Lots of discussion lately about pricing and how many times it’s taken someone to get a deal in place.

So, this thread will be for anyone who wants to share that info and added to the list, please post as follows:

disboards name - resort - # of points - Offer - List - Month/Year

I will keep a complied list here

AUL

Curiousporpoise- 200 points $85 Feb UY $100 list price, March 2023, 150 points $83 Feb UY, $100 list price, March 2023, 200 points $80 Feb UY, $100 list price, April 2023, 300 points, $80 Feb UY, $100 list price, April 2023

lorie13 - 160 pts $89, Listed $130, 200 pts, $80, Listed $100, 175 pts,$83, Listed $126, 200 pts, $80, Listed $105

150 pts, $83, Listed $115, 140 pts, April UY, $80, Listed $103.57, 160 pts, $80, Listed $108, 200 pts, $80, Listed $125 160 pts, $80, Listed $130. 205 pts, $80, Listed $115, 205 pts, $83, Listed $120, - May and June 2023

HH

VB

VGC

AKV

sab53085 - 120 points, Listed $120, Offered $95, 100 points, Listed $115, Offered $95, 120 points, Listed $125, Offered $95, 120 points, Listed $122, Offered $95, 50 points, Listed $139, Offered $109, 100 points, Listed $115, Offered $109 - June 2023

BRV

MsChristy12 - 175 pts, $85, Listed $110, 175 pts, $90, Listed $117, 170 pts, $82, Listed $108, 175 pts, $85, Listed $105

150 pts, $90, Listed $105 - April 2023

CCV

Runthemouse - 100 points - $130 offer - $159 listed - July 2023

BWV

DonnerB - 100 points - $95 offered - $117 list

crazycatlady - 75 points, $120 - listed $140, June 2023

BCV

buzzrelly -100 points, Listed $171, Offered $132.50, 150 points, Listed $168, Offered $125, 150 points, Listed $145, Offered $125, 200 points, Listed $140, Offered $130, April UY, 200 points, Listed $179, Offered $130, 210 points, Listed $169, Offered $118, 250 points, Listed $147, Offered $115, 270 points, Listed $153, Offered $115 - March, 2023

buffalobasingal - 150, $120, listed $150, 150, $120, listed $155, 150, $120, listed $163, 150, $128, listed $152 (April 2023), 150, $115, listed $149, 150, $125, listed $163, (June 2023)

RIV

sandisw335- 100 -$100- listed $160, 75-$110, listed $155 - March 2023

Superbri7-100-$129-listed $158- 6/2023

BLT

Tom1944-150 points at $137, March 2023, 160 Points at $137, March 2023…both listed around $160 to $165

PVB

VGF

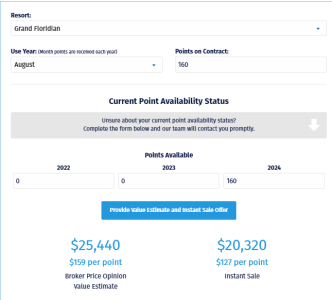

Rex1993 - VGF - 160 - $115 - listed $185 - 06/23

OKW

SSR

mousehouse23-100 points, $80,- Posted at $111

GrumpyInPhilly - 155 - $70 - (April 2023). 160 - $70, 150 - $75, 200 - $70 , 160 - $70, 200 - $70, 200 - $70 (May, 2023) 160 - $75, 200 - $75 (June 2023) - listing prices unknown