wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,940

https://www.fool.com/investing/2023...hoo-host&utm_medium=feed&utm_campaign=article

Streaming's Stalwarts Are Losing Viewers to Newcomers. Here's What Investors Should Know.

By James Brumley – May 30, 2023 at 9:37AM

No streaming service is still assured that its subscribers will remain interested enough to continue paying its monthly fee.

The streaming market's powerhouses are losing ground to up-and-comers, forcing adaptations that could end up doing more harm than good.

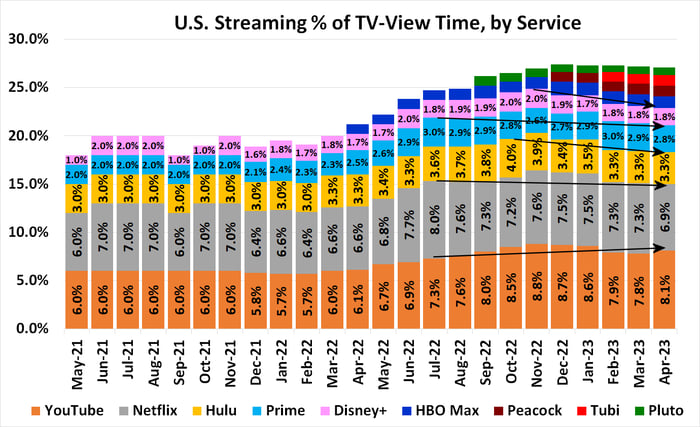

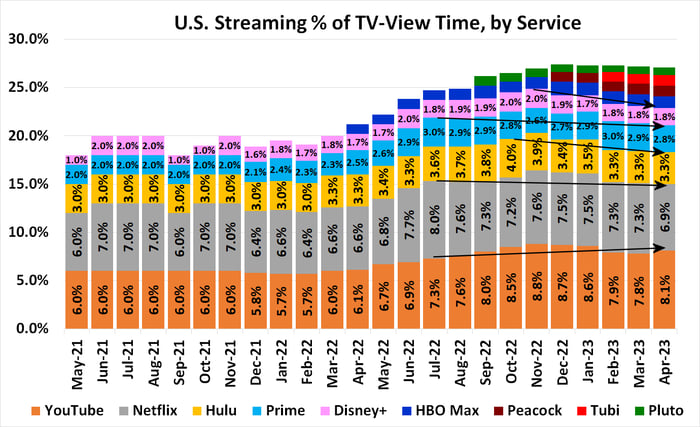

That's the implication of Nielsen's latest look at the matter, anyway. The audience-ratings company reports that at its peak in the middle of last year, Netflix (NFLX 3.06%) accounted for 8% of the time the average person in the U.S. spent looking at a television screen. As of last month, though, that figure had been pared down to 6.9%.

Were it just Netflix or just a month or two, the decline might be dismissible. It's not just Netflix, though, and it's not just a couple of months. Walt Disney's (DIS -0.46%) Hulu has seen its share of viewing time slump from October's peak of 4% to only 3.3% last month. Amazon's (AMZN 1.96%) Prime and Disney+ have also seen their share of domestic viewing time slip for roughly the same time frame.

But where is this viewership going? It would be naive to pretend Comcast's (CMCSA -0.04%) Peacock, Warner Bros. Discovery's (WBD -1.00%) HBO Max, Fox's (FOX 0.44%) (FOXA 0.26%) Tubi, and Paramount (PARA 2.65%) aren't making a dent in the usual stalwarts' reach. A year ago, these platforms didn't even register with Neilsen. Now they do.

And several other, lesser-known services such as Discovery+ or AMC Networks (AMCX -0.08%) are also contributing to the shake-up.

Data source: Nielsen. Chart by author.

There's one overarching implication to the streaming market's growing fragmentation, prompting one strategic response consumers probably aren't going to like. So shareholders of any on-demand video company should understand the problem. This shift will almost certainly impact their stocks.

The bulk of streaming services (Netflix being an exception) are unprofitable. For years, most of them touted plans, only to raise prices at a later date once subscriber bases were bigger. But most of them underestimated just how intense the eventual price war would become.

