We bought our home in 1997 (thank goodness) for $180,000, it’s now assessed at over $550,000, and 1500 square feet. It’s over 100 years old on a 60 x 110 lot. Nothing fancy like a/c, garage, has 1 1/2 tiny bathrooms. New construction here means a tear down, so those are closer to a million (homes on larger lots mean 2 houses go in). Another issue building bigger homes here are the taxes, I have friends paying over $20,000 a year. During the last reassessment friends built a wall over an illegally built bathroom. Bigger isn’t always better.This isn’t a competition. Early 80s mortgage rates were 16- 18%. Home prices were proportional at the time. The houses being built now are way more extravagant than houses that were built in the 70s & 80s. Homes were about 1800 -2200 sq feet. A lot of rising home costs have to do with the size & amenities buyers started demanding. And buyers being willing to over pay. Coz I bet there are homes in your area that don’t cost 750K. But a lot of people now are conditioned to building with all the newest trends & don’t want to buy smaller less extravagant homes. When rates were 18%, it wasn’t that people didn’t want to buy, people couldn’t buy. Any house, let alone a new build. Think it’s hard to get a mortgage today, try getting one when it’s 18%.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Was Anyone Else As Stupid As Us (and probably 1/2 of my neighbors)

- Thread starter SomewhereNotAtWDW

- Start date

Buzzsgramma

DIS Veteran

- Joined

- Oct 3, 2000

- Messages

- 1,080

Can you improve your income and cut back to save for the impending raise or high rates....so you could afford the payments...? MAybe rates will come down but with the crazy people running the Fed who knows....just a thought....

matt_in_nh

Mouseketeer

- Joined

- Jun 18, 2023

- Messages

- 233

At least you have time to plan I guess. I have always found the difference between Fixed and ARMS to not justify going ARM.

PrincessDadx2

Openly has the hots for Wuv Tigger

- Joined

- Aug 24, 2004

- Messages

- 637

Have not read the whole thread, but check your loan documents. Most ARM loans have an adjustment cap, so the rate will not increase all the way to the index + margin, but will be limited to 2% or 3%. I would be surprised if it jumped from 4.5% to 8%, the bank does not want you to fail either. Otherwise, enjoy the below market rate for the rest of the 5 years and try not to stress. No one knows what the rate will be years in the future. If you are worried about it then save money now and make a prepayment prior to your adjustment to lower the payment. Currently you are paying 2% less than market and my money market makes over 4.5%, so there is the option to improve going forward.

gottalovepluto

DIS Legend

- Joined

- Jul 14, 2014

- Messages

- 23,630

“It’s different this time!”I'm sure there are millions of home buyers across the US in the same boat. A lot of this went on back in the early 2000s and then the crash came. I'm surprised people still do ARM's, but then may I shouldn't be.

Hope it all works out.

Narrator: It wasn’t

DCLMP

DIS Veteran

- Joined

- Jun 28, 2020

- Messages

- 6,745

LOL. Different problems, but human nature doesn’t change. I work with a lot of twenty something’s with good paying jobs. Do you think the spent the last three years of deferred student loan payments saving up to pay off their student loans….heck no.“It’s different this time!”

Narrator: It wasn’t

We live in a debt-based economy and that’s how we’re all conditioned. It’s all about the monthly payment.

Ive made some good and good financial decisions over the years. There is always a learning curve.

If he sells than what? You need a place to live. Rent is high, housing prices are high and interest rates are high.

It’s hard to say what the future hold in terms of interest rates. We have a commercial real estate crisis coming, more liquidity issues, and probably more food Inflation due to shortages.I think I would get a second job or increase my income somehow.

DCLMP

DIS Veteran

- Joined

- Jun 28, 2020

- Messages

- 6,745

That’s what I was thinking. Theres got to be things they can cut. I can think of quite a few things I could cut out if it came down to be able to afford food and shelter.Can you improve your income and cut back to save for the impending raise or high rates....so you could afford the payments...? MAybe rates will come down but with the crazy people running the Fed who knows....just a thought....

gottalovepluto

DIS Legend

- Joined

- Jul 14, 2014

- Messages

- 23,630

They can afford food & shelter- they just can’t afford this fancy of a shelter if rates don’t drop. Hella hard to cut your expenses by $30k/yr (what they estimate they will be short). So then it becomes do you downgrade the shelter or get the second job? Second job means you can afford the shelter but you’ll be missing out on a lot of your children’s lives. I don’t envy them their path ahead.That’s what I was thinking. Theres got to be things they can cut. I can think of quite a few things I could cut out if it came down to be able to afford food and shelter.

DCLMP

DIS Veteran

- Joined

- Jun 28, 2020

- Messages

- 6,745

Dang I missed the 30k part. I guess it depends on what you spend on your disposable income. There are many posters on here who spend a good chunk of change traveling every year, but it doesn't sound like they are in that boat. Downgrading sounds reasonable if they can sell their house and find something else, but they'll still be at a high-interest rate. It's possible by 2027 rates could be higher than 8% or they could be much lower. It's a ways off.They can afford food & shelter- they just can’t afford this fancy of a shelter if rates don’t drop. Hella hard to cut your expenses by $30k/yr (what they estimate they will be short). So then it becomes do you downgrade the shelter or get the second job? Second job means you can afford the shelter but you’ll be missing out on a lot of your children’s lives. I don’t envy them their path ahead.

MimitoAlex

Mouseketeer

- Joined

- Feb 6, 2023

- Messages

- 183

I've never understood buying big ticket boats, trailers, etc... You can always rent these things and then you're not tied to a monthly payment, registration, and parking. From what I've seen most people use these expensive toys rarely and I doubt they really think through the per day cost when they are using it. For the gas and space rent I could take a cruise or stay in a hotel near or in a national park and have someone else make my bed and cook for me.

The contractor thing is horrible! Anyway they can find other jobs? The SE tax will be a killer and their retirement will be tanked. Even a lesser paying job with benefits would be an improvement.

With my friends an becoming contractors, I really think that they did not think the whole thing out apparently. I think that they just thought okay I can work from home. She told me that they did not look at the whole covid thing coming to an end. Nor did they think, that becoming a contractor would work against them. She said they loved, not spending for lunch, or gas in the car, or not having to make the commute each day. They could walk the dogs, and go to the gym, or beach. They created this bubble around them... and just had this false sense of security. Which now that bubble has burst.

As far as the truck and 5th wheel, This was something that they had planned for, but in stages not all at once. They do use it alot, camping, mountain biking, hiking, fishing, camping on the beach is their favorite thing ever... they just love it, it's really their jam.

I spoke with her yesterday, and she is looking for a different job, one with benefits she has had several interviews, the problem is that she wants to work from home, and companies are not offering benefits for these type of positions that are in her field. She has an in person interview today this is the 3rd interview with this company, and the pay and benefits are rock star, but it is a position where she will have to go to the office 3 times a week.

I'm keeping my fingers crossed for her.

Anthony1971

DIS Veteran

- Joined

- Mar 11, 2005

- Messages

- 3,848

First off yes interest rates play a HUGE role in the actual cost of a house but 20-30K more sounds a bit high. Yes in the first years of your mortgage you are mostly paying interest on the payments so you can use excel (there are a lot of missing numbers) using the formula for an annuity and see what your principle will be in 2027 -start with when you bought the house until the end date. After you have this number you can start playing with the rates to see what your actual payments will be. From there you can come up with a plan like paying as much as you can towards principle now, selling, refinance now and other options.

DCLMP

DIS Veteran

- Joined

- Jun 28, 2020

- Messages

- 6,745

They would have to have a really huge loan amount for that type of increase.First off yes interest rates play a HUGE role in the actual cost of a house but 20-30K more sounds a bit high. Yes in the first years of your mortgage you are mostly paying interest on the payments so you can use excel (there are a lot of missing numbers) using the formula for an annuity and see what your principle will be in 2027 -start with when you bought the house until the end date. After you have this number you can start playing with the rates to see what your actual payments will be. From there you can come up with a plan like paying as much as you can towards principle now, selling, refinance now and other options.

Anthony1971

DIS Veteran

- Joined

- Mar 11, 2005

- Messages

- 3,848

There are many problems with using this:According to stats I could find the average price of a house has increased 326.1% (as of 2020 numbers so you know it's even higher in 2023) since 1950s

View attachment 766281

View attachment 766282

View attachment 766283

View attachment 766284

View attachment 766287

View attachment 766289

View attachment 766290

View attachment 766291

1) please take the average SQ footage of a house for each decade use the price per SQ foot

2) When you take into consideration interest rates as the exact example of this conversation a 4% can increase can double your payments much less the 12-15% decrease in rates as you will find through the decades.

3) salaries.

So here is real life My parents paid 25K for a whopping 800 sq foot house about 1970 one bath room 3 bedrooms and that is where my parents lived and me and my brother lived - unheard of by 2020 standards. I can not comment on salaries being I was just born and did not care until I did--but vacations were a stay at a relatives house and trip to a local amusement park (one day) think Dorney park or Hershey park and this was once a year period. Going out to dinner yeah Arthur Threachers was a big deal lets not get started on how big Sizzler was back then.

I can comment on the 80s My wife has a MASTERS degree and her first job in 1995 paid 17.5K and that was a great starting salary. I worked and went to college later I did ok as a retail store manager 6 days a week minimum of 50 hours although I do not recall the salary because I spent a lot still living at home (great times BTW) however in 1998 with an accounting degree my starting salary which was also very good (remember I had strong work experience) was 27K. I bought a condo that I had to save for 69K If I recall it was 670 sq feet. With my Maint I was paying over 1300 a month still had electric on top of this plus laundry as this was extra and a perking space that was 50.00 a month Bus/Train to get to work. that is with making 2,250 a month before taxes...... Got married in 2002 bought a house in 2004 I will leave out these details as the numbers continue... Point is things were just not easy EVER. Dont make the mistake of saying today a house cost... I said 2004 I bought a house walked into a 3 BR one bath 1,200 sq foot house in house where I wanted to live 3 houses in from major highway that needed a few repairs like a very small amount of ceiling damage from a previous leak with a 680K price tag when I asked about if that would repaired I was asked if I know I was in X area. So WE DECIDED to look and move to a very less nice desirable far less convenient area with far more reasonable prices after looking for well over a year. Still a choice these days..... I have great stories from folding tables set up front with a person asking if you want to make an offer as you left to a 2 bath room houses when asked where the second bathroom was you were directed downstairs where you found a bowl bolted to a drain in the middle of an unfinished basement. Sink HA... On a good side I could have peed as I stood there putting the laundry in the machine.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

- Messages

- 30,614

There are many problems with using this:

1) please take the average SQ footage of a house for each decade use the price per SQ foot

2) When you take into consideration interest rates as the exact example of this conversation a 4% can increase can double your payments much less the 12-15% decrease in rates as you will find through the decades.

3) salaries.

So here is real life My parents paid 25K for a whopping 800 sq foot house about 1970 one bath room 3 bedrooms and that is where my parents lived and me and my brother lived - unheard of by 2020 standards. I can not comment on salaries being I was just born and did not care until I did--but vacations were a stay at a relatives house and trip to a local amusement park (one day) think Dorney park or Hershey park and this was once a year period. Going out to dinner yeah Arthur Threachers was a big deal lets not get started on how big Sizzler was back then.

I can comment on the 80s My wife has a MASTERS degree and her first job in 1995 paid 17.5K and that was a great starting salary. I worked and went to college later I did ok as a retail store manager 6 days a week minimum of 50 hours although I do not recall the salary because I spent a lot still living at home (great times BTW) however in 1998 with an accounting degree my starting salary which was also very good (remember I had strong work experience) was 27K. I bought a condo that I had to save for 69K If I recall it was 670 sq feet. With my Maint I was paying over 1300 a month still had electric on top of this plus laundry as this was extra and a perking space that was 50.00 a month Bus/Train to get to work. that is with making 2,250 a month before taxes...... Got married in 2002 bought a house in 2004 I will leave out these details as the numbers continue... Point is things were just not easy EVER. Dont make the mistake of saying today a house cost... I said 2004 I bought a house walked into a 3 BR one bath 1,200 sq foot house in house where I wanted to live 3 houses in from major highway that needed a few repairs like a very small amount of ceiling damage from a previous leak with a 680K price tag when I asked about if that would repaired I was asked if I know I was in X area. So WE DECIDED to look and move to a very less nice desirable far less convenient area with far more reasonable prices after looking for well over a year. Still a choice these days..... I have great stories from folding tables set up front with a person asking if you want to make an offer as you left to a 2 bath room houses when asked where the second bathroom was you were directed downstairs where you found a bowl bolted to a drain in the middle of an unfinished basement. Sink HA... On a good side I could have peed as I stood there putting the laundry in the machine.

Yes this is mentioning 1980 and people were talking about later on with the recession but it's just meant to reflect the very different realities of back then to now.

It's been a bit since that comment so in all honesty I did not actually fully read yours (no disrespect meant). It's fairly well known about the housing market and incomes of today as well as prices of goods today. There's just too many articles out there over time to discuss this aspect. Square footage doesn't account for the fact that my husband's grandmother's place built in 1950s as a tiny house now can be sold for over $300K (this is just as of last week with comps pulled as they were looking to potentially sell). That price point for that area for that house is absolutely ludacris. Truly. It also has knob and tube wiring, etc. Many things are original as once you open a wall the whole house has to be brought up to code. Just nutty. And they would pay higher property tax in proportion to us. I digress but you get the picture.

Robbie Cottam

DIS Veteran

- Joined

- Jun 15, 2015

- Messages

- 2,689

without trying to blame anyone, this is kinda the thinking that caused the 2006 / 2008 housing crash....

Maybe not to the same extent, but salesmen get paid to sell. Their responsibility is to their broker, our in this case themselves.

I can only assume in the next 5 years something will crash and interest rates might be one of them.

Maybe not to the same extent, but salesmen get paid to sell. Their responsibility is to their broker, our in this case themselves.

I can only assume in the next 5 years something will crash and interest rates might be one of them.

