View attachment 786498

View attachment 786503

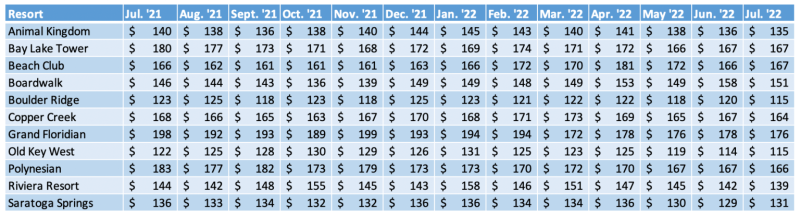

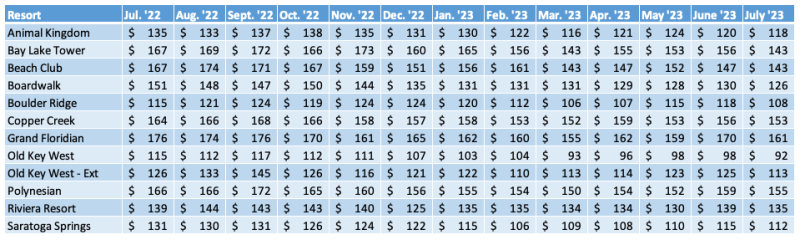

You're very much cherry picking data to fit your narrative. VGF was at it's peak in 2021 shortly after the expansion was announced and before direct pricing was announced. People were buying resale in the 190s thinking they were getting a bargain under the assumption that direct pricing would start around 220-230. At that same time Poly was going for $173-183 resale. You keep acting like VGF was in the 190s while Poly was living in the 160s. That couldn't be further from the the truth when you look beyond your cherry picked numbers. VGF's spike to the 190s was due to a combo of a strong market overall (affecting an increase across all DVC properties) and people majorly overplaying their betting hand with VGF's future pricing. Nothing more and nothing less.

Once the direct pricing for VGF came out, the market quickly corrected itself and dropped the monthly average 22 points. VGF hasn't sniffed $180 per point since. That's a market correction if I've ever seen one. Poly's resale has been within 5 or 10 points for most months ever since March 2022.

Note that I don't feel strongly either way. I'm about 60/40 split same association vs new association. I recognize the historical arguments for why this fits into the VGF expansion bucket vs the more recent arguments of bucketing it into the Riviera and VDH camp. I'm just trying to provide data where you're being a little misleading.

That surprises me. I had been watching resale on and off since before covid. Then I started watching very closely as inventory built up late last year (with an aggregator that tracks 13 brokers). Early this year we zoned in on Poly and VGF intending to buy resale. In my mind I had the spread between $15-20pp. We were trying to get contract size/UY $135-140 Poly or $150-155 VGF. Those values are just what I came up with between the rofr thread and watching the aggregator.

$20 or $30 is a bit of a stretch but honestly I can understand why there seems a gap. I’m not saying I’m right or my methods were correct, just that if felt like $15-$20 difference was there.

Pulling up the aggregator today with Poly and VGF, there are 14 Poly contracts between $135 and $149 and VGF starts at $150 and only goes up.

The rofr thread is quiet this quarter. Last quarter:

VGF: (7 out of 9 are $150 or more, 2/9 are less)

jkmdds4osu---$150-$15803-100-VGF-Aug-0/21, 0/22, 100/23, 100/24- sent 3/29, passed 4/12

JZ_LBNY---$155-$17040-100-VGF-Oct-77/22, 200/23, 100/24- sent 3/29, passed 4/13

Kayaddict---$140-$23290-160-VGF-Apr-0/22, 160/23, 160/24, 160/25- sent 3/31, passed 4/14

Chirpee---$151-$25059-160-VGF-Aug-0/21, 0/22, 0/23, 160/24- sent 4/10, passed 4/27

mlittig---$160-$10800-60-VGF-Dec-60/22, 60/23, 60/24- sent 4/11, passed 4/28

Rbjfamily---$127.77-$23865-180-VGF-Feb-0/22, 29/23, 180/24, 180/25-seller pays MF '23- sent 4/10, passed 4/27

HyperspaceMountainPilot---$150-$20252-125-VGF-Jun-0/22, 201/23, 125/24, 125/25- sent 4/21, passed 5/12

disnid---$165-$16139-90-VGF-Apr-0/22, 177/23, 90/24- sent 5/1, passed 5/23

buzzandzurg---$150-$29071-180-VGF-Jun-0/22, 263/23, 180/24- sent 5/19, passed 6/7

PVB: (7 out of 16 are $135 or less)

RichDVC---$135-$17710-120-PVB-Jun-0/22, 188/23, 19/24- sent 3/23, passed 4/4

hockeymomnh---$150-$23114-150-PVB-Aug-0/22, 150/23, 150/24-Delayed Closing 6/16- sent 3/23, passed 4/4

ccv_fam---$130-$22036-150-PVB-Jun-0/21, 0/22, 150/23, 150/24- sent 4/3, passed 4/12

pkrieger2287---$130-$23635-175-PVB-Feb-0/22, 175/23, 175/24, 175/25- sent 3/28, passed 4/12

BellePoly---$135-$23747-160-PVB-Aug-0/22, 165/23, 160/24- sent 4/7, passed 4/25

Ineedavacation33---$139-$14894-100-PVB-Dec-0/21, 0/22, 100/23, 100/24-$199 closing special- sent 4/3, passed 4/27

Rocky092---$130-$24198-169-PVB-Mar-0/22, 169/23, 169/24- sent 4/12, passed 4/28

sevargas---$130-$18228-135-PVB-Dec-0/21, 0/22, 116/23, 135/24-seller pays MF '23- sent 4/3, passed 4/14

Sleighbelle---$135-$34839-250-PVB-Jun-0/21, 0/22, 0/23, 250/24- sent 4/25, passed 5/16

Galactic Reversal---$150-$21922-135-PVB-Dec-135/22, 135/23, 135/24- sent 4/13, passed 5/23

klutzyjo---$145-$7945-50-PVB-Jun-0/22, 23/23, 50/24, 50/25-delayed closing- sent 4/27, passed 5/23

TikiRoomMania---$164-$8869-50-PVB-Dec-0/21, 0/22, 25/23, 50/24- sent 5/4, passed 5/30

oldmanjames---$158-$10882-60-PVB-Mar-0/22, 120/23, 60/24- sent 5/12, passed 6/1

jlnten17---$135-$61895-425-PVB Fixed Week-Dec-0/21, 225/22, 425/23, 425/24-weeks 32&33- sent 5/5, passed 5/30

momomaya---$145-$31189-200-PVB-Jun-0/22, 400/23, 200/24- sent 5/17, passed 6/7

mkatsy---$156-$8726-50-PVB-Dec-8/21, 18/22, 50/23, 50/24- sent 5/28, passed 6/16