And achieving profitability by spending less on content isn't a viable plan, either. U.S. consumers are already watching each service less than they previously were. Offering even-slimmer content libraries will only prompt them to watch less, spurring more questions about why they continue to pay for that subscription.

The current preferred go-to solution is melding single streaming services into super-services, sharing some content costs while hopefully increasing the overall marketability of a package.

Warner Bros. Discovery recently launched a platform called Max, which for all intents and purposes is a melding of HBO Max and Discovery+. Disney CEO Bob Iger has confirmed Disney+ and Hulu will be available as a single bundled offering before the end of this year.

Comcast just unveiled a platform called Now TV, with a wide array of on-demand content from popular cable channels, some premium content from Warner, a bunch of free-to-watch services, and a premium (ad-free) subscription to Peacock.

Other cable and streaming companies are likely to follow suit, assembling super-services that are quantity-minded as much as quality-minded, in search of a sustainable balance between price and cost.

Except, this isn't what consumers seem to want.

Consumers crave less, not more

Hub Entertainment Research's recently published Battle Royale report asked 3,000 U.S. consumers for their feelings about bundling various subscription services. A whopping 82% of them answered: "Budget is the main factor limiting how many subscriptions I have."

That isn't terribly troubling as long as a streamer is one that a consumer is willing to pay for. But the same survey found that 82% of those surveyed feel: "There's a limit to how many platforms I can use, even if I can afford to have them all."

Based on the two data points, Hub's principal, Jon Giegengack, concludes:

That conclusion underscores the message delivered by Nielsen's recent look at how the typical U.S. consumers allocate their viewing time. That is, they just don't have the same amount of time to continue watching all of the top-tier streaming services as they had in the past.

If viewing time is down, it's likely only a matter of when until these consumers rethink paying more and more for a streaming service they're watching less and less. Expanded services with more content only makes them more complex (not to mention more costly), exacerbating the complexity Hub Research's Giegengack points to as a growing problem.

The same dynamic should eventually play out in international markets as well.

Nobody can afford to ignore this

Does the data suggest imminent catastrophic failure of most streamers? No, there's more likely to be a continuing, slow deterioration of each streamer's audience at the hands of competing services. It's a troubling industry-wide backdrop that's too big for investors to ignore.

Most of the major streaming operations are still unprofitable as is. Now they'll soon be fighting to justify their prices to customers who have lots of other options. This, in turn, will force a rethinking of content budgets. It's just an awful lot of uncertainty. And, as veteran investors can attest, the market abhors the unknown and unknowable, and it prices stocks accordingly.

Every investor needs to understand the shift that's underway, because all streaming services are going to have to respond to it. Their current pricing and content budgets will have to be adjusted, and some of them aren't going to figure it out until it's too late.

Streaming's Stalwarts Are Losing Viewers to Newcomers. Here's What Investors Should Know.

By James Brumley – May 30, 2023 at 9:37AM

Key Points

- New streaming platforms are pulling viewing time away from the industry's titans.

- Meanwhile, viewers just don't have the same amount of time to watch as they did in the past.

- Investors should pay attention to streamers' weakening pricing power and shrinking content budgets.

No streaming service is still assured that its subscribers will remain interested enough to continue paying its monthly fee.

The streaming market's powerhouses are losing ground to up-and-comers, forcing adaptations that could end up doing more harm than good.

That's the implication of Nielsen's latest look at the matter, anyway. The audience-ratings company reports that at its peak in the middle of last year, Netflix (NFLX 3.06%) accounted for 8% of the time the average person in the U.S. spent looking at a television screen. As of last month, though, that figure had been pared down to 6.9%.

Were it just Netflix or just a month or two, the decline might be dismissible. It's not just Netflix, though, and it's not just a couple of months. Walt Disney's (DIS -0.46%) Hulu has seen its share of viewing time slump from October's peak of 4% to only 3.3% last month. Amazon's (AMZN 1.96%) Prime and Disney+ have also seen their share of domestic viewing time slip for roughly the same time frame.

