Epcot Forever Forever

What I should have said was nothing.

- Joined

- Jul 2, 2021

- Messages

- 1,426

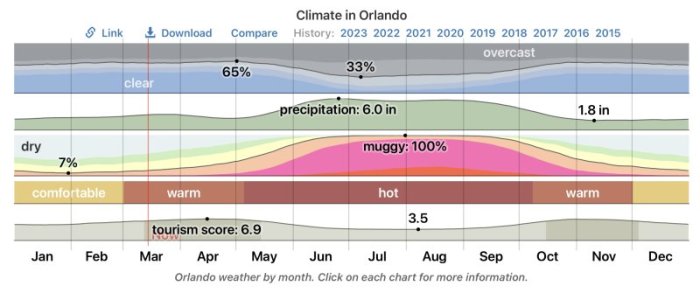

I did specifically call out Fall though in my 2BR example. A weird thing happened when they reshuffled the point charts where (outside of the holidays) fall has remained one of the less expensive times to book a room in cash but has become one of the more expensive times on points. It’s created a misalignment.Interesting. I've not hit the same answer, but haven't looked in a while.

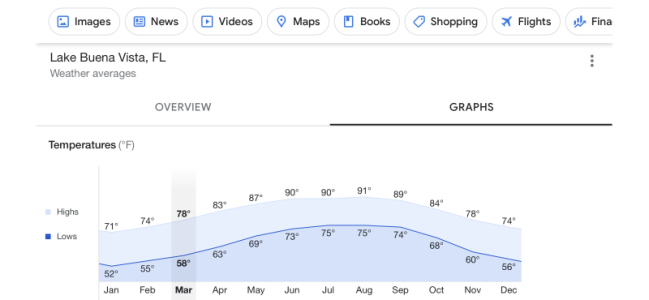

A Preferred 2BR at Riviera is 513 points during the Feb/Mar spring season (my usual time). At that level, points are $201/pp direct. Amortize that $103K over the 46 years remaining (rounding down) at, say 7%, the long-term after-tax rate of return of the SP500. That gives a first-year cost-of-capital of $14.66. Throw in dues of $8.50, and you get $23.16, or a cost of the room as $11,881.

That's not attractive vs. renting, but owning carries some benefits--not the least of which is that finding a single Riviera owner to rent you 500 points might be hard. Likewise, we are potentially in a trough for rental rates, as they've dropped quite a bit recently, arguably due to the macro environment. So, maybe not horrible and arguably within the bounds of uncertainty over the long run given historical fluctuations in rental-rate.

Comparing to Disney's rates, that room for my usual week (late Feb/early Mar) goes for rack of $15,589 all-in. Owning is roughly a 25% discount over that, and that's Disney's prevailing-rate discount in that time of year. So, again, about a wash, but owning gives you certainty without having to be subject to Disney's willingness to discount the specific room I want at the specific time I want.

So maybe one way of looking at owning is that you are locking in the "best case" prevailing-rate discount, and maybe within spitting distance of renting-from-an-owner, with more certainty than either of them. Given my perspective that the point of timeshares is not necessarily saving money, but is instead all about making vacations a priority, I think there's still a decent case to make for a direct purchase.

Of course, the resale case is better. Riviera at $140/pt with the same assumptions is $18.71pp in the first year, and now you're cooking with gas. You've locked in even the prevailing owner-rental rate (or close enough for rock and roll), and are north of 35% off of rack.

Then there's the argument that owning gets better over time, because the CoC contribution is fixed in current-year dollars, and only dues is subject to inflation vs. Disney's prevailing rental rate, all of which is inflationary. It's less clear that renting-from-an-owner grows at inflation, but even if it tracks cost of ownership instead, you're still close enough to a wash to ignore it.

So I think my take is: "Buying direct is not a terrible idea; buying resale is a good one."

And while I don’t think most people are doing the math in the detail you and I do, I think they have a sense of what is a good deal based on what they paid for their last room.

I prefer Oct/Nov and post-Easter April/May avoiding holidays.

I prefer Oct/Nov and post-Easter April/May avoiding holidays.