3 years will be telling for RIV.

Remember, at that point, poly hadn’t been ROFRd yet.

E2ME2

ET

- Joined

- Oct 17, 2011

- Messages

- 1,950

I think that's probably a contributing factor, coupled with the fact that February is usually a high selling season anyway, as those who want out want to avoid another full year of MFs. All of this is just exacerbated by the sleeping ROFR monster, and its making for a wild first quarter of 2023.Seems like a lot more buyers are picking up contracts in the last week or two. Anyone else think it could purchases from tax refunds?

E2ME2

ET

- Joined

- Oct 17, 2011

- Messages

- 1,950

Thought I would line up your prognostications against the data currently on P.1 of pangyal's ROFR threadWhere do you think DVC resort resale point costs will be? Here are some of my guesses:

VB $49 a point

HH $55 a point

AUL $80 a point

OKW $80 a point

AKV $83 a point

Riviera $118 a point

VGF $138 a point

Is this too “sky is falling”?

(as of several minutes ago ~ 7:25pm EST)

This is not scientific, and I quite possibly may have made an error, as I did it manually - BUT

here goes: (hopefully screenshot comes through): Looks like your VB prediction will be tested at $46, OKW did hit 80, and VGF hit $137.5 New Lows will be tested at BCV, BWV, PVB, SSR, and VB

Andrewh2020

Earning My Ears

- Joined

- Apr 5, 2018

- Messages

- 17

The crazy thing is these predictions were only a month ago and some already hit... the bottom may not even be in until quarter 3 or soThought I would line up your prognostications against the data currently on P.1 of pangyal's ROFR thread

(as of several minutes ago ~ 7:25pm EST)

This is not scientific, and I quite possibly may have made an error, as I did it manually - BUT

here goes: (hopefully screenshot comes through): Looks like your VB prediction will be tested at $46, OKW did hit 80, and VGF hit $137.5 New Lows will be tested at BCV, BWV, PVB, SSR, and VBView attachment 745026

Speaking of which, there are a lot of Dec UY's out there for resale. Anyone know why so many in the first place? If RIV resale goes low enough, I may pick up a few contracts to add to my direct points, but as of now, there are none in my UY (June).That is when we will jump in...we are willing to go as high as $115/pt for 75 to 100 points but the contracts out there that have the Dec UY I want are not that low and sellers are not interested in selling that low.

As I shared, I understand why...if I was selling RIV now I would not take that little either...but it can never hurt to offer!!

- Joined

- Nov 15, 2008

- Messages

- 48,536

Speaking of which, there are a lot of Dec UY's out there for resale. Anyone know why so many in the first place? If RIV resale goes low enough, I may pick up a few contracts to add to my direct points, but as of now, there are none in my UY (June).

That was one of the ones pushed by DVD to start since the resort opened in Dec so it seemed they gave a bigger % to that one UY.

That was what we were offered first but then we said we wanted it to match our Aug UY instead..we had both at the time.

All of those Dec UYs that are in my point range are either firm offers or not yet ready to take less.

Epcot Forever Forever

What I should have said was nothing.

- Joined

- Jul 2, 2021

- Messages

- 1,426

There’s definitely going to be a nice spike in direct sales for a bit when Disneyland DVC opens up. I think it’s basically impossible at this point to predict the end of the overall direct downturn because it’s hard to pin down what’s driving it.I think we are still on our way.......... down still, probably at least another 6 months to a year for the bottom.

Frugal Fairy Tales

points are just points

- Joined

- Sep 14, 2021

- Messages

- 548

The prices are too high.There’s definitely going to be a nice spike in direct sales for a bit when Disneyland DVC opens up. I think it’s basically impossible at this point to predict the end of the overall direct downturn because it’s hard to pin down what’s driving it.

Epcot Forever Forever

What I should have said was nothing.

- Joined

- Jul 2, 2021

- Messages

- 1,426

I tend to agree. If you want to buy DVC to stay in 1 bedrooms you have to either buy resale or go full on Disney Math. Even 2 bedrooms in the fall - direct is upside down if you use a cost of capital approach (which you should absolutely be doing). Studios are barely positive.The prices are too high.

It’s still a good deal for studios in the summer. But that’s becoming a pretty specific case.

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,848

Interesting. I've not hit the same answer, but haven't looked in a while.direct is upside down if you use a cost of capital approach

A Preferred 2BR at Riviera is 513 points during the Feb/Mar spring season (my usual time). At that level, points are $201/pp direct. Amortize that $103K over the 46 years remaining (rounding down) at, say 7%, the long-term after-tax rate of return of the SP500. That gives a first-year cost-of-capital of $14.66. Throw in dues of $8.50, and you get $23.16, or a cost of the room as $11,881.

That's not attractive vs. renting, but owning carries some benefits--not the least of which is that finding a single Riviera owner to rent you 500 points might be hard. Likewise, we are potentially in a trough for rental rates, as they've dropped quite a bit recently, arguably due to the macro environment. So, maybe not horrible and arguably within the bounds of uncertainty over the long run given historical fluctuations in rental-rate.

