PlutoNotThePlanet

Earning My Ears

- Joined

- Dec 5, 2024

- Messages

- 18

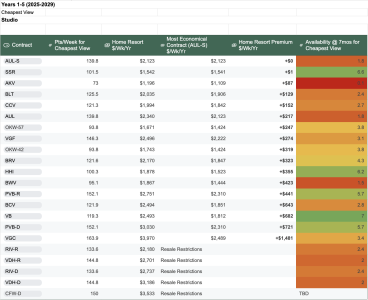

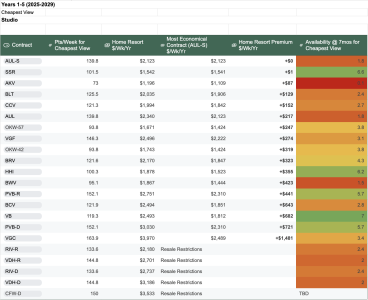

A common maxim here is “buy where you want to stay” which is important advice for someone who must have a specific resort and unit type in peak seasons. The home resort booking advantage allows owners to book at the 11-month mark and snag in-demand reservations. Others are content to have “Sleep Around Points” (SAP), contracts with low upfront costs and cheap dues that they never use at their home resort, but instead book other resorts at the 7-month mark. But how big exactly is the gap between the SAP contract and one at the preferred Home Resort, both in terms of upfront cost but also dues over the life of the contract?

In this post I attempt to calculate the Home Resort Premium, the price paid above SAP, on a per-point and a per-reservation (a week in each unit size) basis.

Home Resort Premium Tables

Here is a link to a Google Sheet containing many tables computing the Home Resort Premium for different time horizons, unit sizes, and two unit “views”.

Google Sheet - DVC Home Resort Premium

There are four sheets:

General Observations:

Notes:

The questions I wanted to answer are:

The point costs are taken from @ehh ’s thread, and incorporate the current resale (or direct) pricing for each contract, a discount rate of 5%, and projected dues. The time horizons I include (5, 10, or 17 years) match those presented there, with the 17 year span ending in 2041, prior to several resorts’ deed expiration date. Note that the point costs are the cumulative cost for the points, not an annual cost. For more info, please read this thread.

Cost for a Week Stay

To book a the 11 month mark, we have to consider the home resort point charts. As these are different, it makes sense to fold them in to the calculation and standardize around an average 1-week stay, as in @ehh ’s thread. I use the same points per week for each resort as calculated there, which are averaged across the seasons. The points costs are then multiplied by the home resort point cost or the SAP contract point cost. The Home Resort Premium is the difference of the two.

Availability Data

I used DVC Field Guide's Availability Tables to get the average availability at the 7 month mark for each unit type (both size and view). In each of the main unit size categories (Studio, 1 Bedroom, 2 Bedroom, Grand Villa, Cababungahouse) I calculate Availability for Cheapest view and Average view room.

Limitations:

In this post I attempt to calculate the Home Resort Premium, the price paid above SAP, on a per-point and a per-reservation (a week in each unit size) basis.

- The Home Resort Premium by Point is the cumulative cost per point paid in upfront costs and membership dues over the time horizon considered (5, 10, or 17 years) vs buying the most economical SAP contract.

- The Home Resort Premium (Weekly) is the additional cost someone would pay for a 1-week stay in their home resort using their home resort points vs. the same stay booked with the most economical SAP contract. This is reported as the per-week cost but is in fact spread over the time horizon considered (5, 10, or 17 years)

Home Resort Premium Tables

Here is a link to a Google Sheet containing many tables computing the Home Resort Premium for different time horizons, unit sizes, and two unit “views”.

Google Sheet - DVC Home Resort Premium

There are four sheets:

- Premium by Point: This shows the Home Resort Premium by Point for each resort, compared to a SAP contract. Aulani Subsidized is the most economical contract and used throughout the entire sheet as our SAP choice. However, Saratoga Springs is very close and could be easily substituted without much changing.

- Years 1-5, Years 1-10, Years 1-17 show the same analysis over different time scales. This matches @ehh ’s thread and incorporates dues growth projections. I would recommend picking one time horizon (Years 1-10) and just looking at that.

- On each sheet are 10 tables, 5 on the left and 5 on the right. The 5 on the left consider the cheapest view category for each unit size type (each in a separate table. The 5 on the right consider the average view (weighted by room inventory) for each unit size type. If you want to use your 11-month booking window to get the cheapest possible room, then look on the left. If you don’t care or prefer a more expensive view type, the right tables may be more your style.

