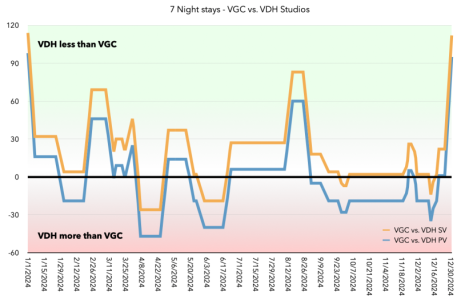

Re-sale of VDH is going to be appealing down the road. Obviously it will take some time for it to be around long enough to have contracts on the secondary market, but I would imagine it would eventually be sub $200/point, even with the high dues/taxes+parking costs, it would still be an option for people in California. Personally I don't think the California parks require nearly as much time, so a small contract could still work out nicely and for people that live on the West Coast already, most of their stays would already be geared to visits to

Disneyland, so the re-sale restriction won't matter so much. A main factor that kept VGC prices high even on re-sale was the scarcity of availability, with VDH we won't have that, which should decrease the value a little bit more. With that being said I think anyone considering VDH will need to focus less on the price per point and more on the annual dues/taxes, because those are going to add up to a significant amount of money over the life of the contract. For people disappointed in not getting in on VGC recently with the prices of re-sale dropping, I still think within the year, we could see prices come down again on the re-sale market and re-visit their recent lows. Until we start seeing Disney exercise ROFR again, and the freshness of the VDH news goes away, the uncertainty of the economy could certainly keep prices low for awhile.