Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,208

Question on that. If the world does end, what happens to our BCV points in 2042?? (j/k!) Great analysis on AUL vs AUL-S.This doesn't include if the world comes to end.

Those with 2042 resorts will be hit the hardest because well it’s a 2042Question on that. If the world does end, what happens to our BCV points in 2042?? (j/k!) Great analysis on AUL vs AUL-S.

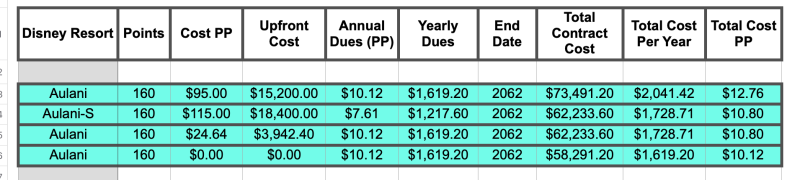

Wow, so it really was a $90/pp difference!!Okay I reworked it to fix the years left. So that changes the savings number to $11,258 saved if you keep it until expiration.

Now for what you asked. Be prepared to have your mind blown! To match a $115pp sub you’d have buy a non sub at $24.64pp.

For fun I added if you paid 0.00 for non sub upfront. This really highlights how dues are whats most important over the life as opposed to price per point.

I am 100% pro AUL-S. But I will include the downside just to be fair. It would take about 8-10 years to breakeven on your initial upfront cost being $3200 more than a non sub. ($95pp vs $115pp)

View attachment 983460

Lastly a disclaimer for the people that will come at me. This doesn’t factor in dues increases. This doesn’t factor in if you took your initial $3200 more spent and invested it. This doesnt include if the world comes to end. It’s rough numbers that I used to help me make an informed decision when I was buying.

I really hope you find it! Wouldn’t hurt to reach out to any brokers you have a relationship with and ask them to be on the lookout for you.Wow, so it really was a $90/pp difference!!

@VGCgroupie thanks so much for confirming I wasn’t losing my mind.

I’m definitely on the hunt for that September Unicorn Sub!

My 3 sub contracts are all Feb and paired with my VGC too. Feb pops up often.I don't think I want to wait and compete for the Sep Aul Sub unicorn. I'm probably going to end up getting a Aul(s) in my Feb use year since that's where my VGC is already. I have been looking a bit already and Feb has a lot that pop up. It just makes more sense to me than SSR since I already have a ton of WDW points, the subsidized dues are lower, and it actually has some home resort priority. So I'll just split up my points into Florida and non Florida I guess.

I think I saw one once, but can’t say I’m 100% sure. There’s a good chance some owners with September UY added contracts when AUL started selling.I thought I recently saw a breakdown on these boards of the UYs that were sold that then became subsidized contracts and there were 0 for September - which also happens to be MY UY and also happens to be something I am looking for. I wish I could remember which thread it was on here that I saw the breakdown.

As many of us here do, I check the aggregators every day for a while and I’ve never seen one. All my other contracts are in my UY and while I think it won’t be great for me to manage more than 1, I too am considering adding on another just for AULs.

Does anyone else know for sure if there IS or ISN’T even a possibility of a AULs in Sept UY out there?

I have also searched for that info and I cannot find it.I thought I recently saw a breakdown on these boards of the UYs that were sold that then became subsidized contracts and there were 0 for September - which also happens to be MY UY and also happens to be something I am looking for. I wish I could remember which thread it was on here that I saw the breakdown.

As many of us here do, I check the aggregators every day for a while and I’ve never seen one. All my other contracts are in my UY and while I think it won’t be great for me to manage more than 1, I too am considering adding on another just for AULs.

Does anyone else know for sure if there IS or ISN’T even a possibility of a AULs in Sept UY out there?

There are some datapoints for September here, so they definitely existI thought I recently saw a breakdown on these boards of the UYs that were sold that then became subsidized contracts and there were 0 for September - which also happens to be MY UY and also happens to be something I am looking for. I wish I could remember which thread it was on here that I saw the breakdown.