But where is this viewership going? It would be naive to pretend Comcast's (CMCSA -0.04%) Peacock, Warner Bros. Discovery's (WBD -1.00%) HBO Max, Fox's (FOX 0.44%) (FOXA 0.26%) Tubi, and Paramount (PARA 2.65%) aren't making a dent in the usual stalwarts' reach. A year ago, these platforms didn't even register with Neilsen. Now they do.

And several other, lesser-known services such as Discovery+ or AMC Networks (AMCX -0.08%) are also contributing to the shake-up.

Data source: Nielsen. Chart by author.

There's one overarching implication to the streaming market's growing fragmentation, prompting one strategic response consumers probably aren't going to like. So shareholders of any on-demand video company should understand the problem. This shift will almost certainly impact their stocks.

Streaming companies respond by repackaging

The big implication: With more choices out there, streaming services are being forced to be much more price-conscious. But at the same time, they also need to be increasingly cost-conscious.The bulk of streaming services (Netflix being an exception) are unprofitable. For years, most of them touted plans, only to raise prices at a later date once subscriber bases were bigger. But most of them underestimated just how intense the eventual price war would become.

And achieving profitability by spending less on content isn't a viable plan, either. U.S. consumers are already watching each service less than they previously were. Offering even-slimmer content libraries will only prompt them to watch less, spurring more questions about why they continue to pay for that subscription.

The current preferred go-to solution is melding single streaming services into super-services, sharing some content costs while hopefully increasing the overall marketability of a package.

Warner Bros. Discovery recently launched a platform called Max, which for all intents and purposes is a melding of HBO Max and Discovery+. Disney CEO Bob Iger has confirmed Disney+ and Hulu will be available as a single bundled offering before the end of this year.

Comcast just unveiled a platform called Now TV, with a wide array of on-demand content from popular cable channels, some premium content from Warner, a bunch of free-to-watch services, and a premium (ad-free) subscription to Peacock.

Other cable and streaming companies are likely to follow suit, assembling super-services that are quantity-minded as much as quality-minded, in search of a sustainable balance between price and cost.

Except, this isn't what consumers seem to want.

Consumers crave less, not more

Hub Entertainment Research's recently published Battle Royale report asked 3,000 U.S. consumers for their feelings about bundling various subscription services. A whopping 82% of them answered: "Budget is the main factor limiting how many subscriptions I have."

That isn't terribly troubling as long as a streamer is one that a consumer is willing to pay for. But the same survey found that 82% of those surveyed feel: "There's a limit to how many platforms I can use, even if I can afford to have them all."

Based on the two data points, Hub's principal, Jon Giegengack, concludes:

Consumers are using many sources, but only half of them are considered essential: The others are at risk of being cut. But the data also show the opportunity for companies that can simplify the user experience. Complexity is as big an impediment as cost.

That conclusion underscores the message delivered by Nielsen's recent look at how the typical U.S. consumers allocate their viewing time. That is, they just don't have the same amount of time to continue watching all of the top-tier streaming services as they had in the past.

If viewing time is down, it's likely only a matter of when until these consumers rethink paying more and more for a streaming service they're watching less and less. Expanded services with more content only makes them more complex (not to mention more costly), exacerbating the complexity Hub Research's Giegengack points to as a growing problem.

The same dynamic should eventually play out in international markets as well.

Nobody can afford to ignore this

Does the data suggest imminent catastrophic failure of most streamers? No, there's more likely to be a continuing, slow deterioration of each streamer's audience at the hands of competing services. It's a troubling industry-wide backdrop that's too big for investors to ignore.

Most of the major streaming operations are still unprofitable as is. Now they'll soon be fighting to justify their prices to customers who have lots of other options. This, in turn, will force a rethinking of content budgets. It's just an awful lot of uncertainty. And, as veteran investors can attest, the market abhors the unknown and unknowable, and it prices stocks accordingly.

Every investor needs to understand the shift that's underway, because all streaming services are going to have to respond to it. Their current pricing and content budgets will have to be adjusted, and some of them aren't going to figure it out until it's too late.