Saw the thread about Expensive Financial Mistakes and wanted to post about my own (but not under my personal account, for semi-obvious reasons).

We decided to purchase our new home in the summer of 2022 after we sold our house in 2020 and tried to "wait out" the madness for over a year. We bought new construction in a wonderful development and are actually happy with our house. Here's the problem, though...

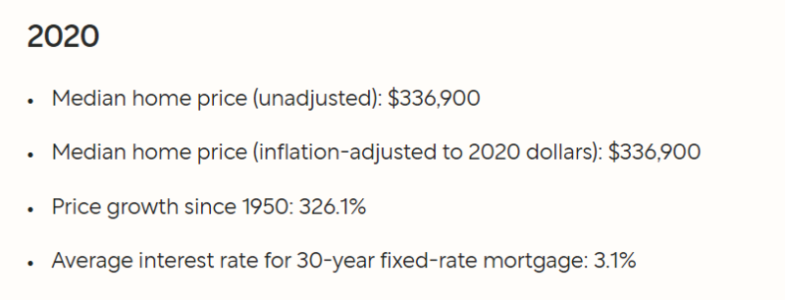

I've basically had to admit to ourselves that we probably bought at the top of the market, and even worse, our builder talked us into a 5-Year ARM, so we would have affordable payments. When our 5 years are up at 4.25% (in 2027), this loan will adjust to 8%, based on today's rates, which we actually can't afford. We could afford up to about 6% before we would be unable to afford the payments, based on my calculations. That also assumes that nothing (like our insurance) goes way up.

Ironically, one of my close neighbors, who is actually a CPA

, brought up to me that she bought her house on a temporary buydown from the builder. Her mortgage is temporary at a 3% rate, which will step up to 4%, 5%, and then 6% fixed rate after 3 years. She told me she had been confidently told that rates would come down before the 3 years were up, and she could refinance.

This conversation brought up a string of conversations at a recent pool party when I realized that more than a handful of my neighbors are in the exact same boat. Some of them took out 3-Year Loans that will Adjust. Some took the buydown with the intention of refinancing, and some are just planning to sell their house before the 3 or 5 years are up. Apparently, a lot of us took the special financing deal from our builder, not realizing how most of us are screwed if ideal scenarios do not work out.

I am now thinking to myself, with a lot of confidence, that impending doom is upon me. I also personally believe that the housing boom is mostly over. And lastly, I cannot get over the fact that so many people (including me) could have been so foolish in our decision-making. It doesn't seem like any of us thought too far ahead into the future.

So... that's me. I am in a brand new subdivision of almost 130 homes, and I am seriously convinced we will eventually lose most of our down payment now. Definitely an example of a financial mistake.

The real question is, though - how many more people like me and our neighborhood are out there? Are there hundreds or thousands of us? Tens of thousands? I wonder now.