wrigleyville

Earning My Ears

- Joined

- Jul 6, 2011

- Messages

- 24

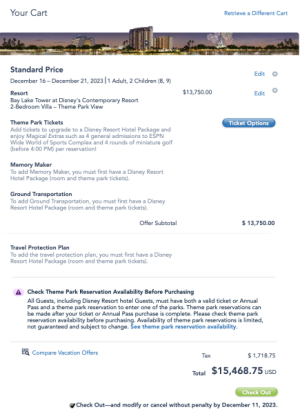

TLDR: DVC points can save more then 82% off room costs for a 2-bdrm villa.

I thought folks might appreciate this real-world example of DVC point values/savings. I just rented my points through our favorite rental store and decided to look up the same reservation on Disney's booking site to see what it would cost to book with cash. Then I compared that price against my tracking spreadsheet, which calculates my real cost per point for each year (calculation explained below)...and the savings are staggering, The actual cost of the reservation to me is 17.9% of the cost of booking the exact same room and dates direct from Disney. Here is the breakdown...

Reservation Details

* Annual DVC cost per point is based on purchase price of points amortized over life of contract plus 2023 Maintenance Fee per point for BLT:

I thought folks might appreciate this real-world example of DVC point values/savings. I just rented my points through our favorite rental store and decided to look up the same reservation on Disney's booking site to see what it would cost to book with cash. Then I compared that price against my tracking spreadsheet, which calculates my real cost per point for each year (calculation explained below)...and the savings are staggering, The actual cost of the reservation to me is 17.9% of the cost of booking the exact same room and dates direct from Disney. Here is the breakdown...

Reservation Details

- Bay Lake Tower

- 2-bedroom Villa

- Theme Park View

- 12/16 - 12/21/2023

- $13,750 plus $1,718.75 taxes =

- $15,468.75 TOTAL

- 294 points x $9.45/point* =

- $2,776.98 TOTAL

- $15,468.75 - 2,776.98 =

- $12,691.77 TOTAL

- 82.04% DISCOUNT

* Annual DVC cost per point is based on purchase price of points amortized over life of contract plus 2023 Maintenance Fee per point for BLT:

- $101/point purchase price (did not finance and bought direct from Disney when first offered with incentives)

- divided by 50 years of contract =

- $2.02/point annual cost

- + $7.43/point Maintenance Fee assessment for 2023 =

- $9.45 Annual DVC Cost per Point

- Note: cost per year does not adjust for inflation or equity value of contract, which makes eventually realized annual cost even lower per year.