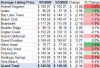

When evaluating a contract I look at:

UY Oct (our personal UY)

Size How many points are available reaching back 2 years, current and next year

#Pts Number of points in contract annually

Banked Useable points in other words, points that do not expire before you can actually rent/transfer/use

I take the price (my offer) plus closing costs and current year MF's. My goal is not to pay MF's on past years. That is the total cost. I then rent (now I'll likely transfer) the two years but not current or next year. I take that income off the cost of total cost and then go forward using points. At some point I will likely flip the contract. Taxes factor in on rental or transfer.

I'm currently looking for a 100-160 pt AKL. My goal price for 100 points is $90 PP (we'll see in 2-3 mo). Buy 100 pts at $90. Transfer 200 pts @ $16 = $3200. Closing $600+/- and MF's (1 yr) $800+/-

100 x $90 = $9000 + $600 + $800 = $10400 - $3200 = $7200 net or $72 PP

It's really just a way to purchase extra points from a loaded contract and reduce the cost of the contract. I'd spend a lot of time reading disboards and learning all you can about

DVC. I'm not a financial guru or anything, I just try to get the best deal possible and this has worked well for us. Good luck!