- In each table, you can see the points required to book an average week at a resort, and the cost of a single week in dollars using both your home resort points or SAP points. This cost includes the amortized upfront cost as well as the dues projection (averaged over time horizon).

- The Home Resort Premium is simply the difference between the two cost columns to the left of it. This is the cost of the Home Resort booking advantage per week stay. The table should be sorted by this column from lowest premium to highest. Some resorts don’t have a premium as they have resale booking restrictions.

- The color coded availability column shows how hard it is to book that unit size at the 7-month mark on average throughout the year. Red (0) is very hard or impossible to book, and green (7) is easy, all dates are available.

General Observations:

- AUL-S and SSR are the obvious SAP candidates with VGF and CCV following. VGF is somewhat suspect as it has very low projected dues growth.

- I don’t think it ever makes sense to buy VB or HHI. Yes, the Beach Cottages can get a little harder to book, but the premium for VB over AUL-S is $3k-$5k per week!

- AKV, CCV, BLT, and VGF are all contracts with a fairly low premium where the cheapest studios and 2 bedrooms are hard to book. It may be worth paying that, but 1 Bedrooms and Grand Villas may be able to be booked at 7 months with SAP.

- The availability for the Average View rooms are much easier than the cheaper views. If you were going to book a more expensive view type anyways, I think it makes more sense to buy SAP.

- BWV, BCV, and VGC are generally harder to book and command a higher Home Resort Premium. This doesn’t seem to be as true for 1 Bedrooms though, meaning maybe SAP for those?

- I probably wouldn’t buy OKW unless you really wanted to get their Grand Villas.

- PVB doesn’t currently seem like a good deal as availability looks pretty good, but we will have to see how things shake out after the Tower has been in play for a while.

- Other than the previously mentioned VB Beach Cottages, all of the other large/special room types look fairly easy to book, so there’s no reason to pay a quite large premium over SAP.

Notes:

The questions I wanted to answer are:

- How much does it cost, on a per-point basis, to buy at my preferred resort instead of the most economical contract?

- How hard is it to book that home resort at the 7-month mark? If it is hard, then a home resort contract might be needed to get a reservation I the unit size I want.

- How much extra am I paying (Home Resort Premium) for this booking advantage, and is that worth it to me?

The point costs are taken from @ehh ’s thread, and incorporate the current resale (or direct) pricing for each contract, a discount rate of 5%, and projected dues. The time horizons I include (5, 10, or 17 years) match those presented there, with the 17 year span ending in 2041, prior to several resorts’ deed expiration date. Note that the point costs are the cumulative cost for the points, not an annual cost. For more info, please read this thread.

Cost for a Week Stay

To book a the 11 month mark, we have to consider the home resort point charts. As these are different, it makes sense to fold them in to the calculation and standardize around an average 1-week stay, as in @ehh ’s thread. I use the same points per week for each resort as calculated there, which are averaged across the seasons. The points costs are then multiplied by the home resort point cost or the SAP contract point cost. The Home Resort Premium is the difference of the two.

Availability Data

I used DVC Field Guide's Availability Tables to get the average availability at the 7 month mark for each unit type (both size and view). In each of the main unit size categories (Studio, 1 Bedroom, 2 Bedroom, Grand Villa, Cababungahouse) I calculate Availability for Cheapest view and Average view room.

- Cheapest is the lowest room of that size on the point chart, for example Standard View at Bay Lake Tower.

- Average is the weighted average of all view types using the room inventory for each resort.

Limitations:

- I wanted some sort of simple metric of Booking Advantage / Premium to get a unit cost for the booking advantage. But I was unable to find a satisfactory metric or way to explain that.

- All of the limitations in @ehh ’s thread apply here as well. Dues could rise at different rates than projections, or the discount rate may not be the best choice.

- This basically compares someone who only uses their points at their home resort, versus someone who has the most economical SAP contract. Most people may be somewhere in the middle of that spectrum.

- Availability averages over seasons obscure some peak seasons with low availability. It might be good to present a version of this just within a peak travel window to showcase where home resort booking can shine.

- Availability data on PVB with Tower and VDH is limited.

- Resorts with resale restrictions do not have a (Weekly) Home Resort Premium computed as they can’t be booked with resale SAP contracts. I could have compared them to a direct SAP contract or compared direct to resale, but those are different metrics and I didn’t want to mix that in.

- Transient taxes are not included for stays at VDH and AUL and maybe should be in the future.

- Presenting 3 time horizons and 2 view calculations for each unit size type is a bit much, and I would like to simplify this a bit.

Last edited: