The high I saw was around 2700200 fewer compared to when?

There are currently over 2500 active listings. That's double March 2022. There may be a slight decrease compared to the beginning of the year but they are still at historically high levels. My point was that the market may be approaching a saturation point whereby contracts will just stagnate and stay listed or prices will have to come down further to stimulate more demand.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where is bottom?

- Thread starter Cfabar1

- Start date

Yes, some postings that are really lousy are starting to be yanked, which makes me think sellers are getting more realistic, and in some instances deciding to just hold their membership…

That could go one of two ways, and I’m not sure the sellers are going to enjoy holding the bag of where I think this is going….

As long as Disney stops ROFR, I think prices will continue to fall. The economy is weaker, and that will limit sales. Financing rates are going to go up. Additionally, more and more restricted resorts are going to start entering the pipeline if Disney continues to build new resorts. That will make ANY resale points less appealing, which will further depress their value.

I don’t see DVC going down to zero. A Disney Family Vacation is a right of passage, and the cash and rental rates will help prop up value much more than many other timeshares would. However, what I do see is something where the value more closely relates to x number of nights over y number of years and not an “asset” that grows in value as you spend down the points available every year.

That could go one of two ways, and I’m not sure the sellers are going to enjoy holding the bag of where I think this is going….

As long as Disney stops ROFR, I think prices will continue to fall. The economy is weaker, and that will limit sales. Financing rates are going to go up. Additionally, more and more restricted resorts are going to start entering the pipeline if Disney continues to build new resorts. That will make ANY resale points less appealing, which will further depress their value.

I don’t see DVC going down to zero. A Disney Family Vacation is a right of passage, and the cash and rental rates will help prop up value much more than many other timeshares would. However, what I do see is something where the value more closely relates to x number of nights over y number of years and not an “asset” that grows in value as you spend down the points available every year.

Genie+

You can never spend enough

- Joined

- May 12, 2022

- Messages

- 6,426

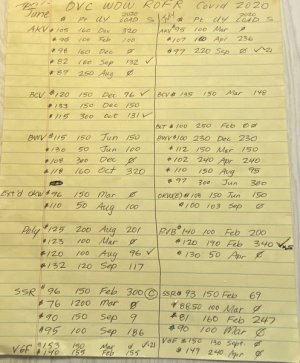

I was packing for WDW yesterday and came across this in my Disney Vault

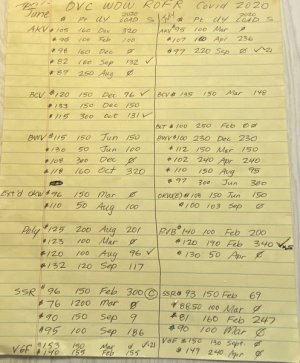

From the ROFR board summer 2020

The left side was Apr-June, right was July. Last column had checks if seller paid dues. Some even included paying ‘21 dues. C circled was seller paying closing. Some of the deals! VGF at $140. SSR 1200pts for $76. Poly $120! This was my cheet sheet for what was possible when making offers.

From the ROFR board summer 2020

The left side was Apr-June, right was July. Last column had checks if seller paid dues. Some even included paying ‘21 dues. C circled was seller paying closing. Some of the deals! VGF at $140. SSR 1200pts for $76. Poly $120! This was my cheet sheet for what was possible when making offers.

Genie+

You can never spend enough

- Joined

- May 12, 2022

- Messages

- 6,426

There’s likely some that decided to sell when the market went high but wanted to finish up that last trip or rental. By the time they were ready the landscape changed.Yes, some postings that are really lousy are starting to be yanked, which makes me think sellers are getting more realistic, and in some instances deciding to just hold their membership…

Over 400 listings sitting for at least 6 months. Much has changed since. Over 100 listings put up in the last 2 days.

Yes, or they realized they can no longer afford to sell. If they are still making payments they would likely have to bring cash to close. It changes the calculus from “I’d love to quit paying these maintenance fees” to “the maintenance fees are much more affordable than what I will have to pay to get rid of this turkey”.There’s likely some that decided to sell when the market went high but wanted to finish up that last trip or rental. By the time they were ready the landscape changed.

