FreeDiningFanatic

DIS Veteran

- Joined

- Aug 18, 2015

- Messages

- 2,302

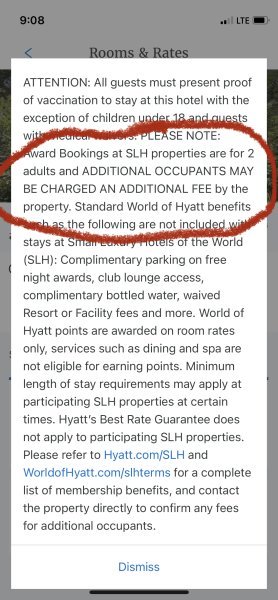

We have a $35k condo assessment due by July 31st (less painful bc they discounted it off the purchase price when we closed in May). Even better, we can charge it to a credit card or split between multiple, they are not adding any transaction fee (yes we verified), and it codes as travel!!

Sapphire Reserve is the best of our current cards at 3%. What other new travel card do you think we should consider? Any great sign up bonuses with crazy high MSR? We already have (many) Chase ink biz, sapphire, and SW along with 2 Hilton Amex. All others are fair game.

I had a similar large tax bill due a year or two back and the recommendation from this board from our two player mode family was: 1-2 Amex Biz Plat cards and a Chase biz Ink, if I recall at the time. If I had that kind of bill coming up, I would definitely be looking for multiple new MSRs. I have been really happy with the Venture X because the AF is easily recouped and it earns 2x on everything, which is awesome. I think the SUB is 75k points for $4k spend. I'd probably throw in a couple of Inks, as well as be looking into Amex.

I know there are some really big MR earning SUBs out there right now if you have big spend- not sure if those are targeted. The Amex Biz Plat offer is 150k +10k for adding an ee. Of course that comes with a big AF, so you have to decide if that's something you want to do.

ETA: Here is the link for the DoC post about the 250k Amex Biz Plat with $30k spend, if you prefer to just do 1-2 cards. I've never done any of those call in offers, so I am not necessarily recommending this, just thought I'd throw it out as an option.

Last edited:

I let it pay for the ESPN + I won't use until hockey season. Easier to let it go than login and cancel

I let it pay for the ESPN + I won't use until hockey season. Easier to let it go than login and cancel