I feel like we’re kindred spirits. I’m on the fence pulling the trigger on an AKV contract so would very much welcome your view on what tipped you over the edge into DVC from the Swolphin?

Like you, I have a ton of points (over a million, lifetime titanium so upgrades are likely). I like being in the Disney bubble, but I also love the flexibility - last minute one night getaway or last minute cancel. In fact, I just canceled a points stay within a day, but am very local so still went to the parks every day this long weekend.

I started a thread on should I/shouldn’t I…and I told myself if the right contract comes up then I should. I’d prefer to burn points elsewhere. If this is as low as it goes, I’d probably jump in. I’m not looking to make money, but I’m not looking to lose money.

Not who you were asking but I can give you my input as a lifetime titanium Marriott member also. We spend way too many nights in a Marriott (and Hilton TBH) and I want my vacation to FEEL different, Swolphin doesn’t do it for me. Yes the location is amazing but I still know I’m in a Marriott property. AND the points will eventually run out. I look at DVC as a discounted room for the duration of the contract, Swolphin rates keep rising too.

I've been Platinum Elite for a long time (though not lifetime), I agree with all of your points. I was a prior Starwood Elite and I feel like the points, even after conversion, don't go nearly as far as they used to. (Still, have ridonkulous amounbts of points, though) Swolphin is, to me, something in between "on property, deluxe resort" and "good neighbor" - I feel like it has a bit more personality and yes, great location, but it's still a hotel room. Our first DVC stay on our own points, we did 3 days at the Swan, which we all enjoyed, and then a 1br standard at BLT which my then 7-yo exclaimed, when we opened the door, "wow! This is the nicest hotel room I've ever seen!!" (She apparently forgot our previous point rentals at BWV (1br) and BLT(2br) )

There came a few times we made last minute trips to WDW and I elected to use points for Swolphin and its location rather than DVC points for SSR which was the only resort left on short notice. If we were only going to book studios, I would include Swolphin in the mix based on location alone. But having a 1br, especially a new(ly refurbished) one like VGF and RIV, is worth the points to me. And I am that cheapskate who would never pay cash rates for a 1br DVC.

We did rent points for quite some time, but I didn't like reestablishing trust with each owner even though some of them have become my "friends" here and were really helpful in talking to me about their experiences. I do also like the ability to modify and stalk and change reservations like when my sister decided last year to join us - I stalked my way to an extra studio at BCV 3-4 months in advance - no way I could have done that with point rentals. (We were already in a 2br at BCV and my backup was to book them a room at Swolphin which I held until I got that studio.) (Yes, very first world problems)

That said, I do like the flexibility with Marriott points. Before we bought RIV, I would book NYE there on points, and it wasn't that hard to do.

Inflation outside of WDW, particularly in dining, has made WDW prices seem downright reasonable.

We live in NYC; pre-COVID we never felt any sticker shock with TS/Signature restaurants because that just felt liek the price of a good restaurant meal. I will add that since COVID/inflation, the WDW Signature dining feels like a decent deal again.

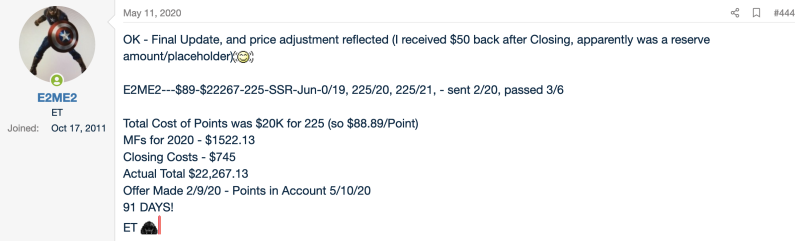

Maybe once I have this in the bank I’ll feel more inclined to see if I can pick up a bargain.

Once you have a contract and points, there is a lot less time pressure to jump on a good deal. You have vacations planned and you feel less like each contract you make an offer on is so unique that you need to have it.

(And I see you made an offer, so ... good luck!)