Over 400 listings sitting for at least 6 months. Much has changed since. Over 100 listings put up in the last 2 days.

Genie+

You can never spend enough

- Joined

- May 12, 2022

- Messages

- 6,426

Lol I wouldn’t exactly call it aYes, or they realized they can no longer afford to sell. If they are still making payments they would likely have to bring cash to close. It changes the calculus from “I’d love to quit paying these maintenance fees” to “the maintenance fees are much more affordable than what I will have to pay to get rid of this turkey”.

but it sure can be when no longer affording the parks with all the increases.

but it sure can be when no longer affording the parks with all the increases.Matty B13

DIS Veteran

- Joined

- Jun 13, 2016

- Messages

- 3,314

Yes, but if you can't afford to go to WDW or DL then you are stuck paying MF's for something you aren't using. You might be able to brake even with renting, but that is starting to fall apart as well.Yes, or they realized they can no longer afford to sell. If they are still making payments they would likely have to bring cash to close. It changes the calculus from “I’d love to quit paying these maintenance fees” to “the maintenance fees are much more affordable than what I will have to pay to get rid of this turkey”.

And if you own a 2042 Resort you're probably at the highest level you will able to sell your points right now, it will just get worse as we get closer to 2042, if this recession last 1 or 2 years, then it could be worse.

Also, yes prices have dropped from their ridiculous high prices over the past 2 years, but even today's prices are not that bad comparatively.

If anyone is interested...

Private sales of DVC points are up about 15% from November 2022 - February 2023, compared to the period of January - October 2022. I think it's reasonable to say that declining resale prices (combined with rising direct) have prompted SOME increase in buying volume. Though it's not dramatic. We're talking about an average of ~60k points per month over most of 2022 and now it's up around 70k.

The biggest change has been the lack of ROFR. ROFR helped take additional points off the resale market, often to the tune of 50-60k points per month. Now that ROFR activity is virtually nonexistent, it has slowed the process of turning-over those contracts.

On the supply side, it's clear the volume of listings has increased. Dating back to early 2022 when prices and ROFR were still healthy, more contracts were being listed. I doubt there's any one factor driving this, rather it's a combination of things like:

- Post-pandemic, people reevaluating frequency of visits to WDW

- Chapek

- Prices / policy changes at parks

- Selling one resort to buy another ('42 resorts, low initial VGF pricing, VDH looming)

- No annual passes

- Disney's politics

- State of Florida's politics

- Finances / economic concerns

I'm not convinced that any one of those factors is driving decisions above all others. It's just a bunch of different things influencing owners in different ways, all coming together to push listings higher than they had been in pre-pandemic 2018-19 when things were purring along.

Direct sales are modestly better in early March compared to February. But bear in mind these early March deed closings would have been contracted during the lackluster late-Feb direct incentives. The impact of better incentives + free luggage + Visa incentives probably won't be apparent until April sales numbers.

Private sales of DVC points are up about 15% from November 2022 - February 2023, compared to the period of January - October 2022. I think it's reasonable to say that declining resale prices (combined with rising direct) have prompted SOME increase in buying volume. Though it's not dramatic. We're talking about an average of ~60k points per month over most of 2022 and now it's up around 70k.

The biggest change has been the lack of ROFR. ROFR helped take additional points off the resale market, often to the tune of 50-60k points per month. Now that ROFR activity is virtually nonexistent, it has slowed the process of turning-over those contracts.

On the supply side, it's clear the volume of listings has increased. Dating back to early 2022 when prices and ROFR were still healthy, more contracts were being listed. I doubt there's any one factor driving this, rather it's a combination of things like:

- Post-pandemic, people reevaluating frequency of visits to WDW

- Chapek

- Prices / policy changes at parks

- Selling one resort to buy another ('42 resorts, low initial VGF pricing, VDH looming)

- No annual passes

- Disney's politics

- State of Florida's politics

- Finances / economic concerns

I'm not convinced that any one of those factors is driving decisions above all others. It's just a bunch of different things influencing owners in different ways, all coming together to push listings higher than they had been in pre-pandemic 2018-19 when things were purring along.