As many of us here do, I check the aggregators every day for a while and I’ve never seen one. All my other contracts are in my UY and while I think it won’t be great for me to manage more than 1, I too am considering adding on another just for AULs.

Does anyone else know for sure if there IS or ISN’T even a possibility of a AULs in Sept UY out there?

First thing I notice is I was using wrong amounts for dues. lol (not $10.12 and $7.61)

Hmm, so about $400 per year x 36 = $14k, which would probably be pretty accurate for the remainder of the contract, but just based on this year alone, that would be $400 in dues / 160 = $2.50/pp? (2.5x36=90… but $90/pp can’t be the answer.!?)

This is crazy. lol

What am I doing wrong here, what is the cost per point difference amount needed to get a regular Aulani contract for to make it worth it over a Sub?

I feel like I’m losing my mind.

There are some datapoints for September here, so they definitely exist

https://www.dvcrofr.com/dis-data/pricing-trends

Found SEPT here in 2024. https://www.disboards.com/threads/r...ost-for-instructions-formatting-tool.3936707/

Its really sad that we have to put a disclaimer because WE KNOW people are looking to attack at the first chanceOkay I reworked it to fix the years left. So that changes the savings number to $11,258 saved if you keep it until expiration.

Now for what you asked. Be prepared to have your mind blown! To match a $115pp sub you’d have buy a non sub at $24.64pp.

For fun I added if you paid 0.00 for non sub upfront. This really highlights how dues are whats most important over the life as opposed to price per point.

I am 100% pro AUL-S. But I will include the downside just to be fair. It would take about 8-10 years to breakeven on your initial upfront cost being $3200 more than a non sub. ($95pp vs $115pp)

View attachment 983460

Lastly a disclaimer for the people that will come at me. This doesn’t factor in dues increases. This doesn’t factor in if you took your initial $3200 more spent and invested it. This doesnt include if the world comes to end. It’s rough numbers that I used to help me make an informed decision when I was buying.

But the more important number is the $90 lower than non sub per point in order to make it worth it.!!!Yes. That $2.50pp is correct.

You went the circuitous route and basically ended up with the same answer as:

$10.12 - $7.61 = $2.51

Yep, game on!!Thank you both!

That changes everything … on with the search!

Truly not attacking, just wanted emphasize that the disclaimer about the time value of money is extremely important.Its really sad that we have to put a disclaimer because WE KNOW people are looking to attack at the first chance

Oh no wasnt talking about anyone in particular in this scenario, I am just talking about my own experiences where I feel like I need to be very careful and write "before someone comes at me" when giving advice/my opinion as some people (usually the same ones) like to pick it apart and/or get offended. Youre not one of themTruly not attacking, just wanted emphasize that the disclaimer about the time value of money is extremely important.

If a salesman tried to get you to invest in a bond that paid $2.50 per year for 36 years for $90, you'd be getting scammed. They'd effectively be saying 1) you don't deserve any financial return for letting them borrow your money for decades 2) a dollar in 36 years is worth exactly the same as a dollar today. So I would not use $90 valuation of the lower dues to feel good that AUL-S is a good deal.

The better way to view this is to discount each year of the $2.50 annual dues saved to get a single lump of present value in today's dollars. If you choose 4% as your discount rate (approximately what a typical high yield savings account pays) you get $47.27 or about half of the $90 with no discounting.

From that perspective, AUL-S you could pay up to ~$47 more for an AUL-S contract and break even. 6% brings it down to $36.55.

Either way, people are right to seek after these contracts since they typically go for less of a premium that my calculations above! In fact, the normal price spread implies a discount rate closer to what we'd see in the stock market.

Yep, totally get it. Just wanted to make sure my reply wasn't taken as being critical especially since a disclaimer was givenOh no wasnt talking about anyone in particular in this scenario, I am just talking about my own experiences where I feel like I need to be very careful and write "before someone comes at me" when giving advice/my opinion as some people (usually the same ones) like to pick it apart and/or get offended. Youre not one of them