Comparing to Disney's rates, that room for my usual week (late Feb/early Mar) goes for rack of $15,589 all-in. Owning is roughly a 25% discount over that, and that's Disney's prevailing-rate discount in that time of year. So, again, about a wash, but owning gives you certainty without having to be subject to Disney's willingness to discount the specific room I want at the specific time I want.

So maybe one way of looking at owning is that you are locking in the "best case" prevailing-rate discount, and maybe within spitting distance of renting-from-an-owner, with more certainty than either of them. Given my perspective that the point of timeshares is not necessarily saving money, but is instead all about making vacations a priority, I think there's still a decent case to make for a direct purchase.

Of course, the resale case is better. Riviera at $140/pt with the same assumptions is $18.71pp in the first year, and now you're cooking with gas. You've locked in even the prevailing owner-rental rate (or close enough for rock and roll), and are north of 35% off of rack.

Then there's the argument that owning gets better over time, because the CoC contribution is fixed in current-year dollars, and only dues is subject to inflation vs. Disney's prevailing rental rate, all of which is inflationary. It's less clear that renting-from-an-owner grows at inflation, but even if it tracks cost of ownership instead, you're still close enough to a wash to ignore it.

So I think my take is: "Buying direct is not a terrible idea; buying resale is a good one."

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 9,152

Interesting. I've not hit the same answer, but haven't looked in a while.

A Preferred 2BR at Riviera is 513 points during the Feb/Mar spring season (my usual time). At that level, points are $201/pp direct. Amortize that $103K over the 46 years remaining (rounding down) at, say 7%, the long-term after-tax rate of return of the SP500. That gives a first-year cost-of-capital of $14.66. Throw in dues of $8.50, and you get $23.16, or a cost of the room as $11,881.

That's not attractive vs. renting, but owning carries some benefits--not the least of which is that finding a single Riviera owner to rent you 500 points might be hard. Likewise, we are potentially in a trough for rental rates, as they've dropped quite a bit recently, arguably due to the macro environment. So, maybe not horrible and arguably within the bounds of uncertainty over the long run given historical fluctuations in rental-rate.

Comparing to Disney's rates, that room for my usual week (late Feb/early Mar) goes for rack of $15,589 all-in. Owning is roughly a 25% discount over that, and that's Disney's prevailing-rate discount in that time of year. So, again, about a wash, but owning gives you certainty without having to be subject to Disney's willingness to discount the specific room I want at the specific time I want.

So maybe one way of looking at owning is that you are locking in the "best case" prevailing-rate discount, and maybe within spitting distance of renting-from-an-owner, with more certainty than either of them. Given my perspective that the point of timeshares is not necessarily saving money, but is instead all about making vacations a priority, I think there's still a decent case to make for a direct purchase.

Of course, the resale case is better. Riviera at $140/pt with the same assumptions is $18.71pp in the first year, and now you're cooking with gas. You've locked in even the prevailing owner-rental rate (or close enough for rock and roll), and are north of 35% off of rack.

Then there's the argument that owning gets better over time, because the CoC contribution is fixed in current-year dollars, and only dues is subject to inflation vs. Disney's prevailing rental rate, all of which is inflationary. It's less clear that renting-from-an-owner grows at inflation, but even if it tracks cost of ownership instead, you're still close enough to a wash to ignore it.

So I think my take is: "Buying direct is not a terrible idea; buying resale is a good one."

If you are going to do it that way then you should assume that the annual cash outlays you are not spending by buying direct/resale vs renting go into the same 7% investment.

Or

Invest the lump sum at 7% and then draw the cash stays from that lump sum vs the buy direct/resale model. How many people will invest after tax money and not touch it for 46 years?

Of course, the market has never returned a 7% annual rate of return consistently (as you acknowledged by using the 100 year average) and you should actually put it through a Monte Carlo simulation to take into account sequence of return risk. From 2000 to 2010 the market had a near 0% rate of return and twice lost 50%.

Of course the long term after tax rate of return also depends on your federal, state, and local tax bracket and inflation (as the 7% is the nominal return, not real). That could be 0% for some people and 36% or higher for others. This also assumes that Congress or your state does not change the tax rates.

IMO, All of this is too complicated with too many unknowable assumptions. The only thing we actually know is the purchase price and that dues will go up.

Last edited:

-

New Descendants/Zombies Worlds Collide: Concert Special

-

Disney Cruise Line Last-Minute Cruise Deals, Updated Weekly

-

Ever Visit Disney on a Holiday and Notice Something Extra?

-

New Disney Merch: Disney Parks Starbucks Tumblers + Easter Plushes!

-

See the 2026 Universal Mardi Gras Tribute Store and ALL the New Merch

-

Disney Wishables Adds New Shimmering 'Zootopia' Series

-

This Walking Olaf Animatronic Is Pure Frozen Joy

New Threads

- Replies

- 0

- Views

- 135

- Replies

- 2

- Views

- 213

- Replies

- 3

- Views

- 305

New Posts

- Replies

- 6K

- Views

- 1M

- Replies

- 18

- Views

- 1K

- Replies

- 16

- Views

- 3K

- Replies

- 695

- Views

- 115K

- Replies

- 5K

- Views

- 669K