Direct sales are modestly better in early March compared to February. But bear in mind these early March deed closings would have been contracted during the lackluster late-Feb direct incentives. The impact of better incentives + free luggage + Visa incentives probably won't be apparent until April sales numbers.

Epcot Forever Forever

What I should have said was nothing.

- Joined

- Jul 2, 2021

- Messages

- 1,426

It peaked at the end of 2022/early Jan. Presumably there’s some seasonality there with the desire to avoid paying another year of dues.200 fewer compared to when?

There are currently over 2500 active listings. That's double March 2022. There may be a slight decrease compared to the beginning of the year but they are still at historically high levels. My point was that the market may be approaching a saturation point whereby contracts will just stagnate and stay listed or prices will have to come down further to stimulate more demand.

I’m marking 2000 as when to start paying attention to it as a trend. And 1000-1200 for when supply and demand stabilize to the point where prices stop falling.

KAT4DISNEY

Glad to be a test subject

- Joined

- Mar 17, 2008

- Messages

- 28,451

When you decide you aren't going to ROFR then it doesn't need to sit around going thru whatever dart throwing they otherwise would do.I don't know if it means we are nowhere near bottom, but my read is resale volume is slowing. Disney hasn't been buying back much if anything for a couple of months now...the only reason I can think of for the rapid ROFR turnaround times is that there are just less contracts in the queue for them to process.

Given the volume of contracts still listed for sale, I don't think that bodes well for sellers.

Agreed. But they clearly decided that a couple of months ago now. We've seen wait times for a response go from a (what was then considered "quick") 3 weeks to now ROFR response coming back in 6-10 (so quickly the title company's are holding closing docs because it's still within the rescission period). To me that means volumes must have decreased. I don't think ROFR responses have EVER been reported this quickly, even during past periods where Disney wasn't active.When you decide you aren't going to ROFR then it doesn't need to sit around going thru whatever dart throwing they otherwise would do.

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,848

Seasaonal variation is definitely a thing. We are moving into the time of year (spring/early summer) when the timeshare resale market is typically in the seller's favor, vs. the winter which is usually more of a buyer's market.

But, year-over-year comparisons are also pretty hard to make sense of because of pandemic knock-on effects.

Either way, there seem to be a lot of contracts these days.

But, year-over-year comparisons are also pretty hard to make sense of because of pandemic knock-on effects.

Either way, there seem to be a lot of contracts these days.

KAT4DISNEY

Glad to be a test subject

- Joined

- Mar 17, 2008

- Messages

- 28,451

It has though. I had one happen verbally in less than 24 hours back in 2011. Paper approval was 2-3 days. That also was the time they were not ROFRing anything and people were scooping up contracts. And that was the time when ROFR and Estoppel were simultaneous so closing happened right afterwards. I closed on that resale contract faster than a couple of direct contracts.Agreed. But they clearly decided that a couple of months ago now. We've seen wait times for a response go from a (what was then considered "quick") 3 weeks to now ROFR response coming back in 6-10 (so quickly the title company's are holding closing docs because it's still within the rescission period). To me that means volumes must have decreased. I don't think ROFR responses have EVER been reported this quickly, even during past periods where Disney wasn't active.

SL6827

DIS Legend

- Joined

- Apr 23, 2017

- Messages

- 11,405

AnnaKristoff2013

DIS Veteran

- Joined

- Apr 20, 2021

- Messages

- 3,364

This seems correct. I wonder how long until we start to see things like major resale brokers downsizing or going under.200 fewer compared to when?

There are currently over 2500 active listings. That's double March 2022. There may be a slight decrease compared to the beginning of the year but they are still at historically high levels. My point was that the market may be approaching a saturation point whereby contracts will just stagnate and stay listed or prices will have to come down further to stimulate more demand.

