Bringing this thread back to life…top SAP+ options in 2025? I feel like the options have gotten murkier. I’m extra curious what people think the top direct SAP+ option is. It feels like every option has a major caveat now.

Caveats:

AKV: most rooms are easy to book at 7 months outside the ones you can’t book at all. Dues.

BLT: small studios don’t fit 5. But I feel like you can use these at the PVB studios without much trouble. WAY too expensive direct.

CCV: need a 2 bedroom to get three sleeping surfaces

GCV: lol. Way too expensive to sleep around.

CFW: no easy washing machine access. Needs a golf cart. High dues. Uncertainty of trust model.

GFV: up front costs; high cost per point resale and direct.

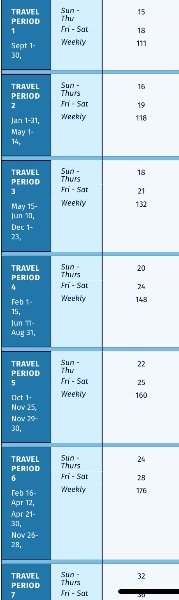

Point charts.

OKW extended: dues. Easy to book at 7 months.

PVB: high point charts and questionable views. High resale buy in cost.

RIV: restrictions. Skyliner is divisive; some love it, some hate it.

SSR: expiration and divisive resort. Easy to book at 7 months.

VDH: restrictions, dues and TOT. Can’t easily swap coasts at 7 months without cancelling your reservation.