- Joined

- Nov 15, 2008

- Messages

- 48,377

Reality has not set in yet for sellers that a recession is coming in 2023. DVD seems to have though by not ROFR contracts since they don't want to get stuck having to pay maintenance fees for units they cannot sell or might not even be able to rent out. Prices have been dropping but they have more to go before they hit bottom. I myself will be looking to add later in 2023 if the prices drop low enough.

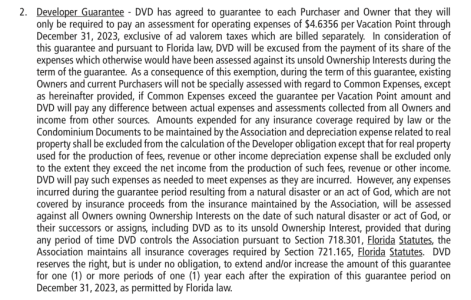

DVD doesn’t pay operating expenses on points they own in exchange for the guarantee to cover shortfalls if the the actual expenses end up being more than what was projected.

But, I think the contracts passing support that ROFR caused prices to drop since buyers get more aggressive with asking and sellers are willing to take less.

Look at how SSR has dropped since ROFR has essentially dropped. It’s going to be tough for me to avoid a RIV resale if prices drop closer to the $100 to $110/pt mark!