Welcome! I'll give you the Ramsey plan for the first four steps below, but here's some ground rules when following the Baby Steps:

1)

Keep making a budget. Plan every dollar, every month to see where you can make sacrifices.

2)

No more use of debt. Stop adding to credit cards and don't take out new loans.

3)

Pause retirement investing. This is temporary until you are past Baby Step 3. If getting out of debt will take more than a couple of years, then you need more income.

Step 1: Save $1000 in the bank as a starter emergency fund. This money is only for emergencies that answer the questions, "Is it unexpected, is it necessary, and is it urgent?" Pay minimums on all debts until this amount is saved.

Step 2: Use the snowball method to pay off all non-mortgage debts. List all debts in order of smallest balance to largest. Pay minimums on all debts. For the smallest debt, you will also add any extra money to this debt until it is paid off. Then, repeat the process on the remaining debts.

Step 3: Save 3-6 months of expenses in a fully funded emergency fund.

Step 4: Contribute 15% of gross household income into retirement accounts.

----------------------------------------------------------------------------

There are a bunch of debt calculators online, but here is the Ramsey one:

https://www.ramseysolutions.com/debt/debt-calculator.

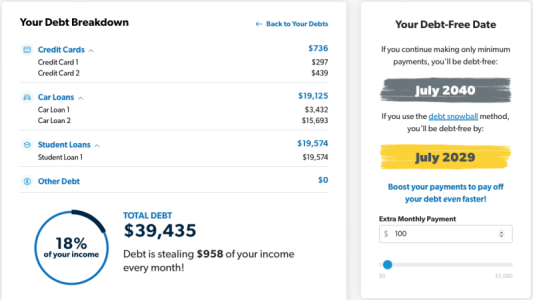

Quickly putting your debts into the calculator gives the following information:

1) Only paying the minimum amount will take about 15 years to pay off all your debt. You would be 65 years old.

2) Adding $100 a month to your minimum payment will take about 4 years to pay off all your debt. You would be 54 years old.

The choice is yours. It would be far preferable to work multiple jobs at 50 years old, than 80 years old.

I highly suggest getting an extra job at a place you already shop and could get an employee discount

I highly suggest getting an extra job at a place you already shop and could get an employee discount (i.e., supermarket,

Walmart, etc.). This would give you income, plus the discount would help your money go farther.

View attachment 1002554

I highly suggest getting an extra job at a place you already shop and could get an employee discount (i.e., supermarket,

I highly suggest getting an extra job at a place you already shop and could get an employee discount (i.e., supermarket,