Just a substantial chunk. To not be accruing interest during that time has saved them a great deal of money.Outstanding! Congratulations!

As much as she did are they free of it or just took out a big chunk of it? To be a Dr now can run into a quarter of a million in loans easy. So much discipline is demanded at every turn, being a Dr is truly a labor of love now.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Student loan payoff strategy - check out the new SAVE plan & Fresh Start - WEBINAR LINK ADDED 9/15

- Thread starter LuvOrlando

- Start date

She and her DH are extremely fortunate. They married young (22), both have lucrative careers, were able to buy a home (at a 2.65% interest rate) and have been saving for retirement. They just had their first child in March and now have a daycare expense. They've cut down on the retirement savings a bit in order to continue hacking away at her student loans.

Not everyone has been that lucky. Yes, they worked hard. Some people simply needed that money to live on.

I wish the government would at least cut the interest payments in half. That would save people a lot of money.

Oh....they're set up for a fabulous life. I agree with you...the interest rates are too high. I think that community college should be free, state colleges should be far less expensive than they are to give everyone the option for a reasonable education. And then I believe that the ridiculous tuitions that private colleges can charge would fall substantially.

I'm 55 and nearing retirement...listen to all sorts of cool podcasts. And even though my DH and I aren't "white coat" professionals like your daughter, we are higher income earners (he's a software architect and I'm a small business owner). A cool podcast they might enjoy, specifically to help with retirement planning/saving and motivation is The White Coat Investor....started by a Doc back in 2011.

He's great with strategic planning for higher income medical professionals (and really any high income earner). And they have inspiring episodes where different Docs, Dentists, Nurses...etc, call in with their net worth stories....some are incredible! Many docs/dentists have such a long education, then residency with a decent but not high income, that when they start making big bucks, they splurge and actually fall behind with respect to retirement savings. Your daughter is ahead of the curve!

Thank you the recommendation. I will certainly pass it along!

I think it's still tough on women (regardless of the profession). Even with husbands that are significantly involved with childcare, the balancing/juggling act still falls on women.

Affordable/high quality childcare at every income level is another issue that needs to be addressed. What a difference that would make!

I think it's still tough on women (regardless of the profession). Even with husbands that are significantly involved with childcare, the balancing/juggling act still falls on women.

Affordable/high quality childcare at every income level is another issue that needs to be addressed. What a difference that would make!

tinkerbellandpeterpan

DIS Veteran

- Joined

- Aug 1, 2021

- Messages

- 1,369

I think affordable high quality child care is such a difficult issue. To make it "affordable" the day care provider is paid significantly less than high income earners. I say this as someone with a JD degree who actually does childcare once a week for a friend because she couldn't find a place to do it once a week at a reasonable rate. To expect high quality care at cheap prices is rough. As a childfree couple I have very mixed feelings about this because I'm already paying for school taxes (which I have no problem with as a product of public school) but why should I have to subsidize someone else's decision to have children in terms of their daycare. To make it any cheaper I'm going to pay more. People want cheaper daycare but then there is the whole argument that daycare workers should make a living wage. It's really a tricky situation and I have no answers.Thank you the recommendation. I will certainly pass it along!

I think it's still tough on women (regardless of the profession). Even with husbands that are significantly involved with childcare, the balancing/juggling act still falls on women.

Affordable/high quality childcare at every income level is another issue that needs to be addressed. What a difference that would make!

