eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 6,366

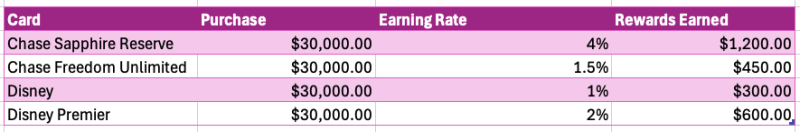

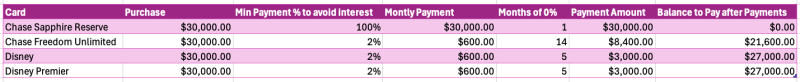

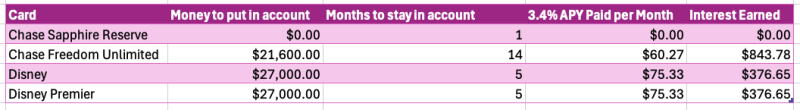

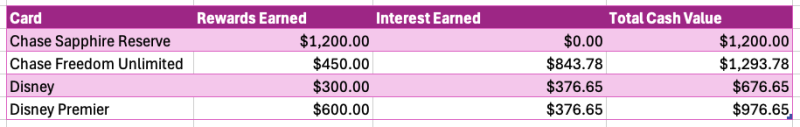

Since you do have a CSR and were wondering about the 0% I would go a slightly different route than @Brian Noble and open a CFU you would be earning less in CUR but they are transferable to your CSR and then you could keep the money in a money market / HYSA or CD with 15 months of growth.@Chili327

In my scenario I already have CSR and Disney Premier. AF are sunk cost for both.

I do, and that is the crux of the question. 0% financing for 6 months vs 4x UR points (disregard SUBs and AFs)?

What is the optimal use of this combo in a $30k 150 pt DVC purchase scenario (where I CSR is already my daily driver and DP is already my goto for DCL trips)?

TPG might put it in terms of cents per point? Whats the conversion to cents per dollar spent?

How do you factor in the time value of money in this scenario?

I suck at math and statistics so thanks in advance for my poorly worded question.

Of course rates will probably go down a little in that time so you would need to account for that as well unless you are locked in with a CD

Edit: fixed the autocorrect of done to down