TinkAgainU

Trust In The Pixie Dust

- Joined

- Dec 11, 2021

- Messages

- 1,673

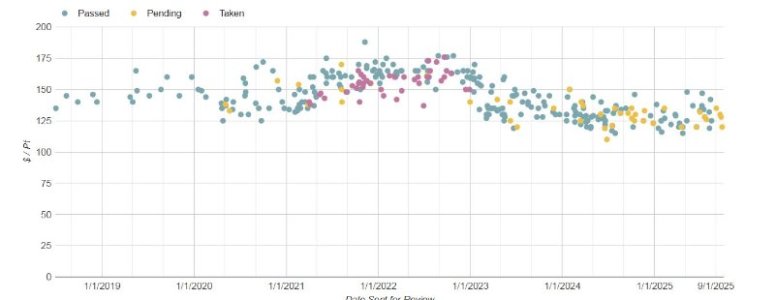

I'd be tempted to just cover that $500 gap and move on with my life (assuming the UY and coming points were okay). With Boardwalk or any 2042 I figure you need to get those bookings in Now to get your monies worth lol.Countered at $125, and I offered $120...

Indeed I do.