A contract just passed for VGF for $165pp and RIV for $118pp. I know there is really no ROFR floor for either of these but since they are both in active sales it does represent quite a disparity in value... Like Sandisw said, once there are more with restrictions, then the resale value could level out... I still hold that these resale restrictions completely change the

DVC product into something much less desirable in the TS market, in general.

It is definitely a different product and the buyer pool will be smaller given its restrictions. But, if someone had offered $118 on a VGF contract and the seller had accepted, then it too would have passed since it is in active sales again.

So, an outlier can't be used as a norm....that is why average is important. The key is that in terms of direct sales, they are matching well, now that the initial surge of buying at VGF is over...and that was fueled by members who added on, not new buyers.

The other piece is that VGF has dropped in value since it went back on sale. It didn't take long because DVD priced it well.

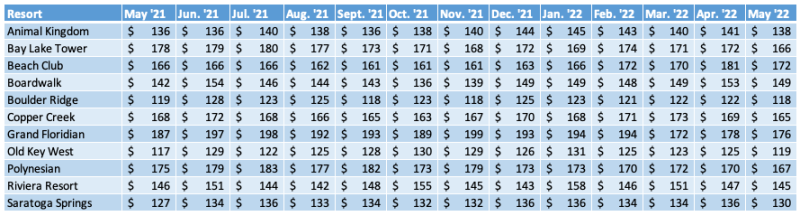

The fact though that the average at

DVC Resale Market is $145 right now...granted, not a lot of contracts sold...does mean that people are paying, for the most part, in the $130 to $150 range right now...and given it is a one resort only product, I think that is pretty strong when VGF can be used at 14 places.

As has been mentioned before, many of us, myself included, thought that value would never be much and that if it commanded more than $100/pt it would be an oddity...well, here we are 3 years later, and it hasn't dropped that low with the exception of a contract here or there...and more likely, those sold low because the owner needed to get out and not wait.

Look at all the VGF contracts you mentioned just sitting there and not selling...those owners have owned long enough that they can wait it out...someone selling RIV already is more likely needs to sell and can't afford to wait.

I agree that RIV may never sell as well as VGF, but neither has Poly...and, if ROFR wasn't as active as it is, many of the resorts right now would not be as high as they are...RIV still would since there is no ROFR on it.