HsimSleepy

Earning My Ears

- Joined

- Dec 24, 2022

- Messages

- 40

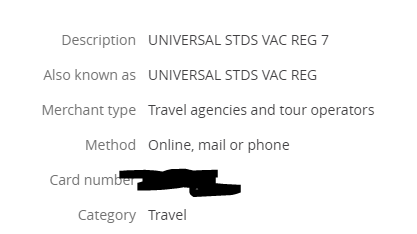

Anyone know how Chase code Universal park tickets? I’m assuming entertainment? Trying to decide if I should put it on my travel or cash back card.

I'm just going to call out a piece of the DoC comment:Thought this DoC comment re: the $900 Chase bank bonus was worth sharing:

Wise Dom

#1536222

Tying up $15,000 for 1 quarter to earn $900 is a guaranteed 6% return (900/15000 = 0.06) in 1 quarter, an effective rate of return of 24% (0.06 * 4) annually. I’m not aware of anything else that comes anywhere close to beating a guaranteed effective 24% APR. The S&P 500 averages 12% nominal yearly returns over long periods of time – this offer is DOUBLING the return while taking the risk that you might lose some of your principal in a given 90 day stretch from “high” to “none”.

If you can’t afford to park $15,000 for a quarter, of course it makes sense to look for other deals with vastly lower rates of return, but more flexibility. But if you can afford to, there’s not really any better place to keep $15,000 for 90 days right now.

That’s not even mentioning that the way Chase have it set up, you have 30 days from when you open the account to deposit the $15,000, but the 90 day countdown for how long you have to keep the funds in the account also starts from when you open the account, NOT from when you deposit the funds. So really, you could wait until the last day of the first 30 days to deposit the $15,000, and only need to tie up the $15,000 for the remaining 60 days to earn the $900, which ups the effective APR to 36%.

So this was already an unbeatable deal (24% APR, FDIC-guaranteed) without gaming the system, but it becomes a truly legendary deal (36% APR, FDIC-guaranteed) once that’s factored in. This will be remembered for years as the insane, unheard of once-in-a-lifetime bank account bonus that easily made all of us nearly a grand at a guaranteed effective 36% APR for about 15 minutes of our time. We’ll all still be reminiscing about this deal the comments a decade from now as one of the top 10 all-time greatest opportunities that (most of) the DoC community has ever had the chance to take advantage of.

They are right, but don't really do that. Chase gives you a big buffer for a reason, not all large transfers (or even multiple transfers) go smoothly. There have been many DPs over the years of Chase fraud craziness gumming up the works and even when it was 20 days people were making it by the skin of their teeth.So really, you could wait until the last day of the first 30 days to deposit the $15,000, and only need to tie up the $15,000 for the remaining 60 days to earn the $900,

He got an email today reminding him of what to do to get the $900 bonus, so it definitely tracked from the email he signed up through. Glad they gave him until 4/16 to get the direct deposit in there!Can you share what if any confirmation you got about the $900 offer being applied to your accounts? During the process of opening the accounts, I got a message that said something like "We opened your accounts but we are having trouble applying the offer. We will send you an email when we have applied the offer." So far the only email I've gotten says that the accounts are open, but no mention of the bonus.

I am pretty certain that I meet all of the criteria for the bonus (no Chase checking or savings accounts within the past several years). I plan on sending a secure message tomorrow but I'm curious if anyone has had this same thing happen.

I sure wish I could take advantage of this! Most of our banking is already with Chase.Thought this DoC comment re: the $900 Chase bank bonus was worth sharing:

Wise Dom

#1536222

Tying up $15,000 for 1 quarter to earn $900 is a guaranteed 6% return (900/15000 = 0.06) in 1 quarter, an effective rate of return of 24% (0.06 * 4) annually. I’m not aware of anything else that comes anywhere close to beating a guaranteed effective 24% APR. The S&P 500 averages 12% nominal yearly returns over long periods of time – this offer is DOUBLING the return while taking the risk that you might lose some of your principal in a given 90 day stretch from “high” to “none”.

If you can’t afford to park $15,000 for a quarter, of course it makes sense to look for other deals with vastly lower rates of return, but more flexibility. But if you can afford to, there’s not really any better place to keep $15,000 for 90 days right now.

That’s not even mentioning that the way Chase have it set up, you have 30 days from when you open the account to deposit the $15,000, but the 90 day countdown for how long you have to keep the funds in the account also starts from when you open the account, NOT from when you deposit the funds. So really, you could wait until the last day of the first 30 days to deposit the $15,000, and only need to tie up the $15,000 for the remaining 60 days to earn the $900, which ups the effective APR to 36%.

