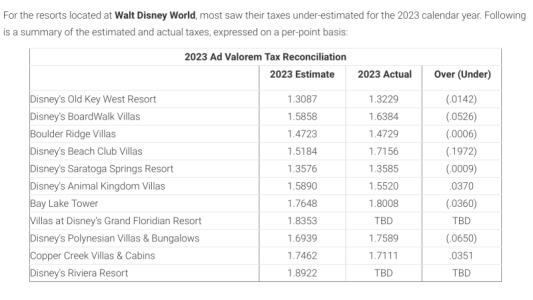

The Aulani debates generally revolve around the SAP issue (e.g., Aulani vs a WDW resort) or the subsidy issue (Aulani subsidized vs non-subsidized).

In regards to the first issue, a 50c per point difference in dues is just $100 savings on 200 points so 10c, 20c or even 50c per point on the dues are not going to make or break things, and 2024 is just a snapshot in time. Looking at the board sponsor's website (

https://www.dvcresalemarket.com/buying/annual-dues/), the growth rate in dues at BLT has historically been substantially higher than Aulani, so if things even out a bit in 2024 that's probably normal. Nobody should make a decision based on one year or one snapshot, and there are probably other factors that matter more. We bypassed that issue altogether by owning multiple resorts, so WDW availability is not an issue.

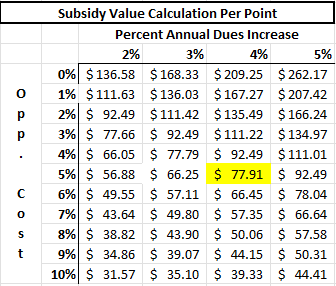

Regarding the Aulani subsidized vs. non-subsidized, large increases in dues, will make the subsidy more valuable. In fact, at 4% average annual dues increases and 5% opportunity cost the value of the subsidy is about $78/point as of 2024. This is not saying what a contract should sell at, but rather that if a non-subsidized contract sells for $X/point, paying up to $78/point more for the exact same contract (same # of points, and same stripped/loaded status) but with the subsidy would be financially justified. Obviously, larger unexpected dues increases may also reduce the resale values for both types of contracts. The subsidy value is higher (lower) if the percentage increase in annual dues is higher (lower), and the subsidy value is lower (higher) if your opportunity cost is higher (lower). Those are really the only two inputs you need to figure out the value of the subsidy, and it's easy enough to do a 2-dimensional sensitivity analysis:

View attachment 808196

. Hopefully not as decals

. Hopefully not as decals