Ruttangel

DIS Veteran

- Joined

- Jun 21, 2013

- Messages

- 1,888

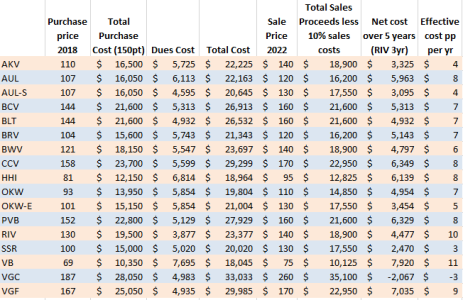

Just put this cashflow together using dvcresalemarket.com sales data from Spring 2018 and a sales estimate for later this year. Assumes contract had 5 years of dues to pay (3 years for RIV).

All this shows is that every resort is a saving on renting at say $18pp (unless someone argues that you could have put $20k in a high interest account and pay for rentals each year) but only 1 resort “in the black” unsurprisingly VGC.

Resorts with lower growth in resale price obviously showing higher costs.

Does this help going forward? Well if you buy now you’re going to have to hope around 15-20% increase in 5 years to see these figures repeated.

Anyone find this useful? I’m also happy to take feedback on anything you disagree with.

We did get some dues credits for closures in 2020, just ignored that on basis it was fairly immaterial