So this was already an unbeatable deal (24% APR, FDIC-guaranteed) without gaming the system, but it becomes a truly legendary deal (36% APR, FDIC-guaranteed) once that’s factored in. This will be remembered for years as the insane, unheard of once-in-a-lifetime bank account bonus that easily made all of us nearly a grand at a guaranteed effective 36% APR for about 15 minutes of our time. We’ll all still be reminiscing about this deal the comments a decade from now as one of the top 10 all-time greatest opportunities that (most of) the DoC community has ever had the chance to take advantage of.

I reached out to Hyatt concierge and to get free parking it must be all on points or FNC. She was able to switch my reservation to all points.I booked a points + cash stay at a Hyatt, does anyone know if I would still get free globalist parking?

My reservation is for Saturday so I need to cancel and rebook today on all points today if I won’t get that benefit

. Trying to find a suitable flight but might have to cut our trip short a day and fly back on Friday.

. Trying to find a suitable flight but might have to cut our trip short a day and fly back on Friday.Ugh..is this a SW flightUggh. Spring break flights changed. Trying to put me on a 5am departure. With a 3 yo, I don’t think that will work. Who am I kidding, it doesn’t work for me either. Trying to find a suitable flight but might have to cut our trip short a day and fly back on Friday.

Got an email saying I get a free Sirius XM trial - again. My car came with this and I've never signed up for it or paid anything. Or clicked on any of the offers. However, it's active in my car. I'll take free if I happen to think of it while traveling next week.

I'm usually in silent mode while driving, so chances are slim I'll actually think to use it.

Check out frontier or Avelo, they may have options.Ugh..is this a SW flight

Anyone know how Chase code Universal park tickets? I’m assuming entertainment? Trying to decide if I should put it on my travel or cash back card.

Yes. Albuquerque to Columbus.Ugh..is this a SW flight

Thanks…Will have to keep an eye on our April 15th and 22nd flightsYes. Albuquerque to Columbus.

My mom has one. I check a few times a year to see if rates are competitive. So far it hasn't been worth moving since she doesn't have a lot in it.Not many others on here with a Marcus online savings account, I think. I pulled a bunch of money out of it back in October to take advantage of the Ally 1% bonus, just moved some of that to Chase for their savings bonus. Today I got an offer from Marcus for $100 bonus if I move $10,000 into my Marcus account for 3 months. They had the same offer last year also.

Yeah our primary checking is Chase and both of us on it.I sure wish I could take advantage of this! Most of our banking is already with Chase.

OK first time post in this area, total newbie so please be gentle.

I currently have three open credit cards, only one approved in the past 24 months. We took advantage of the Chase SW 100,000 points offer to earn a companion pass for the first time ever in mid 2022. Current cards:

04/17 - CHASE Sapphire Preferred

12/21 - CHASE Southwest Rapid Rewards

02/20 - CHASE Marriott Bonvoy Boundless Personal

1. We pay for everything allowed on our favorite card, the CSP.

2. We always, without exception, pay the full balance on our cards.

3. We fly out of DAL and DFW, and occasionally out of IAH.

4. We prefer SW and AA FF programs.

5. We prefer Bonvoy but are open to others.

6. Currently have around 100,000 SW RR points and 100,000 Chase Rewards points

Traveling is easily our biggest interest! We have been using points and sign up bonuses to help with hotel stays during our huge road trips across the USA. We set a goal to visit all 50 states with our two kids (DD15 and DS12) before our daughter graduates from HS in 2025. This coming July we will achieve that goal 2 years early when we fly to Maui and Oahu (and using our SW CP to save $$). Yours truly is turning 50 during this trip so it truly will be the big Hawaii 5-0. I even added a couple of DLand days to the trip on our way back to Texas - I may have issues at this point.

So, with all of the above information, my first question is what suggestions/advice or recommended credit cards do you have for me now that our focus will shift much more to international travel. Europe will be our likely first choice (Ireland, London, Paris, Italy, etc.). I want to hop the pond for this trip either summer 2024 or definitely by graduation summer 2025. It would be our four pack going (myself, wife, daughter and son).

Also is there a solid all around card that has a 1:1 transfer to AA like our beloved CSP card does for SW and United?

I really want to learn more ways to use card offers and strategy to maximum benefit. Wife and I started applying individually for some credit card offers 3-4 years ago (declining spouse card option) - is this considered a good practice?

Hopefully this all makes sense - any guidance, critiques and/or help is greatly appreciated. Glad I found this forum - I have a lot to learn for sure!