Back to topic, I pay almost $600 a month in student loans and it is literally killing my family financially. I understand I took these loans and I've paid faithfully. Nothing I pay takes anything of meaning off the principal. I'll be long dead and these loans will still be here. I'm praying I'll qualify for something because of my salary. There are many days I think about just not paying anymore and letting the cards fall where they may.

leebee

DIS Legend

- Joined

- Sep 14, 1999

- Messages

- 14,316

I don't understand all of the SAVE program benefits. DD has 4 subsidized undergrad loans (all at interest rates of <5%) and two unsubsidized grad loans (interest rates of 6.XX%). She has been paying on the undergrad loans from 2015 to now, except for the covid pause. I am not sure how SAVE would help her. It's my understanding that you don't qualify for the program unless you have already made 20 years of payments, and also that you have to consolidate your loans. Any idea what the new interest rate would be if the loans are consolidated? Of course, there is the added complication of her husband's loans, I guess. She does NOT want to become responsible for his ed debt and is worried that if they both sign up for SAVE, she will be on the hook for his loan repayment, too (and his loans are a mess, serviced by Navient). I tend to be very conservative in my view about school loans: Don't borrow too much, and pay them off on the standard repayment plans in 10 years. I don't want her to pay more than she should have to and would like to see her save some $$, but I don't know. It seems like stretching out the loan repayment period would only cost more money in the long run.

Back to topic, I pay almost $600 a month in student loans and it is literally killing my family financially. I understand I took these loans and I've paid faithfully. Nothing I pay takes anything of meaning off the principal. I'll be long dead and these loans will still be here. I'm praying I'll qualify for something because of my salary. There are many days I think about just not paying anymore and letting the cards fall where they may.

LuvOrlando mentioned the SAVE plan, which reads like it's designed to help someone in your situation exactly. As long as you qualify income-wise, it doesn't allow the interest rate to keep you trapped in forever having to pay your loans. I'm sure it's super frustrating, but not paying just lands you in another less enjoyable pot of hot water. It can eventually lead to wage garnishment. I hope you can find a program that helps!

Thank you the recommendation. I will certainly pass it along!

I think it's still tough on women (regardless of the profession). Even with husbands that are significantly involved with childcare, the balancing/juggling act still falls on women.

Affordable/high quality childcare at every income level is another issue that needs to be addressed. What a difference that would make!

Oh yes, childcare is a huge issues for working Moms. The "big things" in life are also just really expensive and have significantly outpaced inflation, well before our recent bout of higher inflation....childcare, healthcare, housing and education.

HeatherC

Alas...these people I live with ...

- Joined

- May 23, 2003

- Messages

- 7,486

My daughter graduated last Dec with 20k in loans. She still has not been able to determine what her payments will be. When you log on, it shows the loans and interest but absolutely no payment amount. It says you can “pay here” but gives no amount. It is so frustrating and we may just pay them off and have her make some payments to us and call it a day.

Her payments can’t be much and we wanted her to just have some “skin in the game” so to speak. The entire loan program is such a nightmare that I think it would be better if we help her get out of it asap.

I have also been hearing stories of people’s payments going up under the SAVE plan. So buyer beware is all I can say. It is all a ..it show.

Her payments can’t be much and we wanted her to just have some “skin in the game” so to speak. The entire loan program is such a nightmare that I think it would be better if we help her get out of it asap.

I have also been hearing stories of people’s payments going up under the SAVE plan. So buyer beware is all I can say. It is all a ..it show.

happybaker

Mouseketeer

- Joined

- Mar 21, 2012

- Messages

- 306

We had five loans for my stepkids. I paid one off last week. We will now throw extra money at the next lowest one and work them that way (I like the snowball method). We should have another one paid off in the next few months.

Like Leebee, I looked at the SAVE program and didn't really understand it. I didnt really want to consolidate the loans. And it looked like in the end it would cost us a ton more over time.

Like Leebee, I looked at the SAVE program and didn't really understand it. I didnt really want to consolidate the loans. And it looked like in the end it would cost us a ton more over time.

LuvOrlando

DIS Legend

- Joined

- Jun 8, 2006

- Messages

- 21,461

I have over $200K. I will qualify for PSLF in a few years, so I will be (and have been) paying the minimum until then. Which will be around $450/month on SAVE. Easily manageable for me.

I read that the pause was made to great use by revamping the parts of the process that were most broken so there are now some changes in lenders & changes in the process. I think this includes some much needed corrections in loan forgiveness programs, hopefully to your benefit. Keep going, good luck.

