If you rent, the income is reportable income on your tax returns except in one situation. If you rent for less than 15 days in a year, and you (or relatives or friends without charge) stay at your resort at least 15 days in the year, you may qualify for a "vacation home" exception and escape reporting the income for federal taxes. Both those conditions must be met for that exception to apply.

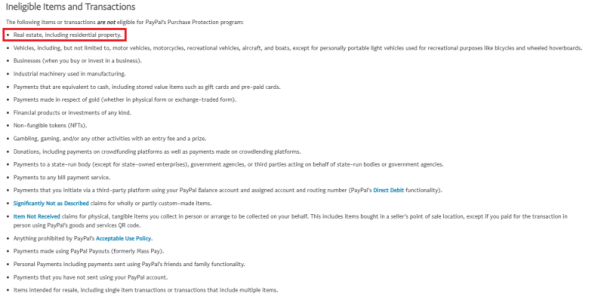

A 1099 reports the income you receive from a rental, not any deductions that you may take. Note that if you rent and do not get a 1099, that does not excuse you from reporting the income for tax purposes. For example, whether PayPal issues a 1099 does not determine the issue, e.g., just because it may not issue one if you assert "friends or family" does not mean you escape reporting any actual rental income for tax purposes. In reporting income and deductions you can take, you, or your accountant, need to prepare and file a Schedule E form with your federal tax return, which you can easily get online.

What you can deduct for a rental is something best done by retaining an accountant (or tax lawyer) because it I can be complicated. One thing to be aware of (which I have seen many members ignore) is that the

DVC rules expressly provide that you cannot use banked or borrowed points to do a rental. See, e.g., Disney Vacation Club Membership Agreement for BWV, sections 4.4 and 4.5. Another thing to be aware of (which I have also seen many ignore) is that income taxes aren't the only ones to be concerned about. For example, in Florida, any rental of your timeshare requires payment to the state of its 6.5 sales tax, and for WDW resorts there is an another 6% Orange County transient tax, i.e., together, a total of 12.5% of the rental charged. Those are taxes on the rent charged without deductions and are technically payable by the person renting the room, but the member in that situation is required to collect the tax and pay it to the applicable agencies, and if the rental agreement does not include payment of the rental taxes by the renter, it will be presumed they were included in the total rental amount and must be paid by the member. Thus, for any rental, you also need to pay those taxes and file tax forms with the applicable government agencies.

As to what you can deduct for income tax purposes, most articles I have seen agree that deductions include the maintenance (operational) portion of your annual dues, and property tax portion (unless you include the property taxes as part your itemized deductions for your overall taxes, e.g., if you generally take only the standard federal deduction for overall taxes, you can separately deduct property taxes as a rental expense). Those deductions are proportional -- as to a rental, you cannot deduct all your annual dues amounts for those items but only the percentage proportion applicable to the total points used for the rental, e.g., own 500 points and use only 100 for the rental and you can deduct only 20% of the annual operational dues and property taxes.

More controversial is whether you can deduct part of the value of your timeshare (depreciation expense). Again, best is to retain an accountant (or tax lawyer) if considering doing so. The possible issue is that depreciation may be allowed only if your timeshare is principally used for rentals, which itself could be a violation of the DVC rule prohibiting you from doing rentals for a commercial purpose.

Assuming depreciation may be deducted, I have seen many state that the deduction is some annual percentage (apparently just under 3.5%) of your purchase price. From articles I have reviewed on the issue, even if you try to take depreciation, the original purchase price may not be what is used to calculate the deduction. That may be true if rental of the timeshare interest began in the first year of ownership and continued annually thereafter. However, if the timeshare interest is not used for rentals until sometime beginning after the first year of ownership, you are supposed to use the fair market resale value in the year when you convert it to rental use. For many timeshares, there is very little market value years after purchasing. For DVC, there is such value and there are sites that provide ongoing average per point values in the resale market, thus providing a source for determining the fair market value of your timeshare ownership.