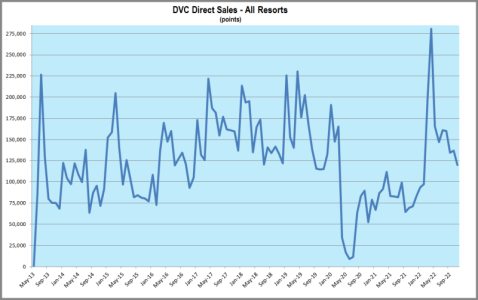

From my graph, it’s apparent that RIV direct sales never rebounded to pre-COVID levels. There’s a few possible reasons for this.

Direct price hikes are having an adverse impact on sales.

Inflation is a affecting sales. It’s one thing to drop $5K on a vacation after not vacationing at all for 2 years. It’s a very different to drop over $30K on a timeshare when inflation is taking a big bite out of family income.

The

DVC market is becoming saturated. There now are over 5500 DVC rooms at WDW.

RIV is not as appealing as earlier DVC resorts. I don’t put much weight on this. VGF and RIV both sold well pre Covid. VGF sales in particular have tanked in recent months.