LuvOrlando

DIS Legend

- Joined

- Jun 8, 2006

- Messages

- 21,461

There will be a helpful webinar about SAVE soon, I am resharing below:

You can sign up at studentaid.gov/SAVE. The Education Department is hosting a free webinar on Sept. 14 from 7 p.m. to 8 p.m. Eastern time. There will be an opportunity to ask questions. Go to Eventbrite.com and search for “Repayment 101: Get Help with Your Federal Student Loans.”

This offers some more insight, but I would totally listen to the webinar in addition to research before making any moves.

https://studentaid.gov/manage-loans/repayment/plans/income-driven/questions

You can sign up at studentaid.gov/SAVE. The Education Department is hosting a free webinar on Sept. 14 from 7 p.m. to 8 p.m. Eastern time. There will be an opportunity to ask questions. Go to Eventbrite.com and search for “Repayment 101: Get Help with Your Federal Student Loans.”

This offers some more insight, but I would totally listen to the webinar in addition to research before making any moves.

https://studentaid.gov/manage-loans/repayment/plans/income-driven/questions

Last edited:

My daughter is starting her 5th semester at BU for DPT and will have about the same after she’s done.DPT. Doctor of Physical Therapy

LuvOrlando

DIS Legend

- Joined

- Jun 8, 2006

- Messages

- 21,461

It sort of seems like you are pulling the criteria for the ongoing forgiveness programs into the new program, the pre existing program was 20. This SAVE plan appears to have a different set of rules with different aging terms designed to make college more accessible and default much less likely for those who get stuck financially for any number of reasons. It is linked to taxes just like FAFSA, for both ease of use and as guards against fraud, which is good to see.I don't understand all of the SAVE program benefits. DD has 4 subsidized undergrad loans (all at interest rates of <5%) and two unsubsidized grad loans (interest rates of 6.XX%). She has been paying on the undergrad loans from 2015 to now, except for the covid pause. I am not sure how SAVE would help her. It's my understanding that you don't qualify for the program unless you have already made 20 years of payments, and also that you have to consolidate your loans. Any idea what the new interest rate would be if the loans are consolidated? Of course, there is the added complication of her husband's loans, I guess. She does NOT want to become responsible for his ed debt and is worried that if they both sign up for SAVE, she will be on the hook for his loan repayment, too (and his loans are a mess, serviced by Navient). I tend to be very conservative in my view about school loans: Don't borrow too much, and pay them off on the standard repayment plans in 10 years. I don't want her to pay more than she should have to and would like to see her save some $$, but I don't know. It seems like stretching out the loan repayment period would only cost more money in the long run.

I pulled the below line directly from the source in my post #31 so it would seem cosigning is no longer a thing. This totally makes sense since lifetime marriages are no longer the standard bearer, when they happen great but the institution is simply no longer what it once had been for many families. Just file taxes separately, which has other benefits such as financial protections against a spouse making terrible choices or not paying taxes, which I have seen more than once.

| The SAVE Plan excludes spousal income for borrowers who are married and file separately. | This change removes the need for your spouse to cosign your IDR application. |

luv2cheer92

DIS Veteran

- Joined

- Jul 13, 2012

- Messages

- 2,651

I qualified for PSLF before the pause, but need the 10 years of payments. I am very thankful that the last 3 years of not paying will still go towards that 10 years though.I read that the pause was made to great use by revamping the parts of the process that were most broken so there are now some changes in lenders & changes in the process. I think this includes some much needed corrections in loan forgiveness programs, hopefully to your benefit. Keep going, good luck.

LuvOrlando

DIS Legend

- Joined

- Jun 8, 2006

- Messages

- 21,461

I think many people have benefited greatly from the 2020-2023 pause so we could all catch our breath & regroup. I am so grateful so many young people and families are going to come out of this stronger, what is good for my neighbor is good for me.I qualified for PSLF before the pause, but need the 10 years of payments. I am very thankful that the last 3 years of not paying will still go towards that 10 years though.

In my household the pause shined a light on the situation while giving us the time to really dig in and that lead us all to completely rethink things and change many financial assumptions. Like now I am way more defensive financially than I ever thought I would be, or would need to be. Risk tolerance for me is as zero because just walking into a store, gas station, opening a utility bill can cause sticker shock of 10% + any random day, that's now more than enough risk for me & mine.

In my household the pause shined a light on the situation while giving us the time to really dig in and that lead us all to completely rethink things and change many financial assumptions. Like now I am way more defensive financially than I ever thought I would be, or would need to be. Risk tolerance for me is as zero because just walking into a store, gas station, opening a utility bill can cause sticker shock of 10% + any random day, that's now more than enough risk for me & mine.

Do you mean that you're more defensive with your household budget due to inflation....meaning, budgeting to pay off debt more quickly, or defensive as in your risk with respect to your retirement savings or investment portfolio?

Pea-n-Me

DIS Legend

- Joined

- Jul 18, 2004

- Messages

- 41,392

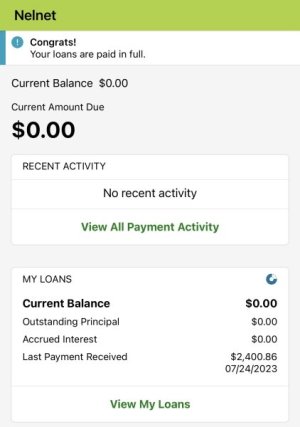

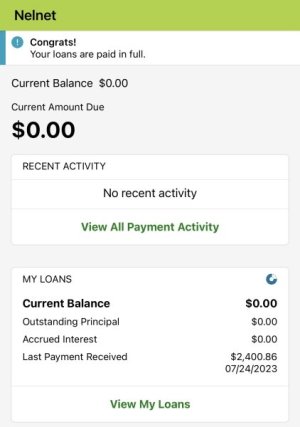

Timely thread! DD just sent me this, for undergrad (BSN)!

She’s about a month away from finishing up her MSN, and between education benefits and a nice scholarship from the hospital, she’ll have just about $3K left to pay on that, then she’ll be completely done.

DS is still plugging away at his, but fortunately they’re not too high. He never paused them, and I paid interest while they were still in school, so it’s pretty do-able. He is considering taking out a large school loan for another form of education, but I really hope he doesn’t. Payments would be overwhelming. Currently he’s picking up OT shifts and paying out of pocket instead while starting down that path.

Curious for those here who have substantial loans for post graduate education. Do you have any regrets about it? If you could change anything, what would it be? Was it worth it to be stuck with school loan payments for years and years?

She’s about a month away from finishing up her MSN, and between education benefits and a nice scholarship from the hospital, she’ll have just about $3K left to pay on that, then she’ll be completely done.

DS is still plugging away at his, but fortunately they’re not too high. He never paused them, and I paid interest while they were still in school, so it’s pretty do-able. He is considering taking out a large school loan for another form of education, but I really hope he doesn’t. Payments would be overwhelming. Currently he’s picking up OT shifts and paying out of pocket instead while starting down that path.

Curious for those here who have substantial loans for post graduate education. Do you have any regrets about it? If you could change anything, what would it be? Was it worth it to be stuck with school loan payments for years and years?

tinkerbellandpeterpan

DIS Veteran

- Joined

- Aug 1, 2021

- Messages

- 1,369

Timely thread! DD just sent me this, for undergrad (BSN)!

View attachment 790168

She’s about a month away from finishing up her MSN, and between education benefits and a nice scholarship from the hospital, she’ll have just about $3K left to pay on that, then she’ll be completely done.

DS is still plugging away at his, but fortunately they’re not too high. He never paused them, and I paid interest while they were still in school, so it’s pretty do-able. He is considering taking out a large school loan for another form of education, but I really hope he doesn’t. Payments would be overwhelming. Currently he’s picking up OT shifts and paying out of pocket instead while starting down that path.

Curious for those here who have substantial loans for post graduate education. Do you have any regrets about it? If you could change anything, what would it be? Was it worth it to be stuck with school loan payments for years and years?

I'll answer. It's not worth it for me. I don't use my JD. I took an entirely different job with a drastic pay cut during Covid. I wish I had never chosen law school. But I got swept up in being smart, good at school, and somewhat fulfilling my parents' dreams (not their fault just honest truth upon reflection). These loans are a source of tremendous stress. They are quite literally the reason DH and I will never own a house. I have been paying on them for over 15 years and the principal rarely goes down. It's a nightmare. And I have often considered just declaring bankruptcy and praying they go away.

On the other hand I know plenty of people who feel very differently. I would just make sure he is very clear it's a career he wants and that the salary will support the loan payback. I wouldn't wish this stress on anyone.

May I ask what you mean about Medicare being a loan to be paid after death? And inheritance taxes don't apply until your estate is valued above $13 million and even then, the tax is only on the excess. If you do have a sizable estate, I suggest a Revocable Living Trust to avoid a lot of probate issues.I had a conversation with my kids about student loans recently and reasons for picking up most of it. The way I see it, picking up the tab for most of their education & housing etc is probably the most beneficial thing we can ever do for them in their lifetimes to help them succeed. We aren't trust fund people and now that I learned that Medicare is actually just a loan to be paid after death (that was a shock last year) plus all the inheritance taxes and such I realize that my kids and grandkids could may never get a dime from anything we accumulate. Quite the cold splash of water to be honest, got me rethinking many things. The more I learn the more I understand that picking up their education is probably, quite literally, the only one to one thing parents and grandparents can do for adult kids and grandkids which is why we hope to keep the remaining $ in 529 standing for future grandkids.

tinkerbellandpeterpan

DIS Veteran

- Joined

- Aug 1, 2021

- Messages

- 1,369

I agree and am confused by the original statement. My relative, who recently passed, owned her own house and she was able to to successfully qualify for Medicaid to cover her nursing home care and still shelter a portion of her assets. This did require the assistance of an attorney. Don't get me wrong, Medicaid took a large chunk, as they should because they covered her care for a long time. I know people often confuse Medicaid and Medicare so there may be some confusion there.May I ask what you mean about Medicare being a loan to be paid after death? And inheritance taxes don't apply until your estate is valued above $13 million and even then, the tax is only on the excess. If you do have a sizable estate, I suggest a Revocable Living Trust to avoid a lot of probate issues.

The only time I can think of that Medicaid is paid after death is if the surviving spouse stays in the home and there are Medicaid costs outstanding for the first to die. Upon the s/s dying then those costs for the first spouse are paid back from the sale of the primary residence. But I am definitely open to more information on the topic.

-

Disney Cruise Line Opens Bookings for NEW Mickey & Minnie Cove Cabanas at Castaway Cay

-

Fun Facts About Walt Disney World Resort Hotels

-

July 2025: Most In-Demand Resorts for DVC Rentals

-

10 Disney Parks Rip-Offs To Bring From Home Instead

-

FIRST LOOK at Jock Lindsey's HALLOWEEN Hangar Bar Menu

-

Hawai'i to Raise Transient Tax: What Disney Aulani Visitors Need to Know

-

Chicken Guy! at Walt Disney World Has NEW Menu Items

New Threads

- Replies

- 0

- Views

- 16

- Replies

- 1

- Views

- 67

- Replies

- 0

- Views

- 52

- Replies

- 0

- Views

- 80

- Replies

- 1

- Views

- 130

Receive up to $1,000 in Onboard Credit and a Gift Basket!

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

New Posts

- Replies

- 17

- Views

- 852

- Replies

- 2K

- Views

- 416K

- Replies

- 60K

- Views

- 2M

- Replies

- 0

- Views

- 16

- Replies

- 109

- Views

- 9K

- Replies

- 11K

- Views

- 471K