Whoops sorry, posted on the wrong thread. It was BWVThey were going to take $110 for poly?I'd jump at that!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How low will Disney let Poly go?

- Thread starter DisMomKY

- Start date

ABE4DISNEY

There's a great, big, beautiful tomorrow...

- Joined

- Feb 16, 2009

- Messages

- 1,259

100 for BWV would be an amazing price.

Yeah I’ve been trying to find a 100-150 pt contract and they have all been 135+ for listing price. I’d like to get one around $100-108BWV has been dropping lately as there's been a flood of supply and reductions. There's at least a dozen contracts under $110 from various brokers, some are without 2020 points; but some still have them.

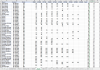

I found this graphic interesting from one broker:

View attachment 489484

lovethesun12

DIS Veteran

- Joined

- Jul 5, 2017

- Messages

- 1,702

I saw one listed at $103 pp (210 points contract) ...Yeah I’ve been trying to find a 100-150 pt contract and they have all been 135+ for listing price. I’d like to get one around $100-108

Vkothari916

Earning My Ears

- Joined

- Apr 3, 2020

- Messages

- 30

Someone mentioned on ROFR thread they just purchased a contract for $125. Will be Interesting to see if Disney defends the price and buys it out.What’s your guess? I’m hoping to find a 120 point contract for $125 and get it to passbut I also can’t imagine disney letting poly go for under $130 pp for small contracts. Do you think DVD will start executing ROFR on Poly soon?

Wow I haven’t seen thatI saw one listed at $103 pp (210 points contract) ...

badeacon

DIS Veteran

- Joined

- Jun 5, 2000

- Messages

- 781

To go along with this https://www.dvcresalemarket.com says on their blog that PVB has overtaken SSR as most economical resort to purchase. 9.75 per point PVB ,9.83 SSR. My purchase last year looks better. Good sleep around points only having studios and bungalows not as restricting.I went through about 3 years worth of the ROFR thread when I made offers on mine. There were only a handful of $125ish offers, all of which passed. There was no indication of execution.

My own passed on 9/25/2019 at $128/point. It was especially notable because it was a guaranteed week contract for Christmas & New Years week, which Disney charges 10% extra for.

There was a 225 contract that passed in Q4 2019 for $125/point but without the guaranteed week.

There was also a larger 450 point contract that passed at $120 in Q1 of this year.

The biggest hurdle for PVB isn't going to be ROFR, it'll be the owners as previously said. But I also expect demand for PVB to pick up starting the end of the year (comparatively with other DVCs, not necessarily year over year due to economics). We can debate about resort characteristics that keep it low (ie, lack of 1 BR) but the reality is that there are a lot of SSR buyers who buy it only for the point economics as sleep around points. PVB quietly dropped into the bottom 5 for cost of annual dues in 2020, 2c behind SSR making the difference negligible.

SSR sells direct for $160 and resales for $90-$110/https://www.dvcresalemarket.com, ($50-70/pt savings) and expires in 2054.

PVB sells direct for $235 and resales for $120-$140, ($75-$115/pt savings) and expires in 2066.

Personal preferences aside, PVB is going to make it's case to value buyers soon. Based on CAGR buyers may be asking by the end of the year "Is it worth $10/point to get an extra 12 years and lower annual dues?"

I was told from two reputable resales that PVB hasn't been ROFR since it started on the resale market and that it typically takes 5 years before a resort sells out direct that they start acting on ROFR.

My analysis backs up a lack of ROFR on PVB. But, the 5 year rule isn’t quite true. When I ran my analysis I did come across a CCV ROFR - which is still selling. I also came across quite a bit of VGF, which is only a couple years older than PVB.

bookwormde

<font color=darkorchid>Heading out now, another ad

- Joined

- Mar 16, 2008

- Messages

- 6,662

I think it is more about that DVD still has a scattering of points when they announce the sell out and it typically takes quite a few years for enough resales to cause the resale price to soften to a level where it it worth DVD buying it back.My analysis backs up a lack of ROFR on PVB. But, the 5 year rule isn’t quite true. When I ran my analysis I did come across a CCV ROFR - which is still selling. I also came across quite a bit of VGF, which is only a couple years older than PVB.

Riviera should be a good test to this theory since in is already quite soft in the resale market well ahead of it selling out

glamdring269

DIS Veteran

- Joined

- Feb 7, 2013

- Messages

- 1,086

PVB and AKV are the two spots we're considering an add on. I was leaning a lot more towards AKV due to price but the way PVB has plummeted gives me pause. Any guess as to what is driving that?

I think the lack of 1bedroom options. We might buy AKL, we found a heck of a deal 96pp for 260 poinysPVB and AKV are the two spots we're considering an add on. I was leaning a lot more towards AKV due to price but the way PVB has plummeted gives me pause. Any guess as to what is driving that?

glamdring269

DIS Veteran

- Joined

- Feb 7, 2013

- Messages

- 1,086

I think the lack of 1bedroom options. We might buy AKL, we found a heck of a deal 96pp for 260 poinys

Yeah I get that but figure that would have been priced in from the beginning. Perhaps folks are just now catching on to that and weighing it more heavily than the location. This could actually end up working out perfectly for us as we are a couple with no kids, and in early 40s with no intention of having kids, so the Poly studio is actually a positive. AKV is interesting in that I know we love to stay there but at this point I have never had an issue getting basically anything we want at 7 months. Have unfortunately not had the same luck with PVB.

striker1064

DIS Veteran

- Joined

- Jan 17, 2018

- Messages

- 2,370

Yeah I get that but figure that would have been priced in from the beginning. Perhaps folks are just now catching on to that and weighing it more heavily than the location.

I think this is a likely explanation. There are probably many people who thought PVB's property-largest studios would be enough space, and it took a few stays (or possibly growing families) to realize that wasn't true.

PVB and AKV are the two spots we're considering an add on. I was leaning a lot more towards AKV due to price but the way PVB has plummeted gives me pause. Any guess as to what is driving that?

Those are the two I own.

AKV was an emotional choice for us and the only time we wish we had more AKV points is when we're booking a 2BR value. Those are near impossible to book so when it's open, I wish I had more home resort points to grab the entire week instead of 1 or 2 days. That happens maybe once every....actually it's only happened once.

AKV dues are currently $1/pt more per year, and there's 37 years left on the AKV contract (which is also 9 years sooner than PVB). With AKV typically $110-$120, I can see the consideration of PVB as an alternative.

My personal belief as to why PVB is low is due to several reasons.

1) It had a low entry point. PVB sold at $160/pt when it first listed

2) It had high dues at launch. Top 3 in annual dues, $0.50/pt to $1/pt higher than its monorail competitors.

2) It's the only resort that doesn't have an affordable bedroom option. Which means...

3) It's the only resort that doesn't have an in room washer/dryer

4) It's the only resort that doesn't have a kitchen as an option

3 & 4 are big if you consider DVC "home" But if you're a studio goer...

5) PVB studios are expensive.

6) It has the most aged decor compared to the newer/modern rooms that feel more fresh (bland to some..)

7) PVB took a little longer to sell out, leaving a marketed direct purchase as competition to resales

8) Lack of ROFR to support the bottom

9) Lack of a strong emotional driver. It holds a LOT of nostalgia. But nobody can really say why. A lot of the nostalgia is brought from memories of a vacation spent at the resort, not necessarily of the resort itself. Good or bad vacation the other resorts make you think of the resort. BLT makes you think Contemporary and iconic monorail pass through. AKV has it's animals.

10) It's the jack of all trades. Convenient? Yes, but not as convenient as walking distance to parks. Good food? Yes, but not as many options as others. Big pool? Yes, but not the biggest.

But despite that, I don't think it'll last. Here's a fun fact. Every sold out DVC resort currently has an average resale price that is about the same of its original direct price...except PVB and soon to be CCV. It's not a guarantee, but direct price increases + ROFR purchases will eventually support the bottom of PVB (and CCV). It won't make all of the above go away, but it'll help stop the fall.

CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,989

I'd been logging IDs on my tracking (which is only DVC Resale Market which is by far the easiest site to scrape and log) and they are not adjusting what they show as the price on the site when it hits pending, unless just nothing has sold below posted price the last week or so.agreed right now it is just anecdotal patchwork

I may log the contract ID from the 2 largest sites on my spreadsheet and add a field for pending price when I find for sure matches. That would allow me to determine an approximation of the level discounting when it happens

I did some ROFR matching last time I was in the market back in 2010

E2ME2

ET

- Joined

- Oct 17, 2011

- Messages

- 1,951

I wouldn't suspect that any resales broker would publish the actual sale price vs the listed price.I'd been logging IDs on my tracking (which is only DVC Resale Market which is by far the easiest site to scrape and log) and they are not adjusting what they show as the price on the site when it hits pending, unless just nothing has sold below posted price the last week or so.

View attachment 489724

It's not in their best interest to disclose that sellers could pay less, as that would mean less commission to them.

Why would they ever do that?

These boards provide feedback on actual sales price, but without tracing them back to the original listings.

I think that data will have to be derived elsewhere.

ET

bookwormde

<font color=darkorchid>Heading out now, another ad

- Joined

- Mar 16, 2008

- Messages

- 6,662

Interesting, so DIS ROFR data is probably the best source for them I started on the other large re seller but have only found 1 so far that changedI'd been logging IDs on my tracking (which is only DVC Resale Market which is by far the easiest site to scrape and log) and they are not adjusting what they show as the price on the site when it hits pending, unless just nothing has sold below posted price the last week or so.

View attachment 489724

-

2026 Universal Mardi Gras Limited Time Menus and Highlights

-

Missing Mansion? Scrim Covers Iconic Magic Kingdom Attraction

-

Disneyland Dropping 11 a.m. Park Hopper Restriction Later This Year

-

Monsters, Inc. Ride Staying Open Until 2027 at Disneyland Resort

-

Loungefly Fans! Stop & Love on this New Aristocats Set

-

Black Tap to Open CrazyShake Pop-Up at Disney Springs

-

Pink No More: Cinderella Castle Repaint Progress at Magic Kingdom

New Threads

- Replies

- 1

- Views

- 118

- Replies

- 3

- Views

- 162

New Posts

- Replies

- 599

- Views

- 99K

- Replies

- 2

- Views

- 170

- Replies

- 1

- Views

- 118