View attachment 769842

Yes this is mentioning 1980 and people were talking about later on with the recession but it's just meant to reflect the very different realities of back then to now.

It's been a bit since that comment so in all honesty I did not actually fully read yours (no disrespect meant). It's fairly well known about the housing market and incomes of today as well as prices of goods today. There's just too many articles out there over time to discuss this aspect. Square footage doesn't account for the fact that my husband's grandmother's place built in 1950s as a tiny house now can be sold for over $300K (this is just as of last week with comps pulled as they were looking to potentially sell). That price point for that area for that house is absolutely ludacris. Truly. It also has knob and tube wiring, etc. Many things are original as once you open a wall the whole house has to be brought up to code. Just nutty. And they would pay higher property tax in proportion to us. I digress but you get the picture.

gotta say-i saw this meme recently on facebook and all i could think was how i NEVER managed as a grocery shopping adult in 1980 to fill my shopping cart to that extent for $20 and how the median home prices where i was living (not new-existing 20 plus year old track homes) were at or above 50K.

the woman portrayed in the meme must have been a PHENOMINAL shopper as well as a long term homeowner.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

- Messages

- 30,614

It's not meant to be explicitly accurate as if you're always shopping for $20 or everyone's house was $15k lol, memes aren't like that.gotta say-i saw this meme recently on facebook and all i could think was how i NEVER managed as a grocery shopping adult in 1980 to fill my shopping cart to that extent for $20 and how the median home prices where i was living (not new-existing 20 plus year old track homes) were at or above 50K.

the woman portrayed in the meme must have been a PHENOMINAL shopper as well as a long term homeowner.

But you're proving the point about the topic, a deliberate misunderstanding of the message. Or maybe it's not deliberate on your part but certainly a misunderstanding of the message.

It's not meant to be explicitly accurate as if you're always shopping for $20 or everyone's house was $15k lol, memes aren't like that.

But you're proving the point about the topic, a deliberate misunderstanding of the message. Or maybe it's not deliberate on your part but certainly a misunderstanding of the message.

i get the message/am not misunderstanding either deliberately or otherwise. i am making a comment on my original personal reaction to the meme and how, based on my own memories and experiences, what it shows does not match what it attempts to exemplify.

nothing more, nothing less.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

- Messages

- 30,614

Forgive me here but actually seriously thinking about how it didn't cost $20 for you nor were houses exactly $15K back then in your area is misunderstanding the message. It would be the same message if it said $50 on groceries and $50K on houses. So yes if your thought is "must have been a PHENOMINAL shopper" and "how the median home prices where i was living (not new-existing 20 plus year old track homes) were at or above 50K." you've missed the message in an unfortunate way. Memes aren't meant to be taken for the exact figures.i get the message/am not misunderstanding either deliberately or otherwise. i am making a comment on my original personal reaction to the meme and how, based on my own memories and experiences, what it shows does not match what it attempts to exemplify.

nothing more, nothing less.

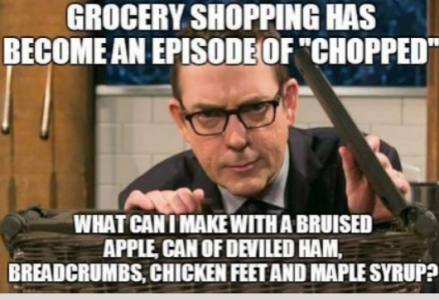

Take this meme for example way back in the early days of the pandemic

It's not intended to mean people are actually making dinners with this stuff but rather to reflect the scarcity of staple products and the unusualness of what was left for people to make meals from. The housing meme isn't about looking at the numbers and saying "well that wasn't the case for me" it's about the larger picture regarding costs of goods and housing over time.

I'm sorry I shared the meme even as apt as it was as it wasn't intended to get into this type of discussion over it

-

Disney's 'Zootopia 2' Sets New Global Box Office Records

-

Pre-Order These Adorable New Disney Stocking Stuffers

-

Why I Believe We Are FINALLY Entering the Post-Chapek Era of Disney Imagineering

-

The Perfect Gift for a Loved One's Disney Vacation

-

Is Jock Lindsay's Hangar Bar at Disney World the Most Festive of Them All?

-

Are the Holiday Weekends in Disney Parks Overrated?

-

What You've Missed This Week in NEW Disney Pins

New Threads

- Replies

- 0

- Views

- 96

- Replies

- 0

- Views

- 309

Receive up to $1,000 in Onboard Credit and a Gift Basket!

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

New Posts

- Replies

- 2

- Views

- 492

- Replies

- 48

- Views

- 13K

- Replies

- 61K

- Views

- 2M

- Replies

- 20

- Views

- 3K

- Replies

- 9K

- Views

- 1M

- Replies

- 18

- Views

- 3K

- Replies

- 2

- Views

- 304