Is there any truth to the Rumor that Disney through Reedy Creek has been able to artificially keep Tax assessments of their Resorts low to avoid taxes ? If so with the state of Florida in charge of Reedy Creek now will they reassess the values to raise taxes leading to a huge tax hike on DVC dues?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DVC Taxes and Dues

- Thread starter Yankee626

- Start date

erionm

DIS Legend

- Joined

- Dec 6, 2008

- Messages

- 25,261

No. The assessed value of the resorts are set by either Orange County or Osceola County (based on physical location). Disney has filed many lawsuits against the Orange County Property Appraiser challenging the valuation of the parks & resorts.Is there any truth to the Rumor that Disney through Reedy Creek has been able to artificially keep Tax assessments of their Resorts low to avoid taxes ?

crvetter

DIS Veteran

- Joined

- Nov 26, 2018

- Messages

- 3,396

It isn't the Assessed Value that Disney has control over (the Poster above is correct the counties set that). What DeSantis is trying to spin is that RCID being a separate government entity is able to control the tax rate (the amount multiplied by the assessed value to get the tax amount), but what he left out is that only for the budget needed for the roads, fire department, water, etc within the district. The argument is disingenuous (surprise!) because RCID is self-funded through the taxes they collect at Disney so if it was below that of other taxing jurisdictions in the state it is simply because RCID was more efficient than other taxing jurisdictions.Is there any truth to the Rumor that Disney through Reedy Creek has been able to artificially keep Tax assessments of their Resorts low to avoid taxes ? If so with the state of Florida in charge of Reedy Creek now will they reassess the values to raise taxes leading to a huge tax hike on DVC dues?

Disney still has to pay County (not sure if Florida has any state level property taxes I'm guessing not) Taxes for those services that are utilized on the county level. Think of the scenario you live in Chicago which is in Cook County, on your tax bill there is a portion that the City of Chicago taxes and a portion that Cook County taxes. Now say you live in Evanston (also in Cook County), you pay the taxes that Evanston charges and those that Cook County taxes, but not Chicago which seems fair, right? In this analogy think of an Evanston Resident as a RCID Resident (Disney), still paying all the taxes it owes to the county (Osceola and Orange) but it is paying for its local "city" that just happens to be a special district. Why should Disney be paying for Orlando (or any other tax jurisdiction that doesn't encompass RCID)? There is no reason, unless they use those public services which I'm sure are fully collected if necessary.

- Joined

- Apr 29, 2004

- Messages

- 39,204

No, there is absolutely no truth to this rumor. Disney pays the same taxes as everybody else. Disney has been proactive in challenging their assessment where they believe the property is inappropriately valued. But they have still paid the full taxes levied pending an abatement.Is there any truth to the Rumor that Disney through Reedy Creek has been able to artificially keep Tax assessments of their Resorts low to avoid taxes ?

Disney_escape

Jedi

- Joined

- Feb 4, 2021

- Messages

- 142

The above about who sets values and taxes is correct. I have also heard that there is a lawsuit currently happening in Florida that is fighting to allow time-shares to be valued like homes are. Meaning that they would be based on the average of resent sales. The article I read said it could potentially LOWER property taxes on time-shares including DVC. If I remember correctly, currently they are basing it on new construction price.

Maybe someone on here knows more about this?

Dues will probably see a higher than normal increase for 2024 due to the new union hourly employees contract recently signed.

Maybe someone on here knows more about this?

Dues will probably see a higher than normal increase for 2024 due to the new union hourly employees contract recently signed.

- Joined

- Apr 29, 2004

- Messages

- 39,204

The increase will not be anything significant. Labor is a small component of our overall dues.Dues will probably see a higher than normal increase for 2024 due to the new union hourly employees contract recently signed.

Disney_escape

Jedi

- Joined

- Feb 4, 2021

- Messages

- 142

What percentage is it? I have seen on these boards that it is 50-55%. I have never done the calculation, but people on here that say they have seem to agree it makes up more than half. And if that half goes up 20% then we are looking at 70-90 cents per point.The increase will not be anything significant. Labor is a small component of our overall dues.

DonMacGregor

Sub Leader

- Joined

- May 13, 2021

- Messages

- 6,578

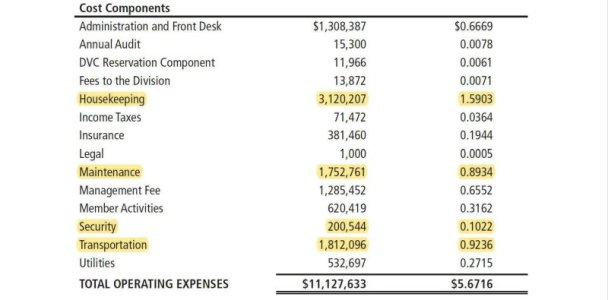

Here is the Cost Component breakdown for Boulder Ridge for 2023:What percentage is it? I have seen on these boards that it is 50-55%. I have never done the calculation, but people on here that say they have seem to agree it makes up more than half. And if that half goes up 20% then we are looking at 70-90 cents per point.

The four categories with measurable potential for increased labor rates are highlighted. Of those 4, the largest, and most likely to move the needle, is Housekeeping, at $1.60 per point. If that $1.60 was increased by 20%, the Housekeeping component would increase to $1.92 per point. That represents an increase to the Cost Components of 9%, and an increase in overall dues from $8.511 per point to $8.83 per point, or just over 3%.

