Okay, let's try this.

The following chart is based on a 100 point purchase. The Poly cost per point (CPP) price of 165/pt is based on a direct purchase; the other CPP numbers are from a resale website that lists weighted average prices. Before I did this chart, I was basically ready to purchase at BCV or BWV, but I can't make that math make sense. Over the life of the remaining deed, BCV, BWV and Wilderness are actually more expensive than buying from Disney directly. I have to assume that the prices of those three resorts will fall significantly in the next few years ... or am I missing something? I'd love for someone to check me on these numbers or chime in with another way to look at the data.

In my opinion, the reason your numbers do not make sense is that they ignore the time value of money. You are physically paying for the time share up front, plus an annual maintenance charge. You receive the benefits in the future.

The points are interesting, but they are not that relevant for the economic analysis. They are quite useful for allocating your entitlement over different sizes, resorts, and weeks over a three year period, but they aren’t useful for the economics. You need to follow the cash.

What would you be willing to pay today to get a hotel room next year? For sake of argument, lets say average rate for hotel room (roughly equivalent to a studio) at Grand Floridian is $750 per night, and my points will get me 5 nights. The value today of the hotel room is $3,750. But what if Disney gives me an offer to reserve the hotel room in a year, but I have to pay today. I will say no thank you. I will keep my money for a year, and then pay my $3,750 then. So to get me to pay now, Disney has to offer a discount. Let's say they give me a 10% discount. I pay $3,375 today, and I get something worth $3,750 in a year. Depending on other ways to use my money, that may or may not be a good deal. But I am sure that I am going in a year, so I take the deal.

Now Disney offers me five days in the Grand Floridian in two years. I certainly am not going to value this offer at the standard rate. I am going to apply my ten percent discount for 2 years. So I am willing to pay $3,750 x (1 - .1) x (1-.1) which equals $3,038.

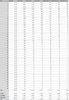

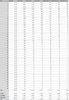

Similar calculations for years 3 thru 49 let us see the value relative to time.

- $3,375 = $3,750 x .9

- $3,038 = $3,750 x .9 squared

- $2,734 = $3,750 x .9 to the third power

- etc. see spreadsheet below

When you look at it this way, you see that most of the value of your purchase comes in years 1-10. A smaller amount comes in years 11-20. And then a very small tail comes in years 21-49.

Here are three scenarios. A 10% discount, a 15% discount, and a 20% discount. For simplicity, we will discount the maintenance fees at the same rate as the hotel discounts.

So, we pay, in your example, $153 per point x 100 points, or $15,300. Plus yearly maintenance of $571.

In the 10% scenario, we get hotel rooms worth $33,557 less maintenance of $5,110 for a net of $28,447 in todays dollars. If we subtract our purchase price of $15,300, we are in the black to the tune of $13,147.

In the 15% scenario, we get hotel rooms worth $$21,243 in todays dollars, offset by maintenance fees of $3,235 for a net of $18,008. If we subtract our purchase price of $15,300, we are in the black by $2,708.

But if we require a 20% discount to part with our money for the next 49 years, the hotel rooms are worth $15,000, offset by the maintenance at $2,284, for a net of $12,716. If we subtract our purchase price of $15,300, we are in the red at -$2,584.

This shows that in a quick and dirty analysis,

DVC breaks even if you assume you are getting hotel rooms at somewhere between a 15% and 20% discount (say 17.5%).

It is also interesting to note the timeline.

In the 10% scenario, you get 66% of the benefits in years 1-10. You get an additional 23% of the benefits in years 11-20. In years 21-49, you get the final 12% of the benefits. If that seems low, ask yourself what you would be willing to pay today for a hotel room in 49 years.

In the 15% scenario, you get 80% of the benefits in the first 10 years. You get an additional 16% in years 11-20. In years 21-49, you get the final 4% of the benefits.

In the 20% scenario, you get 89% of the benefits in the first 10 years. You get an additional 10% in years 11-20. You get the final 1% of value in years 21 through 49.

Perhaps this is why people are telling you that the resort end dates are not a huge factor in the analysis.

If you did a similar analysis for the other resorts, say BCV for 27 years vs. an equivalent hotel room, you can start comparing the economics.

Also, the 10%, 15%, and 20% numbers are representative of YOUR PREFERENCE for money today versus benefits in the future. If you prefer a 10% discount tomorrow rather than your cash money today, DVC makes sense. If you would require a discount of 17.5% before parting with your money today, DVC breaks even. So it still sort of gets back to “how bad do you want it.?”