piglet1979

DIS Veteran

- Joined

- Mar 18, 2015

- Messages

- 5,123

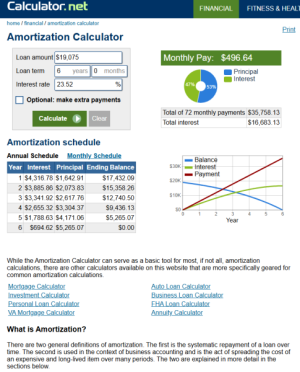

I've been thinking about refinancing my car loan because I'm paying 26% ARP right now, and that's a little high. I'd like to get it lowered. So I've been going through CreditKarma to try and straighten out my finances, and they've offered several options. But some I've never heard of. So I'm hoping people here can help me with what would be the best option. Right now I'm paying $500 per month on my car payment. I bought it 2 years ago this September, and I've barely even touched the principal. For the past 2 years, everything single penny has gone to interest. So looking for help on which of these options is best (not which option has lowest monthly payment or lowest APR, but what company is best to go with).

AutoPay got 4/5 stars and would drop my APR by 5% and my monthly payment by $35;

Caribough got 4/5 stars and would drop my APR by 3.23% and my monthly payments by $24;

RateGenius, Tresl and Upgrade each got 4.5/5 stars but would drop my APR by 2% or less and my bill by $15 or less;

Should I try and go with someone else? Or should I just keep it where I'm at?

By the way, I also keep getting emails from Capital One Auto Financing with requests to auto finance. I tried it once, but it say I had to pay the current loan down to what the car is worth ($14k). So I'd have to pay $4k just to refinance, and that's not happening. But they still keep sending me those emails saying I qualify for auto refinancing.

We have either gone through our local banks or through the dealership. Our 2 last loans (both paid off the tail end of 2020) were through Huntington Bank. The loan we have right now is through the dealership.

If you do go with one of the above, I would consider still paying what you have been to help pay it down faster.

thankfully we have the emergency fund to cover it.

thankfully we have the emergency fund to cover it. When he checked in the night before, his juror # was not part of the group that had to report and it said now he is not required to serve for another 3 years.

When he checked in the night before, his juror # was not part of the group that had to report and it said now he is not required to serve for another 3 years.