The other three categories do have a labor component to them, but have other significant costs subsumed into their total cost like equipment, materials (maintenance), vehicle maintenance and fuel (which we KNOW represents the vast majority of transportation costs), etc., and labor is likely a significantly smaller percentage of those categories. Even if we assumed that 100% of each of those categories was entirely labor costs and nothing else, it still only represents 41% of the total per point dues at Boulder Ridge. We would have to increase ALL of those categories by 20%, to barely touch an additional $.70 per point.

In reality, I'd put labor costs somewhere around 20% of the cost of annual dues per point.

ETA: here is the total cost breakdown per point:

The amount of ad valorem taxes assessed against each Unit will be determined by the Orange County

Property Appraiser’s Office and the Reedy Creek Improvement District Appraiser, respectively. The estimated

ad valorem tax assessments to be included on your 2023 Annual Dues billing statement will be $1.4723

per Vacation Point. This is DVCM’s best estimate of the actual taxes which will be assessed for the tax year

2023. DVCM does not certify this ad valorem tax estimate. Each Owner is responsible for his or her per

Vacation Point share of the actual tax bill received each year from the tax collector’s office. Any difference

between the tax estimate and actual taxes paid on the Owner’s behalf will be applied towards the Owner’s

subsequent year’s tax assessment.

The estimated Annual Dues for the year January 1, 2023 through December 31, 2023 are $8.5110 per

Vacation Point, which is comprised of the estimated Annual Operating Budget ($5.4454 per Vacation Point),

the estimated Annual Capital Reserves Budget ($1.5933 per Vacation Point) and the estimated ad valorem

taxes ($1.4723 per Vacation Point). The total amount of Annual Dues paid by a Purchaser or Owner is

determined by multiplying the total number of Vacation Points represented by the Ownership Interest

purchased by $8.5110.

Last edited:

Disney_escape

Jedi

- Joined

- Feb 4, 2021

- Messages

- 142

I was figuring that Admin & front desk, Reservation, management fee and member service would also be heavy on the labor side. While I don't think the Management is part of that particular union, I would guess most cast members will get similar adjustments. Not an accountant, just basing it on other things I have seen.Here is the Cost Component breakdown for Boulder Ridge for 2023:

View attachment 762582

The four categories with measurable potential for increased labor rates are highlighted. Of those 4, the largest, and most likely to move the needle, is Housekeeping, at $1.60 per point. If that $1.60 was increased by 20%, the Housekeeping component would increase to $1.92 per point. That represents an increase to the Cost Components of 9%, and an increase in overall dues from $8.511 per point to $8.83 per point, or just over 3%.

The other three categories do have a labor component to them, but have other significant costs subsumed into their total cost like equipment, materials (maintenance), vehicle maintenance and fuel (which we KNOW represents the vast majority of transportation costs), etc., and labor is likely a significantly smaller percentage of those categories. Even if we assumed that 100% of each of those categories was entirely labor costs and nothing else, it still only represents 41% of the total per point dues at Boulder Ridge. We would have to increase ALL of those categories by 20%, to barely touch an additional $.70 per point.

In reality, I'd put labor costs somewhere around 20% of the cost of annual dues per point.

ETA: here is the total cost breakdown per point:

DonMacGregor

Sub Leader

- Joined

- May 13, 2021

- Messages

- 6,578

There are about 75,000 CM's at WDW, but about 45,000 (still a big chunk), spread over 6 unions, were party to the new agreement. Salaried CM's in management and administrative roles are typically non-union.I was figuring that Admin & front desk, Reservation, management fee and member service would also be heavy on the labor side. While I don't think the Management is part of that particular union, I would guess most cast members will get similar adjustments. Not an accountant, just basing it on other things I have seen.

Here's a good breakdown of those who received the largest pay increases:

Custodial and attractions CM also received pay raises, but the net increase was smaller due to higher existing pay rates.Union leaders said that the following roles would receive wage increases of higher amounts:

- Union Housekeepers: increase from $17 to $20 immediately, ending at $24 in October 2026

- Union Dishwashers: increase from $15 to $18 immediately, ending at $22 in October 2026

- Cook 2 (Union Prep Cook): increase from $16.40 to $20 immediately, ending at $24 in October 2026

- Cook 1 (Union Line Cook): increase from $19 to $23.10 immediately, ending at $27.10 in October 2026

- Union Chef Assistant: increase from $20 to $24.60 immediately, ending at $28.60 in October 2026

- Union Bus Drivers: increase from $18 to $20.50 immediately, ending at $24.50 in October 2026

Last edited:

- Joined

- Nov 15, 2008

- Messages

- 47,987

I was figuring that Admin & front desk, Reservation, management fee and member service would also be heavy on the labor side. While I don't think the Management is part of that particular union, I would guess most cast members will get similar adjustments. Not an accountant, just basing it on other things I have seen.

DVCMC gets paid a straights 12% fee...so that amount can't adjust the same way that other areas can.

-

Disney Cruise Line Stateroom Reviews

-

Free Holiday Magic to Experience at Walt Disney World

-

New Disney App Feature Helps You Find Viral Merchandise

-

Growing the Next Generation of Disney Adult

-

The Disney Community Needs More Collaboration

-

Five Ways to Spread Holiday Cheer in the Disney Parks

-

Clix Breaks New Ground With First-Ever Fortnite Livestream From Disney World

New Threads

- Replies

- 2

- Views

- 133

New Posts

- Replies

- 24

- Views

- 2K

- Replies

- 10K

- Views

- 287K

- Replies

- 3

- Views

- 128

- Replies

- 13

- Views

- 1K

Resort Thread

Walt Disney World SWAN, DOLPHIN & SWAN RESERVE Resorts

- Replies

- 24K

- Views

- 3M