I think some of the big ones will stay but I do think they might not need as many people. Especially if sales slow. As prices fall sales might actually improve.This seems correct. I wonder how long until we start to see things like major resale brokers downsizing or going under.

DVC direct has priced itself so high right now it is really absurd that most families would even consider it. Especially with the 150 point buy in. That’s the best differentiator the resales can offer is small contracts. Second best differentiator they can offer is huge savings.

I think the brokers are trying to get creative and hold on, and trying to react to the market, but old habits die hard and I think they are not doing their clients any favors with listing at the prices they are offering. Before their prices felt moored in reality. Now, not so much.

Jimmy Geppetto

DIS Veteran

- Joined

- Sep 4, 2021

- Messages

- 1,143

I think some of the big ones will stay but I do think they might not need as many people. Especially if sales slow. As prices fall sales might actually improve.

DVC direct has priced itself so high right now it is really absurd that most families would even consider it. Especially with the 150 point buy in. That’s the best differentiator the resales can offer is small contracts. Second best differentiator they can offer is huge savings.

I think the brokers are trying to get creative and hold on, and trying to react to the market, but old habits die hard and I think they are not doing their clients any favors with listing at the prices they are offering. Before their prices felt moored in reality. Now, not so much.

I’m still waiting for the day where I meet a Realtor who passes on a listing because the potential clients want to list too high.

Realtors have fixed costs in every listing. Photos, listing fees, open houses etc.

DVC resale agents have minimal to no fixed costs. So there is no reason for them to not take the listing. All they do is gather the info and post it. They will hope the seller comes to terms with their advice after it’s been listed for a month without one offer or with multiple offers at 30+% off the list price.

Matty B13

DIS Veteran

- Joined

- Jun 13, 2016

- Messages

- 3,314

DVC will just reduce the minimum point requirement back to 50 or 100 points, I'm guessing this Fall for a new member. They can make it what ever they want.DVC direct has priced itself so high right now it is really absurd that most families would even consider it. Especially with the 150 point buy in. That’s the best differentiator the resales can offer is small contracts. Second best differentiator they can offer is huge savings.

That being said I think DVC is going to be hurting for the next couple of years. It seems like everyday there is something new about some bank and/or company that made a move that is falling apart now with the higher interest rates.

There was another thread discussing broker "customer service" and such, but related to this conversation I think many agents have been very lackadaisical both in customer service, but also in "working" for the market. I had a realization that a month ago I made some offers on contracts that were rejected (with or without a counter) as being much "too low"; there are now contracts listed with the same brokers for the same or less than my offer. Has anyone bothered to reach out to me to point this out? Nope. Tells me they have no system for tracking this and/or don't care. Seems like wasted sales prospecting. The whole model is focused on getting the listings and then sitting back and expecting the sales to come in on their own.

Of course, I know the market has moved on (greatly) in the past month and wouldn't pay what I offered a month ago....but would seem there is a real missed opportunity for some facilitation here.

Of course, I know the market has moved on (greatly) in the past month and wouldn't pay what I offered a month ago....but would seem there is a real missed opportunity for some facilitation here.

Last edited:

-

Have the Disney Parks Become Too Mainstream?

-

New Descendants/Zombies Worlds Collide: Concert Special

-

Disney Cruise Line Last-Minute Cruise Deals, Updated Weekly

-

Ever Visit Disney on a Holiday and Notice Something Extra?

-

New Disney Merch: Disney Parks Starbucks Tumblers + Easter Plushes!

-

See the 2026 Universal Mardi Gras Tribute Store and ALL the New Merch

-

Disney Wishables Adds New Shimmering 'Zootopia' Series

New Threads

- Replies

- 1

- Views

- 105

- Replies

- 4

- Views

- 244

New Posts

-

-

-

Lowest price per point including incentives Riviera has been sold for direct?

- Latest: DoubleBaconBLT

-

-

New Posts

- Replies

- 765

- Views

- 121K

- Replies

- 32

- Views

- 2K

- Sticky

- Replies

- 30

- Views

- 3K

- Replies

- 9K

- Views

- 865K

- Replies

- 1

- Views

- 105